Placating the Licensing Authority

Page 123

Page 124

If you've noticed an error in this article please click here to report it so we can fix it.

IN my previous article I referred to a clause in the Transport Bill which may make licences easier to obtain, and will give the Licensing Authority powers to include questions about rates in his examination of an application for a licence. The fact that the onus of proof that facilities arc sufficient will be upon objectors is bound to make it easier to obtain additional tonnage. On the other hand, if the Authority can ask what rates, are to be charged, the apPlicant may be placed in a quandary. He will want to know whether the Authority will approve a high rate or a low rate. In the absence of any indication of an Authority's preference, hauliers will probably be diffident in putting forward schedules of charges. Operators will need to be particularly careful about the figures they put forward for, according to another clause, cancellation or suspension of the licence is likely to result if any of the evidence be found subsequently to be false. That binds the haulier to continue to operate at the rates quoted ill his application, as otherwise he may be charged with making untrue statements with the consequence mentioned. There should be no such diffidence on the part of the hauliers, and no difficulties in arriving at reasonable figures to put before the Authority need arise. It is the haulier's business to know what his vehicles cost to run and what he should charge, on the basis of cost plus profit, for the work he wishes to do. However, as few hauliers do know what their vehicles cost to operate, the difficulty lies there. Having that in mind, I indicated in my previous article a rough-and-ready method whereby an operator who has not hitherto kept complete and accurate records of his costs may begin to do so using estimated figures for depreciation, maintenance and tyres. In the absence of any figures of his own I suggested that the haulier should consult the current issue of "The Commercial Motor" Tables of Operating Costs, but at the same time I warned him that whilst estimated figures might suffice on the first occasion, the Authority would probably expect actual costs to be presented to him in company with any application for a renewal of his licence.

Reasonably Accurate This week, I shall deal with maintenance in such a way that' the figures, although partly estimated, are nevertheless likely to impress as being reasonably accurate. This item is divided, one part being referred to as maintenance (d), the other maintenance (e). Maintenance (d) is intended 10 cover what may be called routine operations, those which are carried out periodically on a time basis irrespective of mileage.

One of. the biggest difficulties in arriving at an estimate of the cost of maintenance is the variation in operators' attitudes towards what is presumed to come under the heading of maintenance. One operator may wash his vehicles only once per month, never repaint or revarnish them and arranges for the drivers to carry out,minor items of routine upkeep.

On the other hand, there is the type of operator who has his vehicles washed and polished daily, varnished every six months, repainted every year, and sees that every item of maintenance is meticulously carried out at the proper time according to the instruction book issued by the manufacturer of the vehicle.

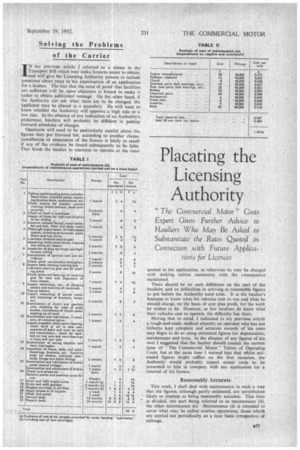

In Table I, I give some figures for maintenance (d) as might apply to the second kind of operator, that is to say one who is agreeable to spending Id. or 2d. more on maintenance in the belief that by doing so he will save pounds in the long run. I have set out, in an abbreviated form, the items which may be included under the heading of maintenance (d), and I give some figures relating to a 5-ton petrolengined machine.

I make an estimate of the cost of each operation, assuming that the work is regularly carried out. In effect, there is little to repair, the work is almost entirely roUtine inspection. The total cost per annum, according to the schedule, is £59.

Time and Mileage I must make a point here; the reader may already have spotted it for himself. As these costs are based on time-, the total will not seriously be affected by the mileage run. The amount just mentioned, £59, is presumably the same within comparatively wide limits whether the vehicle does 10,000 or 50,000 miles per annum, and if I am, as is customary, to regard this item as a running cost, its actual amount per mile diminishes as the annual mileage increases. At10,000 miles per annum, approximately 200 miles per week, it is I.42d. per mile, at 20,000 miles per annum, or 400 miles per week, 031d., and at 40,000 miles per annum, or 800 miles per week, it is as little as 0.36d. per mile.

Now, the figure in the Tables is 0.80d. for maintenance (d) with the vehicle running 10,000 miles per annum. This compares with 1.42d. per mile for the same mileage but calculated in accordance with the information provided in Table I. Why is the 1.42d. given here so much bigger than the average of 0.80d.?

The answer is, I think, that many of the operations are so closely allied in their nature that theywould be carried out together. Items 1-7_would, in fact, form one operation, at a total cost of £1 10s., whereas listed and costed separately, the total is £3 10s., a difference of £2. Other items could also be grouped together and would no doubt show a corresponding difference.

Take the job of varnishing. In many small establishments the owner would buy the varnish and get a handyman to do the work, thus saving £5 or so. In that way the total of £59 could be reduced to perhaps £50, which is equivalent to 1.20d. per mile at 200 miles per week.

In all probability economies more substantial than those just indicated are effected in actual practice, and in addition, of course, there is the large number of operators who do not go to the expense of frequently washing and polishing, varnishing and repainting, and these, as can be seen by referring to the schedule are the heavy items of expense. Halve the frequency, as many operators will, and a further economy of £32 could be made, thus reducing the annual total to £43, which is equivalent to I.03d. per mile at 200 miles per week.

Repairs and Overhauls

• Maintenance (e) covers expenditure on repairs and overhauls made necessary as the result of ordinary wear and tear. It does not include such repairs as are made necessary as the result of accidents. These are presumed to be covered by insurance. I have set out a number of items of this type in Table II. In the column headed, " Costs " I have set down the probable expenditure on materials and have added 50 per cent. to account for labour. The total comes to 1.451d. per mile, which is practically the same' as the figure in the Tables, 1.47d.

There is still another important item of expense to take into consideration, namely; establishment costs. In an article which appeared in the July 25 issue, I dealt with the actual amounts of establishment costs and showed that there could be great differences between those of one operator and another. Most hauliers assume that their establishment costs are nil. The only way to convince an operator who holds that view that he is wrong is to set down a list of the items and ask him to put some amount down against each and see what the result might be.

What I propose to do in my next article is not to try to assess establishment costs but to indicate a simple method of keeping a record. For the time being, I might suggest an approximate figure of £3 per week. S.T.