FIXING ESTABLISHMENT COS • VEHICLE CARRYING CAPACITY

Page 38

Page 39

Page 40

If you've noticed an error in this article please click here to report it so we can fix it.

incorrect Apportionment of Overheads May Show an Unusually Low Figure for Each Vehicle. Small items That May be

Overlooked

AT the conclusion of my previous article (in last week's issue) I had asked George, one of my two haulier friends, George and Jack, how much money he was making per week with his four vehicles. I must say that George looked just a little bit taken aback. I do not think he expected me to go quite so far as that with my questions. However, he took it in good part and this was his answer : "Last year," he said, "I made a net profit of £325 and some odd shillings." •

Jack : " What, with four vehicles, and you tell me you cover 700 miles a week with them? You've some room to talk about cut rates. I'll bet S.T.R. will have a go at you now. Fetch up your Tables, S.T.R., and let's see what he ought to have made."

" Not a bad idea, Jack," I said. "Let's look into it.

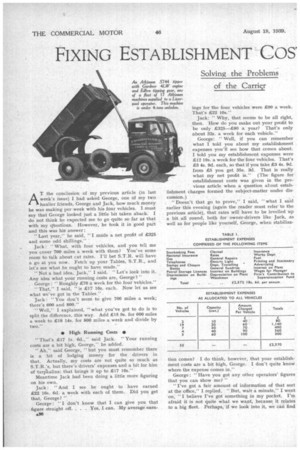

Any idea what your running costs are, George?" George : "Roughly £70 a week for the four vehicles." "That," I said, " is £17 10s. each. Now let us see what we've got in the Tables."

Jack : "You don't seem to give 700 miles a week; there's 600 and 800."

" Well,'' I explained, "what you've got to do is to split the difference, this way. Add £15 9s. for 600 miles a week to £18 14s. for 800 miles a week and divide by two."

• High Running Costs •

"That's £17 is. 6d.," said Jack. "Your running costs are a bit high, George," he added.

" Ah," said George, " but you must remember there is a bit of lodging money for the drivers in that. Actually, my costs are not quite so much as S.T.R. 's, but there's drivers' expenses and a bit for hire of ta.rp'aulins; that brings it up to £17 10s."

Meantime Jack had been doing a little more figuring on his own.

Jack "And I see he ought to have earned £22 16s. 6d. a week with each of them. Did you get that, George? "

George : "I don't know that I can give you that figure straight off. . . Yes, I can. My average .earn ings for the four vehicles were £90 a week. That's £22 10s."

Jack: "Why, that seems to be all right, then. How do you make out your profit to be only £325.—£80 a year? That's only about 32s. a week for each vehicle."

George: " Well, if you can remember what I told you about my establishment expenses you'll see how that comes about. I told you my establishment expenses were £12 19s. a week for the four vehicles. That's £3 4s. 9d. each, so that if you take £3 4s. 9d. from £5 you get 35s. 3d. That is really what my net profit is." (The figure for establishment costs was given in the previous article when a question about establishment charges formed the subject-matter under discussion.) "Doesn't that go to prove," I said, "what I said earlier this evening (again th.e reader must refer to the previous article), that rates will have to be levelled up a bit all round, both for owner-drivers like Jack, as well as for people like yourself, George, when stabiliza tion comes? I do think, however, that your establishment costs are a bit high, George. I don't quite know where the expense comes in."

George : "Have you got any other operators' figures that you can show me? "

"I've got a fair amount of information of that sort at the office," I replied. "But, wait a minute," I went on, "I believe I've got something in my pocket. I'm afraid it is not quite what we want, because it relates to a big fleet. Perhaps, if we look into it, we can find some means for comparing with yours and we may find out what your trouble is. I should tell you that these do not happen to be a haulage contractor's figures: they come from a C licensee who has a fairly big fleet, but, as he runs his transport department separately and ...xpects it to show him a profit, there may be the ?ossibility of useful comparison."

