F L EET

Page 34

Page 35

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

NA 1 11

6. A sober look at LPG by M. swiss

THE PRODUCTION of LPG intended for consumption in Britain will amount to no more than 5 per cent (say 1.5m tons) of all motor fuels during the years up to 1975. In fact, LPG consumption as a motor fuel may not exceed a figure of 1 or 2 per cent. Is, then. LPG likely to become a common alternative or additional fuel for road transport? And will taxation be introduced to obviate the price differential? It would seem that while the amounts so used are small no tax will be imposed.

A conversion and /or annual tax on the installed conversion equipment could be imposed. If this is done the use of LPG as motor fuel could still remain very attractive to companies which use it on a large scale, preferably for purposes other than transport alone.

As costs go down with increasing rate of consumption the advantages to bus companies, metallurgical LPG users, some Gas Boards and so on may still outweigh the taxation handicap. Instead of 16p a gallon LPG could be available at 5p a gallon. This would compare favourably even with the bulk price of LPG of 7p quoted by the Lipton company.

On the margin we may also consider the use of natural gas in diesel engines, since its octane number is 120. This is very important but the difficulty concerns storage, as natural gas will not liquefy unless the temperature is brought down to cryogenic levels. Otherwise a heavy high-pressure steel bottle to carry compressed natural gas would be required; so this fuel could best be used for converted stationary diesel engines. It offers the advantages of increased power and some exhaust control.

The main suppliers of gasoline and dery fuel in Britain are the "majors" (Essa, BP, Shell, Mobil, Texaco. Gulf) and also Total, Petrofina, Burmah and Continental—all with refineries in the UK. Then there are Marco, Atlantic, Tenneco, Amoco, Ultramar, Mex and Maxol (Northern Ireland), Chevron and a number of distributors who simply own several forecourts. Although the seven named companies are in the general oil business (or their parent companies are), the others are not and have no refining plants anywhere.

In addition there is Imperial, a distributing company wholly owned by ICI. ICI shares a refinery with Phillips but petrol is a by-product of its petrochemical plant. Phillips does not sell petrol.

The "majors" have a common attitude to the sale of LPG for road transport. At present they are not interested in supplying it but if they were approached with a substantial contract they might consider such a proposition on merit. This absence of any positive policy, or any attempts to take an initiative in seeking new markets, is explained by a threefold argument. First, the major suppliers would not wish to invest in a venture which would reduce sales of gasoline or dery as such extra effort would not add to total sales. Secondly, it is argued that they would be inducing customers to expenditure on conversion not knowing how soon LPG for road transport may be taxed. Thirdly, it may require a great deal of "image building" for a very doubtful return.

The other companies see the picture in a different way, primarily because they sell less petrol in the UK. The major suppliers do, however, sell LPG to any large organization and no longer write into the sale contract the proviso that this fuel must not be used for transport. Many small firms purchase LPG for industrial purposes and use it in their fleets—perhaps at first for trial purposes.

Two LPG distributors, Calor Gas and British Oxygen Co, have outlets all over the UK. The former buys its LPG from all oil refiners and the latter is supplied by Esso. The plans for each of these liquefied gas suppliers concerning the used LPG for transport have recently been given some publicity. To sum up. Calor Gas intends to supply taxicabs and BOC may avail its depots throughout the country to all users, much as if they were forecourts.

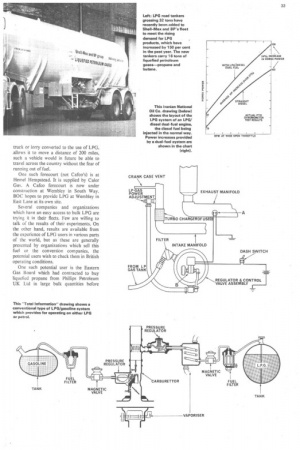

The real breakthrough may, however, come by way of the proposal by the Cafco Division of L. Lipton Ltd, Wooburn Green, Bucks, to provide LPG in the same way that petrol is supplied today at some 50 forecourts specially to be built all over the country. As a full load in a large pressurized cylinder, such as is fitted in a truck or lorry converted to the use of LPG, allows it to move a distance of 200 miles, such a vehicle would in future be able to travel across the country without the fear of running out of fuel.

