The horns of a dilemma

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

As demand for trailers across Europe shows little sign of abating Brian Weatherley tal Ks to two leading UK manufacturers with differing strategies in pursuit of the same goal.

Iames Dennison, managing director of Dennison Trailers, appreciates the dilemma facing trailer makers who offer a plethora f "specialist" products. "We're a company 3at's profitable and efficient, but I seriously :link at times we spread ourselves Do thin. We'll have to streamline nd get more volume," he says.

He insists: "If you're going to iroduce up to 45 trailers a week • ou can't write curtainsiders off ust because the margin is low." Last year the Anglo-Irish trailernaker built more than 1,700 trailTs in its Lancaster and Naas plants. 3uring 2005 it aims to increase this o around 2,100. Inevitably, that neans slugging it out in the vol une-rich, but price-poor, A Dennison: :urtainsider market. "We've pre lominantly been known as a skeletal trailernaker,but we keep promoting the curtainsider -in fact we're probably building more now than ever before," says Dennison. But he adds ruefully: "If you want volumes with curtainsiders you've got to go in on price. Youll never get rich over them, but if you get the efficiencies and labour right you can make it right. SDC has always been very competitive with us.but Montracon were very aggressive on pricing at the beginning of last year,for whatever reason."

Likewise Dennison reckons the tipper market is not for the faintbearted."They're worse than curtainsiders," he says. "And bulkers are a waste of time. There are more people building bulkers in the UK than making standard products."

Go in on price Skeletals currently ac count for over 65% of Den nison's production, including its sliding bogie models and latest Multi-Function Split Skeletal. Dennison has also successfully extended its sliding bogie concept to include tipper, tanker and (through Hymix) mixer versions. While volume continues to preoccupy all the major manufacturers Dennison maintains that the real untapped market lies with trailer parts.

Growing market

"That's a massive business, it just depends how much you want of it The spend on trailer spares is something like £100m a year; it's crazy:There's a business-within-a-business supplying parts on our own trailers and to other customers."

Ultimately, predicts Dennison: "We'll end up partnering somebody else, which doesn't rule out using existing infrastructure. The one thing we're doing already with a number of big fleet hauliers is they hold an imprest stock so that could be expanded. I think you've got to do it like that,not through creating your own depots."

While Dennison debates what not to build, Montracon has added a new double-deck reefer to its range (CM 16 Dec 2004). Says sales and marketing director Paul Mead:"We needed it so that if someone is a 100% Montracon reefer operator they don't have to look elsewhere."

The company recently spent £1.7m upgrading its Market Weighton reefer site, increasing production capacity by 30%.

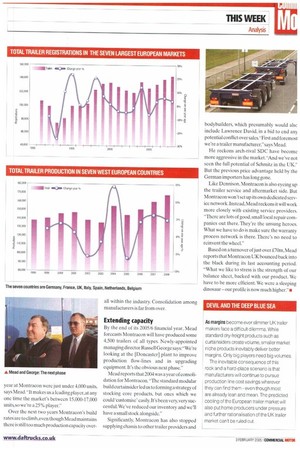

Production volumes for the last financial year at Montracon were just under 4.000 units. says Mead. "it makes us a leading player, at any one time the market's between 15,000-17,000 units, so we're a 25% player."

Over the next two years Montracon's build rates are to climb, even though Mead maintains there is still too much production capacity over all within the industry Consolidation among manufacturers is far from over, Extending capacity By the end of its 2005/6 financial year, Mead forecasts Montracon will have produced some 4,500 trailers of all types. Newly-appointed managing director Russell George says:"We're looking at the [Doncaster] plant to improve production flow-lines and in upgrading equipment. It's the obvious next phase."

Mead reports that 2004 was a year of consolidation for Montracon. "The standard modular build curtainsider led us to forming a strategy of stocking core products, but ones which we could 'customise' easily. It's been very, very successful. We've reduced our inventory and we'll have a small stock alongside."

Significantly. Montracon has also stopped supplying chassis to other trailer providers and bodybuilders, which presumably would alsc include Lawrence David, in a bid to end an potential conflict over sales. "First and foremost we're a trailer manufacturer," says Mead.

He reckons arch-rival SDC have become more aggressive in the market. "And we've not seen the full potential of Schmitz in the UK,' But the previous price advantage held by the German importers has long gone.

Like Dennison, Montracon is also eyeing up the trailer service and aftermarket side. But Montracon won't set up its own dedicated service network. Instead,Mead reckons it will work more closely with existing service providers. "There are lots of good, small local repair companies out there. They're the unsung heroes. What we have to do is make sure the warranty process network is there. There's no need to reinvent the wheel."

Based on a turnover ofjust over £70m, Mead reports that Montracon UK bounced back into the black during its last accounting period. "What we like to stress is the strength of our balance sheet, backed with our product. We have to be more efficient. We were a sleeping dinosaur— our profile is now much higher.it