Removal Costs are Different

Page 62

Page 67

If you've noticed an error in this article please click here to report it so we can fix it.

IHAVE been asked by a reader to give some figures for the operating costs of vehicles employed on

. furniture removal. He suggests that these be applied to a fleet of five vehicles each of 3 tons unladen weight and having a capacity of 1,000 cubic ft.

This is one of those cases to which the average figures set out in "The Commercial Motor" Tables of Operating Costs cannot be applied. This department of haulage is different in several ways. The vehicles are expensive, maintenance costs are above the average, chiefly because of the expense of keeping the bodywork in good repair and appearance, the mileage per week varies between wide limits and so do the labour charges.

There is next the question of establishment costs, which is difficult because most furniture removers also run depositories so that the establishment costs have to be divided between the two sections of the business. The apportionment of the establishment costs to the transport side is an important matter. Most important of all, especially in its effect upon the charges which the remover must make in order to cover his costs and make a profit, is the fact that no furniture van is fully occupied throughout the year and rarely even throughout the week. A contributory cause is that the householder who wishes to have his furniture removed is usually the arbiter of the time when he will have the removal effected. The furniture remover, in order to comply with these conditions, will often have the vehicle or vehicles standing idle for a day or sometimes two days per week. This has a considerable effect on cost and must never be overlooked in assessing rates to be charged.

As will be deduced, these peculiar characteristics affect first of all the way in which the operating costs are assessed and allocated. They also have an important bearing on the assessment of depreciation and make it necessary to deal with labour costs as a separate entity.

Exclude the Driver In all, 1 have found the best way to assess operating costs is to segregate costs into three main departments— the cost of operating the vehicle, the cost of labour employed, and establishment costs. It follows from this that the vehicle-operating costs must be compiled without including any provision for the wages of the driver. He is considered to be one of the crew whose principal business is to handle the furniture at the collection and delivery points. 1 he fact that he drives the vehicle between these two points is merely extraneous to the main issue.

I begin with the first of these three items in assessing the operating costs of the type of vehicle specified in the inquiry, less the driver's wages. In doing so, I shall have to pay particular attention to the items "depreciation" and "maintenance" so as to make provision for the special circumstances in which the vehicles are operated.

So far as possible, I shall take the figures from "The Commercial Motor" Tables of Operating Costs, amending c24 them to take into account increases in commodity prices which have occurred since the current issue was compiled.

It will be convenient first of all to deal with those items about which there are no difficulties, that is to say, items. which are more or less static and applicable to every type of vehicle. They are licence, garage rent and rates, fuel, lubricants and tyres. We can set down the amounts to be debited under these headings right away.

The inquirer has already staled that the vehicles weigh under 3 tons unladen so that the Road Fund tax will amount to 12s. per week. I can also take the figure of 9s. per week from the Tables for rent and rates: that is an arbitrary figure subject to amendment according to what the operator has to pay The inquirer also gives me a little assistance inasmuch as he states that the vehi6e insurance rates are low and are practically those applicable to C-licensed vehicles. I can therefore take the figure of 7s. per week which is set down in the Tables on that account.

Consumption Difficulty

A little difficulty arises in connection with the amount to be debited against petrol consumption, and this occurs because of the fact that the weekly mileage of furnitureremoving vehicles varies, as I have already stated, within wide limits. In the Tables, the fuel consumption of a 5-tonner is given as a shade over 11 m.p.g. if the vehicle runs 200 miles per week, whereas for weekly mileages of 300 and upwards it is given as 13 m.p.g. What is the operator to take as his consumption, having in mind the fact that some weeks he may do 200 miles and others he will cover perhaps 700 or 800?

In considering this matter, regard must be had to the fact that furniture is bulky and light. The average weight of a full load of a van of 1,000-cubic-ft. capacity is not likely to reach 3 tons. In this connection I should perhaps tpoint out that I am thinking in terms of household furniture and not of special loads which may be carried if the operator is removing the effects of an office, in connection with which there may be some unusually heavy items.

