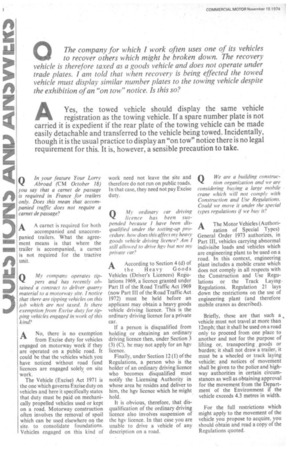

Q /14:y company operates tip pers and has recently obtained

Page 42

If you've noticed an error in this article please click here to report it so we can fix it.

a contract to deliver quarry material to a motorway site. I notice that there are tipping vehicles on this job which are not taxed. Is there exemption from Excise duty for tipping vehicles engaged in work of this kind?

ANo, there is no exemption from Excise duty for vehicles engaged on motorway work if they are operated on a public road. It could be that the vehicles which you have noticed without road fund licences are engaged solely on site work.

The Vehicle (Excise) Act 1971 is the one which governs Excise duty on vehicles and here it specifically states that duty must be paid on mechanically propelled vehicles used or kept on a road. Motorway construction often involves the removal of spoil which can be used elsewhere on the site, to consolidate foundations. Vehicles engaged on this kind of