Compared with Normal Lorries with Fixed Bodies'

Page 58

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

TIPPERS

Cost 12hPer

Cent. More to Operate

AREADER wishes to know why there is not a special Table for tipping vehicles in ' The Commercial Motor" Tables of Operating Costs. The writer points out, correctly, that there is a big difference bemeen the cost of operating tippers and that of ordinary vehicles. The first cost, maintenance cost, fuel consumption and tyre cost are all greater.

I accept all these points, but, even so, I do not think they constitute a claim for the inclusion of a special Table for tippers. If it were to be accepted, there would shortly he a request for similar treatment at respect of furniture vans, cattle trucks, of tank wagons and others, and the Tables would soon become impracticable because of their size. There is a limit to what can be included in a publication of that description.

What 1 have agreed to do is to write an article or two in this series, giving the information sought by this inquirer, and I begin the task this week. It occurred to me, while preparing last week's article, that the figures contained in it relating to the up-to-date operating costs of 6-ton lorries on local work, might well serve as a basis for comparison if, in the suceeding article, I gave corresponding figures for 6-ton tippers. Before doing so, 'however., I would like to round off the figures published last week and make some additions to them.

Data for 'Grade II Areas

The data contained in that article related to vehicles operating in a Grade II area. To make it complete I must give similar information for vehicles operating in London and Grade I areas. In London the basic rate of wages is 9s. per week more than in Grade II areas. Instead, therefore, of a wage of £5 19s. 6d. per week, I must take £6 9s. (the extra 6d. provided in that amount is to allow for the additional cost of holidays with pay).

Garage rents in London are much higher and the operator will probably have to pay 10s.. instead of 5s. per week. The cost of insurance will probably be 25 per cent. more (El 5s. per week instead of £1). The total additional cost so far is 19s. 6d.

Establishment expenses in London will undoubtedly be much higher-certainly another 10s. per week-so that the total of fixed costs for Londoners, compared with operators in Grade II areas, is £1 95. 6d. more. Instead of a total of fixed charges of £16 3s. 6d., as in a Grade II area, the operator in London will have to find £17 13s.

In a Grade I area, as compared with Grade H, the extras are 4s. per week for wages, 2s. for insurance, 3s. for rent and 5s. for establishment costs, making 14s. in all, so that the total of weekly fixed charges in a Grade I area will approximate to £16 I7s. 6d.

R24 The running costs are not materially affected by the district. The only item which might prove more expensive is that of maintenance, and the difference is so small that it can be ignored. There is a small difference, too, in petrol costs under the present system of zoning, but as I cannot reasonably split that up as between Grade I and Grade II areas and London, I shall have to let that go. In any event, calculations for fuel consumption cannot be so accurate as to take into account id, per gallon difference in a cost of nearly 3se per gallon.

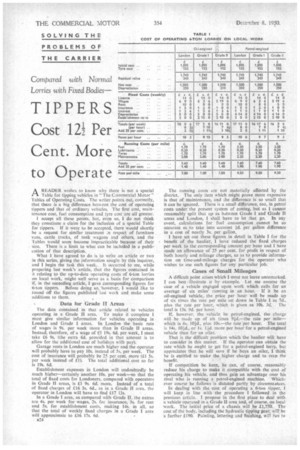

have set out these figures in detail in Table I for the benefit of the haulier, I have reduced the fixed charges per week to the corresponding amount per hour and I have made an allowance of 25 per cent. for profit in respect of both hourly and mileage charges, so as to provide information on time-and-mileage charges for the operator who wishes to use such figures for any particular job.

Cases of Small Mileages

A difficult point arises which I must not leave unremarked.

can best 'illustrate it by example. Let me assume the case of a vehicle cngaged upon work which calls for an average of six miles' running in an hour. If it be an oil-engined vehicle,, the price per hour will be made up of six times the rate per mile set down in Table 1 as 7d„

plus the rate per hour, which is given as II3S. 3d. The total is 13S. 9d. per hour.

If, however, the vehicle be petrol-engined, the charge will be made up of six times 91(1.-the rate per 'milewhich is 4s, bid., plus 10s.-the rate per hour. The total is 14s. 10d., or ls lld. more per hour for a petrol-engined vehicle than for an oiler.

That is the difficult problem which the haulier will have to consider in this matter. If the operator can obtain the rate which he ought to get for a petrol-engined lorry, but appreciates that he will save if he buys an oiler, I think he is entitled to make the higher charge and to reap the benefit.

If competition be keen, he can, of course, reasonably reduce his charge to make it compatible with the cost of operating his vehicle, and thus gain an advantage over his rival who is running a petrol-engined machine. Whichever course he follows is dictated partly by circumstances.