It should also be appreciated that the average furniture remover takes on a greater number of local removals than those over long distances, so that the tendency will be for the weekly mileage to be less than 200 rather than more. These two considerations balance. The fact that the vehicle is lightly loaded will tend to lower the fuel consumption, whilst the fact that the majority of the journeys is short will increase it. I think it will be fair, therefore, to assume an average figure of 12 m.p.g. Assuming petrol at 3s. per gallon, that means that the cost per mile for petrol will be 3d.

For lubricants 1 will take the figure from the Tables of 0.81d. per mile. The tyres in all probability will he 34 by 7 and the cost of a set of six at to-day's prices will approximate to £160. If I allow a life of 24,000 miles per set, that means that I can take 1.6d. per milt for tyres.

These are all the items which can he taken directly from te Tables. I will now consider those that require nendment. The-most important of all the cost items which ise in this connection is the inital outlay on the vehicle. he first-class furniture van of the type and size specified the inquirer's letter will approximate to £2,000 to-day. I take the cost of tyres from that, £1,840 remains, and king £180 as the residual value, £1,660 is the basic figure ir the assessment of depreciation.

In dealing with depreciation, we come at once to the roblem of providing for widely differing weekly mileages hich are involved in this traffic. Regular readers will now that I am in the habit when calculating costs for a articular type of operation, to refer to depreciation as a anding charge in the case of particularly low mileages and s a running cost for large mileages. In "The Commercial Motor" Tables of Operating Costs, revision is made for the item depreciation for low weekly lileages by adding a percentage to the basic figure for epreciation as the weekly mileage decreases, thus providing sr obsolescence.

As I wish to go thoroughly into this matter of eprcciation on this occasion, it may be as well if I kill we birds with one stone by answering these questions. oking this case as an example. One of the factors which mat be taken into consideration in this matter is the omparatively low weight of the load. The chassis will be at of a 5-tonner and although the body will be heavier han average, the load will rarely exceed 3 tons. It will

e reasonable, therefore, to give the vehicle a life in miles reater than the average, and I propose to take 240,000. :11.at means that what I call the basic figure of depreciation, ibtained by dividing £1,660 by 240.000 miles, is 1.66d. If take that as applicable to a vehicle which has Covered upwards of 48,000 miles per annum, thus giving a vehicle ife of five years, then I must, if the annual mileage be less han that, make provision for obsolescence, otherwise I hall be expecting the vehicle to last so long that it will oe obsolete long before it has run its expected mileage. At 15,000 miles per annum, for_ example, the expectation of ife will be 12 years.

Obsolescence Factor

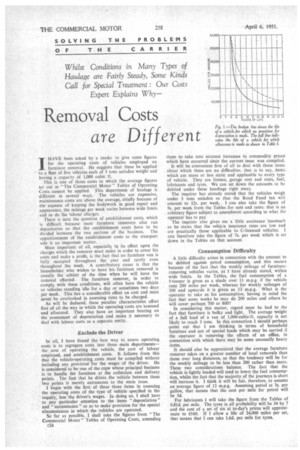

I make allowance for that factor of obsolescence by idding a percentage to the basic figure of 1.66d. per mile. add 5 per cent. for every 2.000 miles that the annual nileage is less than 48.000. What this means is shown n Table I and graphically in Fig. 1. On 40,000 miles per onnum I have to add four times 5 per cent. to 1.66d., which nakes depreciation 2d. per mile. At 30,000 m.p.a., that is, 18,000 less than the basic figure, . must add 45 per tent, to the basic figure, giving me 2.41d. ser mile and so on. That is how the figure for depreciation n "The Commercial Motor" Tables of Operating Costs is :alculated. It will be seen from Table I that at 10,000 m.p.a. o vehicle has a life af 121 years.

