all~DAY _AIJOVER

Page 53

Page 54

If you've noticed an error in this article please click here to report it so we can fix it.

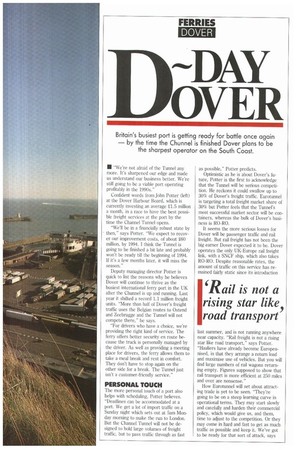

• "We're not afraid of the Tunnel any more. It's sharpened our edge and made us understand our business better. We're still going to be a viable port operating profitably in the 1990s."

Confident words from John Potter (left) at the Dover Harbour Board, which is currently investing an average 21,5 million a month, in a race to have the best possible freight services at the port by the time the Channel Tunnel opens.

"We'll be in a financially robust state by then," says Potter. "We expect to recover our improvement costs, of about £60 million, by 1994. I think the Tunnel is going to be finished a bit late and probably won't be ready till the beginning of 1994. If it's a few months later, it will miss the season."

Deputy managing director Potter is quick to list the reasons why he believes Dover will continue to thrive as the busiest international ferry port in the UK after the Chunnel is up and running. Last year it shifted a record 1.1 million freight units. "More than half of Dover's freight traffic uses the Belgian routes to Ostend and Zeebrugge and the Tunnel will not compete there," he says.

"For drivers who have a choice, we're providing the right kind of service. The ferry offers better security en route because the truck is personally managed by the driver. As well as providing a meeting place for drivers, the ferry allows them to take a meal break and rest in comfort. They don't have to stop again on the other side for a break. The Tunnel just isn't a customer-friendly service."

PERSONAL TOUCH

The more personal touch of a port also helps with scheduling, Potter believes. "Deadlines can be accommodated at a port. We get a lot of import traffic on a Sunday night which sets out at 5am Monday morning to make the run to London. But the Channel Tunnel will not be designed to hold large volumes of freight traffic, but to pass traffic through as fast as possible," Potter predicts.

Optimistic as he is about Dover's future, Potter is the first to acknowledge that the Tunnel will be serious competition. He reckons it could swallow up to 30% of Dover's freight traffic. Eurotunnel is targeting a total freight market share of 30% but Potter feels that the Tunnel's most successful market sector will be containers, whereas the bulk of Dover's business is RO-RO.

It seems the more serious losses for Dover will be passenger traffic and rail freight. But rail freight has not been the big earner Dover expected it to be. Dover operates the only UK-Europe rail freight link, with a SNCF ship, which also takes RO-RO. Despite reasonable rates, the amount of traffic on this service has remained fairly static since its introduction last summer, and is not running anywhere near capacity. "Rail freight is not a rising star like road transport," says Potter. "Hauliers have already become Europeanised, in that they arrange a return load and maximise use of vehicles. But you will find large numbers of rail wagons returning empty. Figures supposed to show that rail transport is more efficient at 250 miles and over are nonsense."

How Eurotunnef will set about attracting trade is yet to be seen. "They're going to be on a steep learning curve in operational terms. They may start slowly and carefully and harden their commercial policy, which would give us, and them, time to adjust to the competition. Or they may come in hard and fast to get as much traffic as possible and keep it. We've got to be ready for that sort of attack, says Potter." He recognises that initially the Tunnel's novelty value will attract extra business. "It'll take some time before customer perception of service and price becomes apparent, but there will be some things the Tunnel will do better and somethings the ferries will do better. The customer will largely dictate who does what."

Pricing policy is something Eurotunnel will not yet talk about. "We have to be prepared to face a challenge from a traffichungry Eurotunnel, which may be prepared to undercut our rates by more than the threatened 10%. But with the higher capital costs incurred, that's looking more doubtful."

Potter is certain that Eurotunnel will use the hard sell. "They will have a large budget and will be able to project the Tunnel expensively and determinedly. That's how it will get business." The Harbour Board allocates a modest £300,000 for advertising and promotion and is currently reviewing both the amount and the way it is spent. Dover intends to push itself in Europe as a port with a wide range of cargo services.

REAL COMPETITOR

Should Eurotunnel fail to recover its everincreasing costs, now estimated by bankers to be as high as £8 billion, the outlook would not be good for the port. "If it goes bust and is sold off for peanuts, then we've got a real competitor on our hands," says Potter.

Meanwhile, Dover is putting into place improvements to structures and systems designed to trim vital minutes off through times for trucks. Already this has been more than halved to around two hours by the introduction of fast-lane customs clearance. Other improvements include the elevated highway from the Eastern Docks, three new weighbridges which can each process trucks at the rate of one a minute, and a £3m bulk general cargo development at the Eastern Docks, which gets under way next month. Customer facilities are being upgraded and all staff, from traffic marshals upwards, are going through refresher courses covering everything from customer care to safety.

Getting information to customers, which Potter cites as "one of our biggest problems", has received particular scrutiny. The Board plans to install an £8m computer system by 1992. "We have to become more information-efficient and this will allow hauliers and forwarders to check where lorries are en route, when they sailed, and when they cleared."

Not surprisingly, all this has not been achieved without a price. Dover axed 10% of its workforce in 1988, "to reduce the impact of the P&O/NUS dispute" — and will be shedding more of its people.

Potter sees Dover's road links as a serious weakness in the chain. He has been pressing the Government "for years" to commit itself to investment in roads which will keep Dover on a par with other European ports.

"In France, ports are served by motorways. But in Britain it's hard to find a port with a motorway going to it, he says." Government plans to upgrade the A20 still leave 11 kilometres of single carriageway leading into the port, an anomaly "for the UK's gateway to Europe which handles approaching 50% of UK non-fuel trade". If roadworks close the road leading onto the A2, as they did earlier this year, traffic has to be diverted through the narrow streets of Dover town centre.

The Tunnel threat has pushed the Harbour Board into taking a tougher commercial approach to its business. "We have to sharpen up." Should times get hard, the Board has plenty of resources to fall back on and has some money-spinning ideas up its sleeve. Its book assets total more than £60m, including property with plenty of development potential, and plans are afoot to convert enclosed docks into an upmarket yacht marina. "But we cannot forget that the predominant part of our business is ferries."

The ferry companies seem just as confident as the port authority. "We'll be carrying more traffic after the Tunnel than we are today," says Sealink freight manager John Mills.

The company is in the process of boosting its freight capacity by about 50% with the introduction of two £50,000 jumbo freight ferries which will each hold 100 vehicles. "It's not a case of what can we do to compete with the Tunnel, but what are they doing to compete with our luxury ferries?" he adds.

BETTER DEAL

MO has talked to many of its customers about the Chunnel, and according to Russell Peters, freight marketing director, there is "scepticism that the Tunnel is going to be a better deal. The biggest question is what's it going to cost?"

With the increasing trend for just-intime delivery, Peters is confident that driver-accompanied freight is going to see steady growth.

His opinion is backed up by last year's Department of Transport RO-RO figures which show driver-accompanied freight growing more than twice as fast as nonaccompanied. "An unaccompanied trailer doesn't ring up and moan if things go wrong," he says.

Dover has experienced plenty of invasions, since Julius Ceasar used the "haven between the hills" for his ships. They may not have come underground before, but it seems the port of Dover is not going to be put out of business by a tunnel. 0 By Gill Harvey •