Planning for Profit

Page 86

Page 89

If you've noticed an error in this article please click here to report it so we can fix it.

Overhead Costs Can Undermine Profits

Establishment Charges, Divided into 55 Items, May Appear Insignificant, hut Add Up to a Large Sum

CHARGES of rate-cutting are as old as haulage itself. But in many instances, discussions on this subject prove fruitless because no definition of the term can be agreed, even if it is attempted. The dividing line between unfair competition and genuine higher-efficiency economy is often so thin.

Persistent undercharging, however, is in another category. In accordance with paragraph 44 of the Road Traffic Act, 1956, an A or B licence operator who persistently charges less than the cost of providing the' transport services could have his licence suspended or revoked for placing his competitors at an unfair disadvantage. In coming to such a decision, the Licensing Authority might consider the short-term advantage to customers of low rates was offset by repercussions to the balance of supply and demand of transport facilities.

What constitutes the cost of providing a transport service? Over many years The Commercial Motor has endeavoured to emphasize to both hauliers and passenger transport operators the need for compiling accurate operating costs. Only by this means can the user know whether, in fact, he is operating at a profit or loss. In this context there is probably more ratecutting through ignorance than by a deliberate act.

Ignorance of Costing

From the many inquiries received from readers it is surprising to find that a high proportion have acquired expensive vehicles, but have little or no knowledge of the basic principles of costing. Even where they appreciate the division of operating costs between standing and running costs, they are not aware of the further division between immediate and deferred expenditure.

If they have started in business with a new vehicle, wages. fuel, and, possibly, oil, may necessitate the only outlay for some weeks, if not months. Charges based on this expenditure alone would, of course, be quite inadequate. With every mile operated potential expenditure accrues which, eventually, will have to be met if they are to remain in business.

For example, the cost of licence duty, insurance premiums and interest on capital may be paid only annually. In the same way, substantial amounts will have to be paid out eventually for tyres, maintenance and depreciation.

More difficult even than this are the eSiablishment or overhead costs. Many small operators will insist that they have little or no overheads, but it is commonly held that one of the advantages of running a large fleet is the spreading of administrative costs.

This, apparently contradictory element, is due partly to confusion which arises in costing if allowance is not made for B.20 the effect of hidden subsidies. The 'small operator of commercial vehicles seems peculiarly prone to undertake. work for which he is not adequately rewarded, and this applies particularly in relation to overheads, Many hours of clerical work Performed in the evenings, or at week-ends, in all probability go unrecorded. Additionally, because a large number of overhead costs are individually small they are considered unimportant, but in total they will add up to a substantial sum. It is imperative, therefore, that these items arc listed for detailed consideration.

While the overhead costs of the owner-driver with a single vehicle may appear to be negligible, they are, in fact, incurred whether or not adequate payment is made. Part of his own house may be set aside for office work, which could necessitate extra lighting and heating. A telephone, together with adequate supplies of stationery, would be an absolute necessity, whether or not his own clerical labour was rewarded.

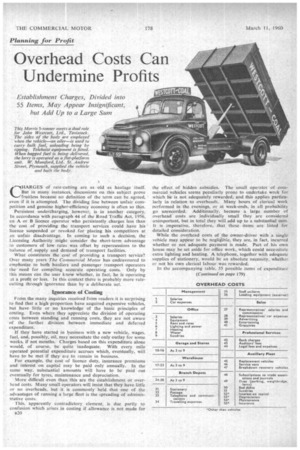

In the accompanying table, 55 possible items of expenditure (Continued on page 179)

on overhead costs are grouped under eight headings. Under the first—" Management "—are listed salaries and car expenses. However small a fleet, the operator will spend some time arranging journeys and attending to the business, generally over and above any actual driving or purely clerical work. Even though he may be an owner-driver, there is no reason why he should persistently carry out such work without payment, and due allowance should be made for this. Failure to do so introduces the element of hidden subsidy to which reference has already been made, and which so often confuses the issue when comparisons with other operators' costs are made.

• A small operator who uses his own car tor business purposes should make some charge under the Same heading..

Where the size of the fleet justifies the appointment of a manager, in addition to the owner of the business, both their salaries and any cars supplied for their 'use will, of course, be a direct charge on the business. For the moment, however, it is more. convenient to enter such expenditure under the heading of overhead costs as it is alrnost impossible to apportion such costs individually to each vehicle of the fleet. The whale purpose of listing overhead costs in this manner is .so that the propOrtion to be allocated, to each vehicle can be totalled.

• The second group is headed "Office." Even the minimum amount of stationery and clerical labour can add up to a substantial itern over a period of, say, 12 months. Where the scale of business justifies separate office accommodation, expenditure 'may be incurred in all seven items under this heading.

In addition to staff wages, equipment will include a desk and chair, filing accomModation and possibly a typewriter. Rent or rates may be payable, and light, water and heating will also be required.

Garage and Store Expenses The next group of overhead costs comes under the joint heading • of "Garage and Stores." Smaller operators, however, may wish to combine the •second and third groups under the one heading of " Office, Garage and Stores." A bigger concern may consider greater. control is obtained by splitting up k he economies of. garage .and stores.

-A-post-War development ancillary, to haulage has been the increasing demand for warehousing accommodation for. manufacturers .Whose sales have a nation-wide coverage. Provided the haulier does not sacrifice too much flexibility, the availability of suchfacilities can augnient a haulier's revenue.

Because of the nature of such work, .however, it is n&essary that the-several additionalitems of,expenditure incurred should be kept separate from the main business. The seven items listed from 3 to 9 under the heading of " Office" would apply under the third group, "Garage and Stores;" and also under. 'Warehouse.'

One of the problems to be met before considering expansion iS the comparative cost of employing an agency and doing the job oneself. An operator may Consider setting up his own branch depots instead of utilizing the. services of clearing houses. Here again it is important to treat such expenditure as a separate entity. Not only does this give the depot or section concerned the incentive to prove its own economies, but it also restricts the possibility of a deadwood section being subsidized by a more profitable department of the organization.

The seven items of cost shown, 3 to 9, are again included under the heading, "Branch Depots." But where the branch is large enough a further break-down of costs may be necessary under the headings of the first four groups.

Common Costs Stationery has been entered as an independent item, No. 31, as. it may be common, to all groups. The same aPplies to postage, telephone accounts and, in some of the larger undertakings, the cost of a radio telephone system.

The telephone is virtually the sole means of control once the vehicles have left their home base. Although it can be included among many other overhead costs, it is by no means an incidental expenditure'and its omission in .ealculating charges could have an adverse effect on profits,

"Travelling Expenses" would be a convenient item under which to list expenditure on fares "incurred while using public transport, as when a driver is serit to collect a new vehicle or .chassis, or report to another depot.

Expenditure on staff uniform shown alongside item 35.applies more to passenger transport operation but the' publicity Value of providing goods vehicle drivers with suitable uniform is becoming widely recognized. This applies particularly to ancillary users engaged on retail delivery, and especially on the distribution of food.

The loading equipment envisaged under item 36 is that provided other than in a warehouse or transit shed. For example, (hiring a sugar beet campaign a haulier may find it.worthwhile to provide his own loading e-quipment on the site to facilitate the quicker' turn-round of his vehicles. Similar 'circumstances

May arise in civil engineering work. S.B.