Europe: a suitable case for treatment?

Page 30

Page 31

If you've noticed an error in this article please click here to report it so we can fix it.

With ambitious truck manufacturers in China eyeing up the European market we take a look at what the future might hold Words: 011ie Dixon There is one thing in particular that has characterised the European truck business over the past couple of decades: the process of OEM consolidation. Gone, mostly, are the regional OEMs, their place taken by a few giant organisations operating in an increasingly narrow market.

The process has made entertaining viewing, but the problem with consolidation is that it is, by definition, a finite thing. Once supply is consolidated under the control of a few behemoths, the process has run its course.

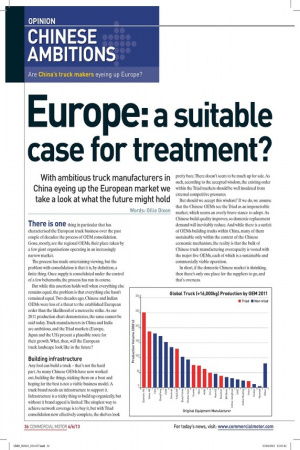

But while this assertion holds well when everything else remains equal, the problem is that everything else hasn't remained equal. Two decades ago, Chinese and Indian OEMs were less of a threat to the established European order than the likelihood of a meteorite strike. As our 2011 production chart demonstrates, the same cannot be said today. Truck manufacturers in China and India are ambitious, and the Triad markets (Europe, Japan and the US) present a plausible route for their growth. What, then, will the European truck landscape look like in the future?

Building infrastructure Any fool can build a truck — that's not the hard part. As many Chinese OEMs have now worked out, building the things, sticking them on a boat and hoping for the best is not a viable business model. A truck brand needs an infrastructure to support it. Infrastructure is a tricky thing to build up organically, but without it brand appeal is limited. The simplest way to achieve network coverage is to buy it, but with Triad consolidation now effectively complete, the shelves look pretty bare. There doesn't seem to be much up for sale. As such, according to the accepted wisdom, the existing order within the Triad markets should be well insulated from external competitive pressures.

But should we accept this wisdom? If we do, we assume that the Chinese OEMs see the Triad as an impenetrable market, which seems an overly brave stance to adopt. As Chinese build-quality improves, so domestic replacement demand will inevitably reduce. And while there is a surfeit of OEMs building trucks within China, many of them sustainable only within the context of the Chinese economic mechanism, the reality is that the bulk of Chinese truck manufacturing overcapacity is vested with the major five OEMs, each of which is a sustainable and commercially viable operation.

In short, if the domestic Chinese market is shrinking, then there's only one place for the suppliers to go, and that's overseas. Chinese brands are already well established in Africa — a market of considerable interest to Beijing as it seeks to ring-fence future energy supplies. They are also beginning to gain a toehold in Brazil, although Dilma Rousseff's government's moves to protect domestic production through tax disincentives have, for the moment, put a dampener on this market. This means it's not so much a case of Chinese brands beginning to expand overseas, as of completing the process.

However, for a Chinese OEM to get into Europe, it needs an infrastructure. There are three ways to get one. The first — self-build — we can partially discount. The traditional model, in which an independent network is developed, requires investment on an almost sightunseen basis using independent money. In the Europe of 2013, this seems unlikely. True, a wholly owned model could be built up, but this too would be a time-consuming and costly process. While not entirely implausible, it does seem an unlikely approach.

The second way, market entry by acquisition, throws up an interesting scenario. The past two decades have been the age of consolidation. We are now, it could be argued, entering the age of deconsolidation.

Deconsotidation pressure Bear with us as we ruffle some feathers. Two candidates present themselves from this perspective. Daimler Trucks and Iveco are now prone to significant deconsolidating pressures, but for very different reasons.

In Daimler's case, it's all about splitting car and truck. Below-par performance has caused a degree of shareholder discontent, and the rumblings don't seem to go away. Notable here is the presence of Christer Gardell, managing partner at Cevian Capital on the Daimler shareholder roster. Garden caused havoc at Volvo a few years ago with his voluble stance, and has long been rumoured to be eyeing up some activist shenanigans in Stuttgart.

The recent addition of former Daimler truck chief Eckhard Cordes, beaten finalist in the Daimler CEO contest won by Dieter Zetsche a few years ago, to the Cevian Board has helped stir this pot Daimler's management position, entirely reasonably, is that a split between car and truck is never going to happen. What its shareholders think remains to be seen, but Daimler Trucks as a strategic acquisition target and a route to market is a stretch.

removal of production facilities to Spain partially out of the sphere of Italian political influence, and the opting for Ducat° over Daily in North America suggests Iveco is an asset being readied for divestment. It presents a very plausible acquisition target for an ambitious European market entrant, and the scarcity of such targets implies a significant price premium.

Fiat rumours Clearly, Fiat Industrials and Fiat are separate companies, so a sale of Iveco will not help Fiat raise the cash for the Chrysler deal. But the Chrysler deal, along with rumours that Fiat is to seek a primary listing in New York, seems to point to a view in Turin that sees the new rather than the old world as key to Fiat's present thinking. If Iveco, pretty much uniquely across the Fiat and Fiat Industrial brands, does not appear to have a place in this plan, it seems to say much about Turin's view of Iveco.

There is the possibility of a third way for a truck brand to gain an infrastructure. The development of European fiber-fleets through downstream consolidation has reduced the value of the infrastructure provided by the OEMs as the larger-scaled operators are now able to provide for their own network needs.

In 2007, Chinese OEM Shaanxi Motors entered the African market via a deal structured with logistics operator SuperGroup that eschewed the need for network back-up. As the European operational landscape continues to skew towards fewer, bigger fleets, a similar deal cannot be discounted in Europe.

Europe must be a part of that ambition, and so we have to expect some move towards a market entry at some point. Quite how and when remains to be seen. •