H aldex pulls

Page 14

Page 15

If you've noticed an error in this article please click here to report it so we can fix it.

out the stops

• Haldex's ambitions in the HIGV disc brake market can hardly be described as "modest': it plans to become one of the Worlds top three suppliers to truck manufacturers, and the leading supplier to trailer makers. It also intends to become the world's largest supplier of disc brake actuator mechanisms.

To put some numbers on that ambition, by the end of 2002 its budgeting to produce 145,000 truck and trailer disc brakes—with a target of 710,000 by the end of 2005.

It won't be easy Haldex is a relative latecomer to a market dominated by Knorr-Bremse, Wane° and Mentor: none of which will be pushovers. But as the leading global supplier of automatic drum brake adjusters (ABAs) it has been effectively cushioned from the impact of discs on its business. There are still plenty of ABA opportunities with huge developing markets including South America and China. But in Western Europe its ABA revenues have fallen significantly as European truck manufacturers have switched from S-cam drums to discs.

Haldex's UK sales manager, Bernard Clancy, says: "Our ABA business in Europe has reduced, and not just on trucks. People tend to forget disc brakes inherently include an automatic brake adjuster. On trailers, disc penetration on axles has reached as high as 80% of build recently but that's recovered to around 60% and with some axle manufacturers its about 50%."

New sector

But the switch from drums to discs has hardly happened overnight, so why has it taken Haldex so long to come up with its own disc brake? The answer lies in Haldex's approach to this new market. The two routes into any new sector are 'do-it-yourself; or buy an existing company which has the products you need.

It's no secret that Haldex wanted to buy into the disc market, but other brake specialists had the same idea. "Knorr Bremse bought Bendix, Wabco bought Perot and Mentor bought Lucas," says Clancy.

'We wanted to acquire, but we had to develop our own disc brake. We had to accelerate that programme and still come to the market quickly. We starte with trailer disc brakes in 1994 but ill( didn't really happen for us till 1998."

Today Haldex supplies the likes of and SMB with trailer discs, but the re prize is with the heavy truck makers an according to Clancy, Haldex finally 1-K the right product to make seriot inroads into that market, in the guise Its Mark IV 'Bolted Bridge' design.

There was a sneak preview at la month's NEC Show, but the new HaIdE truck disc won't be officially launched un e IAA Exhibition in Hanover in September. Clancy isn't naming names, but he 'ports that Haldex has already signed a tter of intent to supply a major zopean truck manufacturer. Its actualr mechanism has also been adopted / US axle maker Dana or its Dana Dicer Air Disc Brake for Class T and 8 op-weight) trucks.

earning process nothing else the delay has allowed aldex to monitor the performance of rivals, and Clancy says its been a 'ugh learning process for manufactur-s and operators alike.

"1 think some people expected an Nful lot from disc brakes," he adds. "hey've gat a 'ft and forget' impreson—but were always battling against lysics. There's been a new learning Jrve on discs and their application, specially on trailers. People promoting ,sc brakes have been making some aims that simply weren't achievable, e 300,000km out of a set of pads, so re fleet perception has been that they'll eatly reduce operating costs."

In fact Clancy argues that the trailers' rvice needs haven't really been ianged by discs; there certainly hasn't beer the sharp fall in servicing times that had been anticipated. What's more, he says, operators are now finding that 'compared with the costs of camshafts and bearings on a drum brake, the cost of replacement parts for disc brakes are much higher. Disc brakes offer new technology, but they don't have the volume of componentry to bring in economies of scale, so the cost per item is still greater."

Servicing issues

Among the serviclng issues that operators have had to face is the fact that disc brake auto adjusters are sensitive to water ingress. Clancy says: 'People have been going through a learning curve with that. Many operators, particularly those running at 44 tonnes, like tippermen, have said 'enough is enough'."

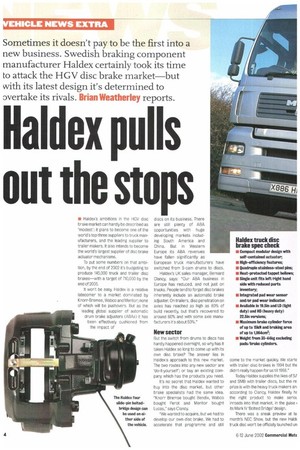

The new Haldex disc has been designed to overcome many of the current problems. Its uses four stainless steel slide pins — most rivals use two—in a bid to deliver high braking efficiency with minimal slide pin wear. The pins have nonlubricated, low-friction slide bearings and are protected from dust by silicon rubber bellows. There's also a protecting cover over the caliper.

The Haldex disc can be used on either side, reducing parts stocks, and the two-piece bolted carrier and caliper unit have been built to handle braking forces in both directions. The patented Haldex actuator/adiuster is a dualpiston design which can be serviced as a single removable unit—and its been designed to overcome prob lems with water ingress.

Despite the Mark IV's imminen launch it will be some time befon Haldex hits full series production However, Clancy is already talking abou electronically activated versions of thi Haldex modular disc design as well as i twin-disc model which will reduce thi overall size of the brake.

That sounds intriguing, but in thi meantime Haldex has to get out there ark sell its disc brake against rivals which an already supplying l-IGV manufacturers.

Number one Clancy Isn't worried by the fact that thi Swedish manufacturer has entered MI fray a title late: We weren't the first ii ABA, even though we're row recognise' as number one. Vehicle manufacturer buying proprietary brakes like MAK Volvo and Renault will buy brakes fror alternative suppliers."

There's certainly a lot to play for Haldex needs to reclaim the revenue has lost through the demise of it European ABA business. 'We'll see a 4C 50% drop in the ABA market, Clanc predicts, "and that drop will be made u solely on truck disc brakes in Europe.'