I then produced a sheet bearing the data which ippears in Table I.

George: "There are a good many things down here, 3.T.R., that I don't have to bother about."

"That," I agreed, " is true enough, in a way, yet I hink if we go into them we shall find that if you don't Ay direct on each one of these items you do ;o indirectly. Let's run through them. "Stocktaking fees? I don't imagine you've anything of that to face. National Insurance? . . ."

George: "I include that with my drivers' wages."

" Ah," I said, " but this is National Insurance on account of office staff."

George : In my figures that goes down in sundries." "Garage? yes, George. Telephones, stamps and cheque books, yes. Petrol storage licences?"

George : "Not that for me, or any depreciation on buildings."

"Perhaps not directly, George," I pointed out, " but indirectly, yes. You pay your petrol storage licence by having to pay a little more for your petrol than this chap rdoes and you pay for depreciation on buildings in the rent you pay for your offices: Clerical?"

George: "Yes, I've got that and I suppose you'll tell me that rates, also, are included in my office rents."

• A Question of Sundries • "Quite right," I agreed, ".and so are your general repairs. You've got electric light down in your list, also travelling expenses—some more sundries. Interest on buildings is another little something which you pay in your office rents and depreciation on plant—ah • . there's something you've forgotten, George."

George "How do you mean ' forgotten '? I haven't any plant."

"You've a typewriter, though," I said, "and you've office desks and chairs, and filing cabinets."

Jack : "Have you ever seen George's office, S.T.R.? " "No, I can't say I have," I replied.

Jack: "I reckon his office furniture's depreciated long ago." George : "Anyway, I've no watchman to pay, although I do pay a little fire insurance. That's shown in my list. I've no works department, but I do pay for fuel and for printing and stationery. No advertising, and I suppose if we talk about interest on plant, I shall have some more backchat from Jack, so we can wash that out. Wages for manager, that's me, and firm's contribution to superannuation fund, that's me, too, I suppose.

" On the whole, I don't think there's a lot in this list that I haven't got in mine. The watchman's wages are the biggest item and as I suppose that will be about £100 a year out of £2,372 I think we can take it -as read," I think that's about fair, George," I said, " but the second part of the Table is the part which will give us the information we want. I see this chap has 35 vehicles, of all sorts and sizes, and I tell you right now that I do not agree with the way in which he has sorted out his establishment costs amongst the lot of them."

George (looking at the figures): "I see that the biggest vehicle is a 3-tanner, so that it is hardly in my class."

Jack : "You know very well, George, your 5-tanners are really 3-tanners, the same as in my case."

" I think it will be fair," r said, "to take the 3-tonner figures for comparisons with yours, George."

George: "In that case I'm a long way out. I see this chap's establishment expenses are only £99 a year for each, as against over £160 for mine."

"That's not quite right," I explained, "and that's the point I am concerned about. I don't think he has

allocated the overheads fairly. Unless he has some special reason for his method I'm going to tell him that the charges should be allocated in proportion to carrying capacity, like this." (See Table II.) Jack : "How do you do that, S.T.R.? "

" Well, I take the total number of cwt. of load capacity in the fleet. You see he has two 10-cwt. machines: that's 20 cwt. He has 19 20-cwt. machines; that's 380 cwt, and so on, all the way down, giving a total of 950 cwt. Now I divide that into his total establishment costs—£2,372 185. 6d.—and that gives me E2 10s. per cwt. Then I assess each vehicle on the basis of its capacity in this way. The 10-cwt. machine 10 times £2 10s.—£25 a year. The 60-cwt. vehicle in the same way—£150 a year—which isn't very different from your's, George."

George : "Well, how do you think he's gone wrong?"

" He may," I said, "be basing his allocation on the total tonnage per year carried by each vehicle, instead of the load capacity for each, but I shall not be able to tell you about that until the next time I see you."

S.T.R.