In dealing with the cost of operating a 6-ton tipper, I will keep in line with the procedure I followed in the previous article. I propose in the first place to deal with a vehicle operated in a Grade H area and, of course, on local -work. The initial price of a chassis will be £1,750. The cost of the body, including the hydraulic tipping gear, will' be a further £190. Painting, lettering and finishing, will run to

another 155, so that the total expenditure on the new vehicle will be £1,995.

From that total initial cost 1 deduct first the price of a set of six tyres (£152). There is £1,843 left, but before calculating depreciation I must make an assumption concerning the amount which the operator will get for the vehicle on resale in five years' time. I have assumed that the life of a tipper will be a year shortcr than that of a lorry with a fixed body. 1 propose to take £243 as the residual value, and if I deduct that from /1.843, there remains £1,600 as the figure on whicn 1 must calculate depreciation. On the basis of five years probable life, £320 per annum. or 16 8s. per week, must be set aside for depreciation. For interest I allow 3 per cent. on 11,995, which is nearly 160 a year or £1 4s. a week.

I can now set out in detail the fixed charges per week. First comes the tax, and as it is unlikely that the tipping vehicle will weigh less than 3 tons unladen. I shall take I6s. per week as the approximate amount. Wages will be EIS before (£5 19s, 6d.); garage rent 5s., and insurance £1. Interest has been calculated as £1 4s. and depreciation46 8s. For establishment costs I take the same amount as in the previous example, that is £2 10s. per week. The total is £18 2s. 6d. per week, as compared with £16 I Is.. the.eorresponding figure for the 6-ton drop-sided lorry. That is equivalent to an increase of approximately 10 per cent.

All Cost Items Higher

Every item of running cost of the tipper is undoubtedly higher than that of the ordinary sided lorry. For fuel I shall assume 14 m.p.g., which. at 2s. 61d, per gallon, is equivalent to 2.18d. per mile. For lubricants I take 0.25d. Tyres will not last so long on a tipper as they will on an ordinary lorry. I propose to allow 20.000 miles, life, instead of 21,500 which I used in the previous article. At £152 per set, the cost is 1.82d, per mile. Maintenance will undoubtedly be more expensive and, including the extra cost of upkeep of the tipping gear, bodywork and chassis will cost 2.50d. The total is 6.75d., which compares with 5.6d. for the fixed bodied lorry, an increase of 20 per cent.

Taking a " snap" set of figures relating to an average weekly mileage of 240, the entire cost per week of the sided lorry was shown in the previous article to be £22 3s. In the case of the tipper there are first the running costs-240 times 6.75d.—of E6 15s. Adding the fixed charges, £18 2s. 6d„ the total is £24 17s. 6d. The difference between the two is actually a 14s. 6d. per week, which is equal to an approximate increase of 121 per cent. for the tipper as against the ordinary lorry.

Before going further with this task, I will deal with one or two points which have arisen since the previous article was written.

First, there is the question whether I should, in deducting the price of a set of tyres from the initial cost of the vehicle. use six or seven tyres as the basis. I take six because I am concerned only with the tyres which are being worn out and not the spare. Someone has raised the point that the spare tyre is sometimes put on to a wheel and one of the other six tyres is employed as the spare. Those who have raised this point seem to think that because the seven tyres are used in that way, I should revise my methods and take the cost of seven from the total.

Problem of the Spare Tyre

do not agree. Whatever may happen to the spare tyre, no more than six tyres are ever being worn at the same lime. The tyre which is at the time being carried as a spare is doing no work and is as much a part of the vehicle as the tool kit or any other component. It does not wear out, but only depreciates at the same rate as the vehicle, and its cost should be included in the amount for the calculation of depreciation,

That brings me to another matter which has been put to me, particularly of late, as to why in "The Commercial Motor" Tables of Operating Costs I always treat depreciation as a running cost, whereas in these articles I have taken it as a standing charge. The answer is that in the Tables I have to deal with averages and set out the information so that it shall be of the greatest use to the maximum number of people. The calculation of depreciation for a variety of weekly mileages involves, in the lower scale of mileages at least, consideration of obsolescence. In the Tables that is taken into account and the figures modified accordingly.

In the low weekly mileages such as I have in mind in these articles, it is preferable to take depreciation as a standing charge, chiefly for the reason that the effect of obsolesence transcends in its importance that of wear and tear when dealing with individual types of operation, as 1 am at present, and when they involve comparatively low weekly mileage. I prefer to take depreciation as a standing charge.

In the next article I shall deal with tipping vehicles in London and Grade I areas. S.T.R.