SHOW REPORT

Page 44

Page 45

Page 46

If you've noticed an error in this article please click here to report it so we can fix it.

TOKYO

IN The largest number of commercial vehicle exhibitors ever gathered in Japan greeted an estimated two million visitors at the 29th Tokyo Motor Show last month.

Japan's consumption of trucks, vans, buses and coaches is exceeded only by the US. The Pacific Rim countries of southeast Asia represent the greatest potential for long-term growth among the world's commercial vehicle makers, and are therefore of increasing interest. Success in Japan is seen as paramount as it is the most developed of this group of countries. The 28th show in 1989 was notable for the announcements by Volvo and Mercedes-Benz that they were to enter the Japanese market. Following lengthy Type Approval tests, both began selling top weight tractive units and Mercedes introduced vans. The market then was opening up to importers who enjoyed small yearly sales increases. However, today the total market and Japanese exports continue to shrink, raising trading tensions and squeezing profits.

The scale of the Japanese commercial vehicle market can be judged by statistics from the Japan Automobile Manufacturers Association JAMA. They show it is dominated by light vans and trucks; the heaviest truck limit being just 20 tonnes for rigid vehicles and 34 tonnes for articulated combinations without special permits.

In 1989 more than 3.2 million light vans with up to two tonnes payload were registered. For vehicles up to four tonnes the figure is 1.1 million; between four and six tonnes this falls to 30,200.

Three and four-axle rigid trucks with a payload capacity above nine tonnes numbered 74,000. And there were 12,071 tractor unit sales. These dropped to 9,000 in 1990. Sales of rigid trucks fell to 58,000, a combined percentage drop of 22%. Light truck, van and coach sales have experienced similar falls. The good news is that 1991 figures are running only slightly behind last year, and there is little sign of the long-term recession which has affected the West so badly.

Models

The outcome is that Volvo and Mercedes failed to achieve their initial aims with image-making heavy trucks. Volvo registered just 60 F16 4x2 and 6x4 tractors; Mercedes managed 50 of its 1748 and 2648 models.

Volvo had predicted sales of around 90 in the first 12 months, rising to "hundreds" within a few years. Mercedes said 25% of the 1,000 vehicles it thought it would sell in its first year would be heavy trucks.

Both manufacturers re

asserted their commitment to Japan at this year's show. They also declared themselves happy with their respective marketing co-operations. Isuzu sells Volvo through 24 of its own dealers, and Stuttgart Truck and Bus (SIB), the independent importer 60% owned by MercedesBenz, sells the 17/2648 through 47 Mitsubishi Fuso dealers.

Volvo's executive vice president Tommy Rengman admits the result is "not enough". He aims to make 1,000 sales a year in three to five years with a wider model range. He says Japan is essential to the company's plans to be a player in the world truck market. "If you want to be a leader you have to accept the Japanese market," he says. "You have to be here.

"Volvo is here to stay. I can promise you we will be very patient. Those that do their homework survive. We have done our homework," Rengman reassured the Japanese press.

He says Japan offers tremendous potential for future truck sales, particularly now that deregulation has begun.

However, there are great inefficiencies built around longheld working practices which restrict loaded returns. One recent estimate by the Japanese transport association puts empty running at 54%.

Volvo is confident improved efficiency will put more sales its way, despite an expected drop in the number of vehicles on the road. Tests run on heavy transport have recorded fuel consumption savings in the order of 20% compared to the best local trucks, it says. STB president Koji Yamada says: "We aim to raise Mercedes' penetration in the Japanese market. We are making steady progress: a gradual increase."

Talk on the stands of the four major domestic heavy vehicle makers, Isuzu, Mitsubishi Fuso, Hino and Nissan Diesel, was of technology and their continuing concern for the environment.

Engines

Nissan Diesel confirmed that the first prototype engines from its Iveco joint venture to design and manufacture an all-new mid size diesel range are now undergoing field trials.

ND president Takuro Endo reported his company's involvement has centred on the supply of advanced fuel injection technology.

It is believed Iveco sought the Japanese company's involvement to meet forthcoming worldwide emissions legislation. Endo's comments endorse Iveco marketing deputy Jean Pierre Neveu's forecast earlier this year when he said Italian prototypes would enter service before December.

The six and eight-litre range of 164 to 239kW (220 to 320hp) units are due for launch in trucks, buses and other vehicles made by both manufacturers during the mid-1990s but none was on show.

Iveco announced the project in late 1989, when its then chief executive Giorgio Garuzzo said only that the agreement would give customers in Japan and Eu rope better products without impeding or distorting the competitive environment. The deal has involved sharing technology in other areas.

The then president of Nissan Diesel, Isamu Kawai, said the constant exchange of ideas, expertise and testing would yield benefits to both parties such as reduced development times, costs and risks. There has never been any intention for the two to co-operate in any sales agreement which might see the introduction of Japanese heavy trucks into Europe.

A severe shortage of skilled truck drivers in Japan is prompting manufacturers to improve their vehicles' style to make them more attractive to transport companies.

Products

Isuzu, Fuso and Nissan Diesel all claim the advanced technology and styling in their products will help employers attract more professionals.

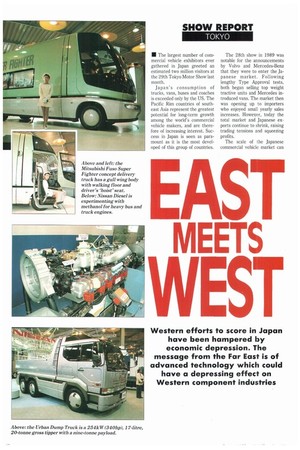

Fuso's centrepiece was the Super Fighter delivery truck with its gull-wing body, fourwheel-drive and steer system and driver's hoist seat.

Significantly many trucks and buses showed infra-red traffic distance sensors to warn the driver when his braking distance was insufficient, or when he was wandering out of lane.

Isuzu is to launch a fourwheel-steer, four-wheel-drive 14-tonne truck chassis for Far East markets next year.

The design is based on its FRR model and is aimed at urban delivery, utility and military customers, all of whom have the need for greater manoeuvrability and traction, it says. Appraisal vehicles are already in service.

Brakes

The Isuzu system works by air/hydraulic actuators controlling an independently sprung, single wheeled rear stub axle. Disc brakes serve all-round.

The company also showed a seven-tonne steer beam axle with rack and pinion steering. It is wholly an Isuzu design and is already being fitted in the new Super Cruiser UFC tour bus. There are no plans for its use in any other vehicle.

Any suggestion that a Japanese commercial vehicle manufacturer would soon enter