Referring again to the problem of assessing depreciation or vehicles engaged on furniture removing, it might be .bought that it will be sufficient for an operator knowing his overage annual mileage to be 20,000, say, to take the figure for depreciation at that mileage, namely, 2.82d. and proceed occordingly. That, however, would not be fair and would sreate an anomaly in charges which had better be avoided. The rate for a long-distance removal will be too heavily loaded with the amount for depreciation and a short-distance removal would be undercharged.

Assume a long-distance removal which is going to involve the vehicle running for one week and covering 800 miles. The appropriate amount for depreciation, as shown in Table

I, will be 2d. Next week, the vehicle is engaged on ocal removals and the mileage covered is only 100, in which case the appropriate depreciation figurd is 3.14d. s Nei her case would be met by the use of the -aiefage' figure. of 2.82d. A satisfactory way Of surmounting this 'difficulty.'lias been devised by the. National ASsociation of. Furniture Warehousemen and Removers: Depreciation according to .'dfis scheme is divided into two' Half of itis-debited asfas,itanding

charge and half as running cost. In this particular ease,. therefore, with the vehicle valued for depreciation purpOSes. at £1,660, 1:830' would be depreciated over' five yearS,' is to say at £166 per annum; and the remaining ,amouut' depreciated on a mileage basis over, 'say', 240,000 Miles; giving. 0.83d., per mile. ' • :

How this works out in practice Irhavc shown in Table IL The third column in that table gives the figure: fordip(e-'ciation per mile'as'caleulated• from the standing chargess7Tfie fourth column gives the depreciation-per mile as i' rtinniq post and in the fifth column the total depreeiation,-whichls the sum of the figures in columns three arid:, four: iSrseVout: The final column gives the Years of lifeallOtted to the vehicle So much for depreciation: Now for maintenance s and want to discuss in this connection the gems .maintenance Id) . and maintenance (e).-'These,.as..detcribed-in the introduction to The comMercrai Motor' Tj.§1.es' of ,Operating' Costss relate, first,' td maintenanceoperations vahich' are cornputed on a time basis, like washing and polishing, greasing and oiling and the annual and biennial varnishing and repainting and lettering of the vehicle. Maintenance (e) deals With operations which are done on a mileage basis

So far as maintenance (d) is concerned, the position in the furniture industry is usually such as to enable the driver, with possibly the assistance of another Man, to wash, Polish and grease and oil his vehicle during the time it is not engaged on removal work. There is.nearlY always plenty of time for this in this class of transport. Aceordingly, therefore, that item does not appear separately as a maintenance charge.

Departure from Standard

The varnishing and repainting, however, still remain and it is better for the purpose of costing to assess the expense of these as standing charges. The reason for this departure from standard practice is the same as that already given for the special way in which depreciation is dealt with.. In the case of the vehicle at present under discussion, I can take it that varnishing will cost about £40 and repainting about £100. If I take it that it is varnished the first year, varnished the second and repainted and lettered the third year, that means that I have £180 for expenditure on this item in three years. equivalent to £60 per annum.

As regards maintenance (e), iii this case having in mind the comparatively light loading of the chassis, it should be less costly than the average. Repairs and maintenance of bodywork, apart from painting and lettering and so on, will cost more than the average, however, and it may reasonably be taken that the total will be about the same as the average. With the exception of the item interest, everything has so far been accounted for. Interest calculated at 3 per cent. on the initial outlay of 12,000 is £60 per annum, or £1 4s. per week. The standing charges per week are, therefore: tax, 12s.; garage rent, 9s.; insurance, 7s.; interest, £1 4s.; depreciation (half), £3 6s. 8c1.; maintenance (d), LI 4s. The total is £7 2s. 8d.

The running costs per mile are: petrol, 3d., lubricants, 0.18d.; tyres, 1.6ds maintenance (e), 1.34d.; depreciation (half), 0.83d. Total '6.95d. S.T.R.