Education & Training... a C111 seminar

Page 72

Page 73

If you've noticed an error in this article please click here to report it so we can fix it.

Accounting I

e smell haulier. ..I

Eldon Bowden and Roger Lees of Tasc — Training assistance in small companies, part of the RTITB management development division — discuss the accounting requirements of the small hauliers from a management information point of view in a six-part series of articles.

Road hauliers are usually very practical people interested in .getting the job done — carrying goods from A to B. The associated bookwork often takes a back seat and is regarded as a necessary evil which contributes little or nothing to company profits.

But is this so? It is highly unlikely that any sensible operator would send a vehicle on a journey without first considering a route. In the same way, management needs to know where it is going and one of the ways of achieving this is through the production and understanding of relevant financial information.

There has always been a need for operators to keep a tight rein on all aspects of their operation. This has never been truer than now, when, over the last few years, costs have steadily increased without corresponding increases in rates. Failure to understand what is happening in the business can have serious repercussions. This point cannot be emphasised too strongly — it is absolutely fundamental to successful operation.

What then, does accounting mean to the small haulage company? It should certainly not be regarded as just book-keeping but as an aid to the management.

This series of articles will discuss how companies can provide themselves with financial information which will give practical assistance in the running of their operation. It will be done by considering past performance and the present operation, then projecting into the future by means of profit and cash planning.

One of the methods we, in TASC, have used successfully, over many years, in assessing past performance is the technique of financial ratios. This process involves extracting figures from financial accounts and we have used it with many companies as a starting point to their making better use of their financial information.

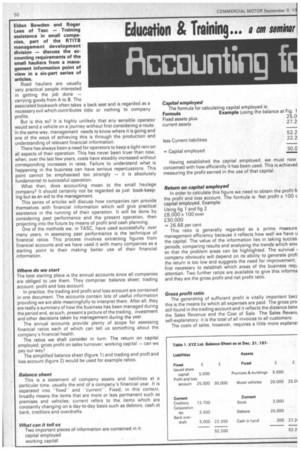

Where do we start The best starting place is the annual accounts since all companies are obliged to use them. They comprise: balance sheet; trading account; profit and loss account.

In practice. the trading and profit and loss account are contained in one document. The accounts contain lots of useful information providing we are able meaningfully to interpret them. After all, they are really a summary of how the business has been managed during the period and, as such, present a picture of the trading, investment and other decisions taken by management during the year.

The annual accounts provide plenty of scope for assessing financial ratios each of which can tell us something about the company's financial health The ratios we shall consider in turn: The return on capital employed; gross profit on sales turnover; working capital — can we pay our way?

The simplified balance sheet (figure 1) and trading and proft and loss account (figure 2) would be used for example ratios.

Balance sheet This is a statement of company assets and liabilities at a particular time, usually the end of a company's financial year. It is separated into "fixed" and "'current". Fixed, in this context, broadly means the items that are more or less permanent such as premises and vehicles: current refers to the items which are constantly changing on 'a day-to-day basis such as debtors, cash at bank, creditors and overdrafts.

What can it tell us Two important pieces of information are contained in it: capital employed working capital Having established the capital employed, we must now concerned with how efficiently it has been used. This is achieved measuring the profit earned in the use of that capital.

Return on capital employed In order to calculate this figure we need to obtain the profit fr the profit and loss account. The formula is: Net profit x 100 c capital employed. Example: Using fig 1 and fig 2 £8,000x 100 over £30,000 = 26.66 per cent This ratio is generally regarded as a prime measure management efficiency because it reflects how well we have u the capital. The value of the information lies in taking succes! periods, comparing results and analysing the trends which emf so that the problem areas can be highlighted. The survival i company obviously will depend on its ability to generate profi the return is too low and suggests the need for improvement, first necessary to establish which areas of the business reqL attenfion. Two further ratios are available to give this informa and they are. the gross profit and net profit ratio.

Gross profit ratio

The generating of sufficient profit is vitally important beef this is the means by which all expenses are paid. The gross pro. still found in the trading account and it reflects the distance betvi the Sales Revenue and the Cost of Sale. The Sales Revem. self-explanatory: it is the total of all invoices to all customers.

The costs of sa!es, however, requires a little more explanai enerally, the following items are included: Jrchases; wages; licences; motor insurance; depreciation.

The subject of Cost of Sales will be discussed at greater length in subsequent article in this series entitled "Management ccounts" The formula for calculating the ratio is quite simple ross profit x 100 over sales turnover. Example: sing fig 2.

40,000 x 100 over 200,000 20 per cent.

Only a limited number of factors occur between the sale and

-oss profit. Any adverse trend can be a means of focusing attention

these to establish the cause and take remedial action.

The gross profit ratio reflects how well the vehicles are being

Derated and gives clues on how effectively key cost areas, such as -ivers' wages, maintenance and fuel, are controlled. It also gives

.) indication of whether we are selling in the right quantities at the right rate. So, the area of gross profit is an important one on which to concentrate, because if we get it right, it will make life a lot easier.

Net profit ratio

It may be that the gross profit level is satisfactory, but the net profit is too low. Since. net profit is the result of deducting overhead expenses from gross profit management can pinpoint likely problem areas by investigating items of expense which appear out of proportion or unduly high. The formula is:

Net profit x 100 over sales turnover_ Example Using fig 2 £8000x 100 over £200,000 = 4 per cent If we have a situation where gross profit is satisfactory but net profit is declining, we only have to look at the items of expenditure contained in the profit and loss account. An example of the items most likely to require most scrutiny would be administrative wages, telephone, heat and light, and finance charges. These can serioUsly. erode profits if not carefully controlled.

Working capital ratio Transport operators face many problems in running their business, but perhaps the biggest problem of all is money. While the haulier may spend a lot of time concentrating on achieving profitability, it is not the lack of profit which is the downfall of many businesses but the lack of cash or working capital. The ability of a company to pay its way can be measured by comparing two figures in the balance sheet. This ratio is called the Working Capital or Liquidity Ratio.

Formula Example (using Fig. 1) E Current assets 27,200 — 1.2:1 Current liabilities 22,200 Road transport businesses often grow from the humble beginnings of a one-man band. Lured by the attractions of profit, firms grow quickly, usually financed by borrowings from, for example, HP companies, who provide capital for vehicles. They frequently come unstuck by going too far too quickly.

Where this happens, it can be detected by the use of the working capital ratio which, for operating comfort, should, ideally, be in the region of 1.5: 1 . This means the company can easily pay its way on a day-to-day basis, but the lower the ratio, the less cash is available to meet debts.

Practical uses Being able to calculate financial ratios places a manager in a position where he can begin to interpret information meaningful to assist in the management of the company. He is also better able to understand the way in which the supplies of finance, such as bank managers, view his company and this puts him in a position to negotiate with them with greater confidence.

Although we have considered ways in which to make greater use of financial accounts, it must also be recognised that they contain inherent limitations of which the main feature is that they are historical.

If we rely on them as a sole source of financial information, we do not have up-to-date information on which to guide management during the year. This, however, can be overcome by the use of management accounts produced regularly throughout the year — subject Jo be covered in a later article in this series.