One such forecourt (not Cafco's) is at Hemel Hempstead. It is supplied by Calor Gas. A Cafe° forecourt is now under construction at Wembley in South Way. BOC hopes to provide LPG at Wembley in East Lane at its own site.

Several companies and organizations which have an easy access to bulk LPG are trying it in their fleets. Few are willing to talk of the results of their experiments. On the other hand, results are available from the experience of LPG users in various parts of the world, but as these are generally presented by organizations which sell this fuel or the conversion companies, the potential users wish to check them in British operating conditions.

One such potential user is the Eastern Gas Board which had contracted to buy liquefied propane from Phillips Petroleum UK Ltd in large bulk quantities before North Sea natural gas became available. At first Phillips used to import propane from its US fields. Now it comes from the Continental refinery at Killingholme and is discharged into a cryogenic storage tank at Felixstowe. From there it is taken to Norwich by a Gas Board pipeline as a gas but there are several points close to the storage tank where Phillips draws liquid propane for other customers and Eastern Gas Board takes it for its trials.

The EGB has three vehicles running on LPG. One was converted by its own workers (using a kit purchased from patent holders), one by Lipton and one by Forge Garage. So far the tests show, not surprisingly, that the mileage per gallon is 124per cent less than with petrol, but EGB pays only at the "wholesale" rate for LPG. There are also those maintenance advantages one hears so much about.

1970—Ed.] and diesel fuel is injected and ignited by compression in the normal way. BOC feels that more advantages are to be gained by the conversion of spark-ignition engines to LPG operation than by the conversion of diesel engines to dual-fuel operation. The company states that the cost of converting a diesel engine to dual-fuel operation is about £300 and that the saving in running cost obtainable is less than the comparable figure for using LPG in a spark-ignition engine.

The average amount of LPG used in dual-fuel engines which have been road tested by certain users is 30 per cent of all fuel (the two fuels are used together in a variable ratio) and horsepower of the engine is increased. However, BOC stresses that the exhaust is not as clean, the engine is not as deposit-free and its life is not as prolonged as when a gasoline engine is converted to LPG. The way BOC would like the development to go is that when the time comes for an engine to be replaced in a commercial vehicle operating on dery fuel, the new one should be a spark-ignition engine powered by LPG. BOC's East Anglian subsidiary, Anglian Industrial Gases, has obtained Lipton's franchise in the region and its other subsidi,ary, Seaflame (concerned at first with the conversion of houses to natural gas), now carries out conversion of vehicles to LPG at an increasing rate; soon they will reach 100-120 per month.

Diesel research Research on conversion of diesel engines goes back 20-25 years and resulted in the development of dual-fuel systems. The type of conversion requires that the compression ratio is high enough to produce ignition for both dualfuel operation and pure diesel fuel operation. This in turn requires that the gaseous (primary) fuel should have a high enough ON to prevent knocking—the dery fuel charge acts much as an electric spark. Yet the events within the cylinder are simultaneously of the spark-ignition and compression-ignition character. The requirements for a high ON are easily satisfied by propane (ON = 105 /110), not so well by butane.

The Ethyl Corporation (now Octel), Socony-Mobil and General Motors conducted some time ago tests on GM's EMD 2-567 engine at Socony's laboratory. These were to measure the effect of tetra methyl 'lead and compression ratio on dual-fuel operations. Lowering the compression ratio and TML brought the bhp to 20 per cent over the power of that engine when operating on diesel fuel alone, but when rpm was increased the advantage vanished. Carnation Company, however, reported that the power increase observed after the conversion of its vehicles was from 150 to 200 hp. The proportions of the two LPG in dual-fuel systems must be introduced and withdrawn gradually to meet the load. This was impossible at first and resulted in energy surges when the driver switched over from dery fuel to dual-fuel operation. As a means of a gradual introduction (or withdrawal) of LPG, Socony produced a device which senses exhaust temperature. This is in step with load, so LPG could be controlled through such a feed-back sensor. With a control device of a design a little more complex than before, a gradual introduction of LPG has been made possible, resulting in a range of power increases in step with load increases.

