Cost Recording Made Easy

Page 36

If you've noticed an error in this article please click here to report it so we can fix it.

INSTALMENT No. 2

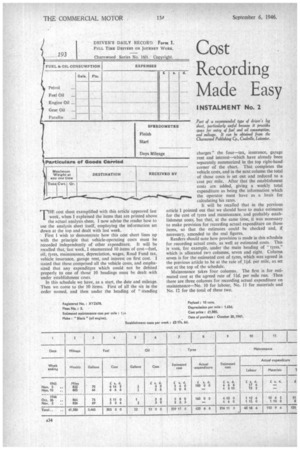

TFIE cost sheet exemplified with this article appeared last week, when I explained the items that are printed above the actual analysis sheet. I now advise the reader how to use the analysis sheet itself, employing the information set down at the top and dealt with last week.

• First I wish to demonstrate how this cost sheet lines up with the principle that vehicle-operating costs must he recorded independently of other expenditure. It will be recalled that, last week, 1 enumerated 10 items of cost—fuel, Oil, tyres, maintenance, depreciation, wages, Road Fund tax, vehicle insurance, garage rent, and interest on first cost. I stated that these comprised all the vehicle costs, and emphasized that any expenditure which could not be debited properly to one of those 10 headings must be dealt with under establishment costs.

In this schedule we have, as a start, the date and mileage. Then we come to the 10 items. First of all the six in the order named, and then under the heading of "standing

charges" the four—tax, insurance, garage rent and interest—which have already been separately summarized in the top right-hand corner of the chart. That completes the vehicle costs, and in the next column the total of those costs is set out and reduced to a cost per mile. After that the establishment costs are added, giving a weekly total expenditure as being the information which the operator must have as a basis for calculating his rates.

It will be recalled that in the previous article I pointed out that we should have to make estimates for the cost of tyres and maintenance, and probably establishment costs, but that, at the same time, it was necessary to make provision for recording actual expenditure on those items, so that the estimates could be checked and, if necessary, amended to the real figures. Readers should note how provision is made in this schedule for recording actual costs, as well as estimated costs. This is seen, for example, under the main heading of "tyres," which is allocated two columns, seven and eight. Column seven is for the estimated cost of tyres, which was agreed in the previous article to be at the rate of Id. per mile, as set out at the top of the schedule. Maintenance takes four columns. The first is for estimated cost at the agreed rate of lid. per mile run. -Then there are three columns for recording actual expenditure on maintenance—No. 10 for labour, No. 11 for materials and No. 12 for the total of these two.