Page 42

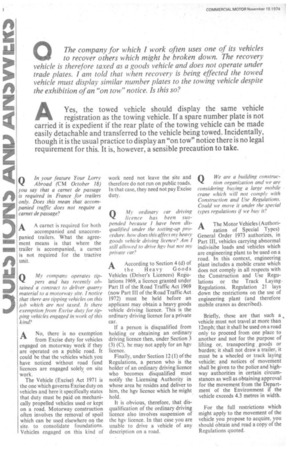

The Company For Which I Work Often Uses One Of

its vehicles \ to recover others which might be broken down. The recovery vehicle is therefore taxed as a goods vehicle and does not operate under trade plates. I am told that......

Q In Your Feature Your Lorry Abroad (cm October 18)

you say that a carnet de passage is required in France for trailers only. Does this mean that accompanied traffic does not require a carnet de passage? A A carnet is required......

Q /14:y Company Operates Tip Pers And Has Recently Obtained

a contract to deliver quarry material to a motorway site. I notice that there are tipping vehicles on this job which are not taxed. Is there exemption from Excise duty for......

Work Need Not Leave The Site And Therefore Do Not

run on public roads. In that case, they need not pay Excise duty. Q My ordinary car driving licence has been suspended because I have been disqualified under the totting-up......

A According To Section 4 (d) Of The Heavy Goods

Vehicles (Driver's Licences) Regulations 1969, a licence granted under Part II of the Road Traffic Act 1969 (now Part III of the Road Traffic Act 1972) must be held before an......

Q We Are A Building Construc Tion Organization And We

are considering buying a large mobile crane which will not comply with Construction and Use Regulations. Could we move it under the special types regulations if we buy it? A The......