Problems of the

Page 66

Page 67

If you've noticed an error in this article please click here to report it so we can fix it.

HAULIER and

CARRIER

A Simple System of Keeping Costs, Based on the Elaborate Scheme Already Outlined in this Series

IEXPECT many readers, when they saw the analysis of operating costs given in the previous article, must have decided that, if that was what was meant by keeping proper accounts, they would continue in the old way and manage without the information. I must confess that, up to a point, they have my sympathies. At the same time, where circumstances make it necessary that every small item should be particularized, that

is the way to account for operating costs.

The method exemplified by the large table accom panying this week's article meets the requirements of the average haulier. If he compares the two, he will appreciate that there is considerably less trouble involved in the second method than in the first one.

Instead of 40 columns, there are here only 12, and of these, two are devoted to a record of the date and of the kind of work upon wilich the vehicle is engaged on that particular day. Moreover, of the 10 remaining columns, two need, as a rule, attention only once per week, and, again, a further two need entries only from time to time. Generally, it is true to state that this method involves only six real entries per day.

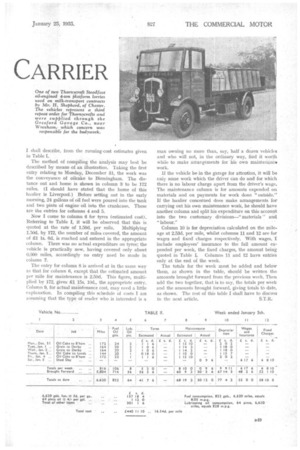

In the beginning, as in the previous system, it is necessary to set out the essential particulars of the vehicle to which the costs relate. Each vehicle must have its own records. Table I, this week, embodies the particulars relating to a vehicle which I have called a Leyton. It is an oil-engined eight-wheeled 13-tonner and the tax is £175 per annum, which is £48 2s, 6d. if paid quarterly, equivalent to £.3 17s. per week. ' Again

1 must point out that, in calculating weekly amounts, I always assume 50 weeks to the year.

The tyre equipment comprises

12 40-in. by 8-in, high-pressure tyres, and I have assumed the cost

of a complete set to be £180. That reduces the net cost of the vehicle, the figure on which interest and depreciation are based, to £1,900. In order to reduce the number of entries to be made each week in the cost analysis, I have lumped together four items of expense, which I have called "fixed charges." These are shown in Table I. They comprise the Road Fund tax of £3 17s. per week ; insurance, 1 ls. 6d. ; garage rent, 17s. 6d. ; and interest, £1 2s, 10d. The total is £6 8s. 10d. per week.

Certain of the running costs—tyres, maintenance and depreciation—haveto be entered up each week on the basis of an estimate. The reason for this procedure is to make sure that the operator is not losing sight of the fact that, at some future period, he will have to lay out fairly considerable sums on the purchase of new tyres, on repairs and maintenance, and, eventually, on replacing his existing vehicle by a new one. The actual amounts are set down in the table.

Now for Table II, the cost analysis. Each sheet covers a week's operation and only at the end of the week do I deem it necessary to summarize, total and check the operating cost of the vehicle. Experienced transport managers will confirm that, in order to keep a check upontheir vehicles, they find it advisable to have returns made daily and to examine those returns at least once per week.

The 12 columns of this table do not need a great deal of explanation. Column 2 calls for the briefest particulars of the work. Details are, in any case, available on the daily record sheets and there is no need to duplicate that information. The third column is for• the number of miles covered during the day. That figure is obtained from the speedometer readings, which, according to a recommendation already made in this series, are entered upon the daily record.

Other items culled from the same source are those which appear in columns 4, 5 and 7, as well as most of those which will be quoted in column 9. The figures in columns 6, 8 and 10 are calculated, in a manner which

I shall describe, from the running-cost estimates given in Table I.

The method of compiling the analysis may best be described by means of an. illustration. Taking the first entry relating to Monday, December 31, the work was the conveyance of oilcake to Birmingham. The distance out and home is shown in column 3: to be 172 miles. (I should have stated that the home of this haulier is Liverpool.) Before setting out in the early morning, 24 gallons of oil fuel were poured into the tank and two pints of engine oil into the crankcase. These are the entries for columns 4 and 5.

Now I come to column 6 for tyres (estimated cost). Referring to Table I, it will be observed that this is quoted at the rate of 1.50d. per mile. Multiplying 1.50d. by 172, the number of miles covered, the amount of Z1 is. 6d. is reached and entered in the appropriate column. There was no actual expenditure on tyres; the vehicle is practically new, having covered only about 6,000 miles, accordingly no entry need be made in column 7.

The entry for column 8 is arrived at in the same way as that for column 6, except that the estimated amount per mile for maintenance is 2.50d. This figure, multiplied by 172, gives £1 15s. 10d., the appropriate entry. Column 9, for actual maintenance cost, may need a little explanation. In compiling this schedule of Costs I am assuming that the type of reader who is interested is a man owning no more than, say, half a dozen vehicles and who will not, in the ordinary way, find it worth while to make arrangements for his own maintenance work.

lithe vehicle be in the garage for attention, it will be cnly some work which the driver can do and for which there is no labour charge apart from the driver's wage. The maintenance column is for amounts expended on materials and on payments for work done "outside." If the haulier concerned does make arrangements for carrying out his own maintenance work, he should have another column and split his expenditure on this account into the two customary divisions—" materials" and "labour."

Column 10 is for depreciation calculated on the mileage at 2.53d. per mile, whilst columns 11 and 12 are for wages and fixed charges respectively. With wages, / include employees' insurance to the full amount expended per week, the fixed charges, the amount being quoted in Table I. Columns 11 and 12 have entries only at the end of the week.

The totals for the week must be added and below them, as shown in the table, should be written the amounts brought forward from the previous week. Then add the two together, that is to say, the totals per week and the amounts brought forward, giving totals to date, as shown. The rest of this table I shall have to discuss in the next article. S.T.R.