Contract hire: star medium for Mitchell Cotts

Page 54

Page 55

Page 56

Page 57

Page 58

If you've noticed an error in this article please click here to report it so we can fix it.

Hundreds more firms are following the contract hire route, whether for financial reasons or convenience.

THOUSANDS of lorries and vans on Britain's roads are not quite what they seem. While it may say "Ace Furniture Manufacturers" on the side of the vehicle, it is no longer safe to assume that Ace Furniture Manufacturers operates that vehicle. The company may not even have an operator's licence.

Contract hire is what lies behind these misleading impressions. It is difficult accurately to define contract hire; the form and extent of the contract can vary enormously. At the very least it is merely the provision of vehicles while the other extreme is the total package vehicles, drivers, maintenance, depots and management; the whole transport function.

Just how widespread is contract hire? Again, it is difficult to be precise because contract hire vehicles are rather like contact lenses; it is virtually impossible to tell who is using them as the majority of contracts include painting the vehicles in the client's own livery. However, a surprising number of household and High Street names have chosen contract hire and it is valuable business for many transport companies, large and small.

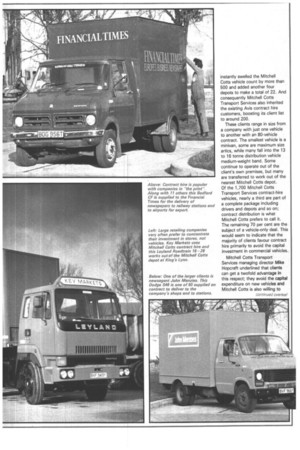

Mitchell Cotts Transport Services can lay claim to being the second largest contract hire fleet operator in Britain with 1,700 vehicles in service with its clients, (BRS is a clear market leader, supplying around 3,000 vehicles on contract hire.) With international activities in engineering, transport and trading the Mitchell Cotts Group has diverse interests. Nevertheless, it has been the contract hire business that has been a star performer in 1982. Its growth record is impressive, This has been achieved largely in the same way that Mitchell Cotts Transport Services established itself in contract hire, namely by the acquisition of transport companies that were already involved in this field. Only last September the company took over the entire Avis commercial vehicle contract-hire fleet, which instantly swelled the Mitchell Cotts vehicle count by more than 500 and added another four depots to make a total of 22. And consequently Mitchell Cotts Transport Services also inherited the existing Avis contract hire customers, boosting its client list to around 200.

These clients range in size from a company with just one vehicle to another with an 80-vehicle contract. The smallest vehicle is a minivan, some are maximum size artics, while many fall into the 13 to 16 tonne distribution vehicle medium-weight band. Some continue to operate out of the client's own premises, but many are transferred to work out of the nearest Mitchell Cotts depot. Of the 1,700 Mitchell Cotts Transport Services contract-hire vehicles, nearly a third are part of a complete package including drivers and depots and so on; contract distribution is what Mitchell Cotts prefers to call it. The remaining 70 per cent are the subject of a vehicle-only deal. This would seem to indicate that the majority of clients favour contract hire primarily to avoid the capital investment in commercial vehicles.

Mitchell Cotts Transport Services managing director Mike Hoperaft underlined that clients can get a twofold advantage in this respect; they avoid the capital expenditure on new vehicles and Mitchell Cons is also willing to buy the existing fleet and hire it back to the client, therefore givinc an injection of fresh capital.

To the client who can use a cash injection this option can be quite a carrot, but I asked Mike Hoperaft: "Is this short-term gain perhaps achieved at the expense of costly long-term hire charges?" After all, there is now a third party—the contract hire company —that has come betweer the client and his vehicles and who is aiming to make a profit from being there.

While Mike Hoperaft admitted that Mitchell Cotts is not going to offer its service free of charge, he denied that this necessarily means extra cost for the client. He cited two reasons_ Firstly, he argued that it is almost certain that the client's real business, whether he is a manufacturer, retailer or service company, is more profitable than road haulage. Therefore a pound spent on that business is going to show a better return than a pounc spent on providing transport. So :ontract hire charges may even be little higher than own-account feet costs, butrthe re nvestment of the vehicle capital 'reed by contract hire will more han offset this, giving a net gain.

Secondly, Mike Hoperaft said that Mitchell Cotts can benefit from the economies of scale when compared with the small ownaccount operator. He listed the purchase of vehicles, fuel and spares as examples of where the large contract-hire company can drive a harder bargain and if the client's vehicles are to be operated out of a Mitchell Cotts depot then the associated overheads are spread over a larger number of vehicles.

Other financial arguments given by Mitchell Cotts in support of contract hire include a smoother cash flow and easier budget forecasting. Mike Hoperaft believes that most people prefer to pay a fixed, regular contract hire payment rather than be landed with the unforeseen occasional hefty bill.

Under the contract hire system it is the contract hire company that now accepts the risk of that unforeseeable bill for something such as a seized engine. In other words, the risk does not vanish, it is transferred and the contract hire company will take that into account in the contract charges. Because most of the contracts are for a five-year period and Mitchell Cotts guarantees the annual cost per vehicle (excluding increases due to Government legislation) the terms have got to be carefully calculated: "If they are not right in the first place we would be on a hiding to nothing," commented Mike Hoperaft. "On the other hand, we cannot go in with a price in the hope of making a quick killing. A profitable relationship is one that both parties are happy with and continues, not ends as soon as the first contract expires."

Many of the large contract-hire clients such as manufacturers or retailing chains opt for the system because they have higher priority needs for investment; they prefer it to be tied up in production equipment or High Street stores. But many of the smaller clients on Mitchell Cott's books are equally attracted by the convenience of contract hire.

For a small manufacturing company with 50 employees and 10 vehicles the need to obtain an operator's licence, employ a transport manager and operate lorries is a fairly major consideration. Mike Hoperaft said that it is exactly this type of ownaccount operator who is the ideal candidate for contract hire, particularly if there is no workshop on the premises and the operator is having to pay commercial garage rates for maintenance.

The most comprehensive type of contract hire avoids all these complications for the small ownaccount operator because the vehicles come under Mitchell Cott's operator licence (which has a generous margin) and all the transport manager's duties can also be taken over if the client so wishes. Choice of vehicle is open, although Mike Hoperaft said that ideally Mitchell Cotts prefers to choose the vehicles itself.

Spare vehicles and drivers are often a problem for the small fleet operator; if you have only 10 vehicles it is costly to hold a spare. Because several contract fleets operate out of a single Mitchell Cotts depot, a spare vehicle (in Mitchell Cott's own livery) can cover for all of them at a fraction of the cost.

Another disadvantage of being a small own-account fleet operator is that you are likely to be restricted to a single operating base when ideally you would also like something away from home to serve other parts of the country. This is another facility that Mitchell Cotts can promote with its 22 depot network and the contract can include the use of these depots. Warehousing in the West Midlands and a cold store in Kent are also available.

Whether for pure financial reasons or mainly for the convenience many would-be commercial vehicle operators are not —they are contract hire clients instead. The vehicles illustrated on these pages give an indication of some of Mitchell Cott's clients and there are hundreds of others who have followed the contract-hire route with other transport companies. Although contract hire has grown in popularity, particularly in the past five years or so, Mike Hoperaft believes that many British manufacturers and retailers have been slow to accept the concept of contract hire. He puts this down to our natural British reserve and although he is surprised that contract hire has not taken off more quickly he also cannot see this changing radically.

So Mitchell Cons Transport Services is primarily looking to take a larger slice of the existing cake and Mike Hoperaft did not rule out the possibility of some more transport company acquisitions to further strengthen Mitchell Cotts's contract-hire operations.