In Britain, the Sea Bird Company is the sole agent and concessionaire holding all patents of Landi LPG apparatus for petrol and diesel conversion. The Hemel Hempstead LPG station supplying Motorgas, and all the 10 future stations being planned will install Landi equipment in petrol engines. Diesel conversion on an experimental scale in the UK is done by Sea Bird engineers. It is hoped that many diesel conversion engineers will soon be trained.

In the meantime, operational experience of Sea Bird dual-fuel systems installed in diesel-powered vehicles is being gained by, Tate and Lyle. There are other companie trying out the effects of this type of conversion who do not wish to disclose their names. Sea Bird confirms that 30 per cent LPG and 70 per cent diesel fuel is the average proportion used by the converted vehicles.

A look at the tonnage of crude oil treated by British refineries in 1969 reveals the proportions of different petroleum products marketed in this country. In that year British refineries treated 93m tons of crude oil and provided 77.7m tons of petroleum products for the domestic market. Of this LPG represented 1.2m tons; LPG consists, in a ratio of about two to one, of butane and propane. In addition, there is a proportion of unseparated butane and propane in the 460,000 tons of refinery gases (sold as such) and in the 390,000 tons of petroleum products sold as "chemical feedstock other than naphtha". These figures give some idea of the present availability of LPG bearing in mind that during 1969 there were some imports of propane for the Eastern Gas Board; now the source is a British refinery.

During 1969 Britain consumed 13.25m tons of motor spirit.* Just over 4.1m tons of motor and aviation spirit were imported and over lm tons were exported. Thus, the crude refined in Britain provided this country with about 10.25m tons of petrol, which means that approximately a quarter of the tonnage consumed by domestic users was imported.

Dery fuel consumption during 1969 was close to 4.8m tons and the imports of distillate fuelst ran at almost 3m tons. During the year aboout 2.5m tons of motor spirit and about 3.7m tons of dery were used by goods vehicles. Motor spirit is responsible for the collection of £781m as tax and dery fuel "collected" £246m. The cost of petrol, ignoring the tax, is very much the same whether it is refined in Britain or imported. Roughly, with anti-knock additives (and othets), the cost of transporting and storing of petrol and the station operator's profit together account for a shilling or little more.

In 1969 imports of motor spirit cost £14,636 per ton (11-id, or 4.896p a gallon) and of dery £10.90 per ton (9d, or 3.75p a gallon). Crude,ion the other hand, costs Britain £7.10 per ton (61d, or 2.812p a gallon). The case for importing crude and refining it at home is very strong and the UK refining capacity will rise steeply in 1971-75.

LPG prospects This shows clearly that the amount of LPG produced by British refineries is going to increase. Another factor which may strengthen this trend is the growing use of "younger" crudes (Algerian, Libyan or even possibly those now being found in the North Sea). In the meantime, as analysis of markets shows, the industrial demand for LPG is falling off. In 1969 gas making required the use of 712,000 tons of propane and butane as well as 5.3m tons of naphtha. The appearance of natural gas on the British fuel market has already affected the demand for both these products. In addition some—even if as yet not very much—of the petrochemical industry (such as fertilizer production) is going to be increasingly based on natural gas which will displace still more naphtha. Naphtha will easily find other markets but it will in so doing displace still more LPG. What it all amounts to is that by mid-1970s there will be about 1.5m tons of this fuel available while the industrial market for it will have shrunk.

Tests carried out by the California Air Resources Laboratories on vehicles submitted by the Western Liquid Gas Association show that the LPG conversion of existing engines will more than adequately cater for the stringent requirements of legislation that will come into force in California in 1974 /75. The 1974 California requirements for all types of power unit are shown in the table compared with the emissions of new and used popular cars.

With respect to carbon monoxide, private tests of a Triumph 1300 indicate that the CO content of the exhaust can be reduced from around 5.8 per cent on petrol to 0.14 per cent by conversion to BOC Autogas operation. This is said to cause slight loss of acceleration and of miles/gallon when operating on petrol; weakening the mixture could likewise reduce the CO content to 2.0 per cent, but it resulted in a marked reduction in performance.