Bright patch amid industrial gloom

Page 66

Page 67

Page 68

Page 69

Page 70

Page 71

Page 72

If you've noticed an error in this article please click here to report it so we can fix it.

ALTHOUGH British industry is often derided because of its less than happy industrial relations record, there are bright patches in the overall picture, and the commercial vehicle industry is one of them.

In this British Vehicles issue, we have been looking at some of the export achievements of the UK chassis manufacturers.

Because of the size of the Leyland Vehicles sales operation, the company has divided it up into three distinct areas: UK, Europe and Overseas. So far as Leyland is concerned, anything east of Turkey comes into the Overseas division, which is itself split into three specific territories: Africa, the Middle East and the Far East/Latin America.

Currently, over 50 per cent of the LV output is for the Overseas division accounting for over 15,000 chassis in 1979. This followed the relatively low (by Leyland standards) number of 13,000 units the previous year.

The backbone of the Overseas division of Leyland is in Africa where the company is represented in every major territory in one form or another, This representation is through either distributors or associate companies of Leyland Vehicles usually established in conjunction with local interests by Governmental and private enterprises.

Leyland Nigeria was established in 1976 followed in March 1979 by the opening of a manufacturing plant. This was built as a joint venture with the Nigerian Government at a total investment of £35 million and is intended to produce trucks, buses and Land-Rovers. The total plant capacity is 12,000 units per year.

Another assembly plant is operated by Leyland Kenya at Thika and this turned out over 500 trucks and buses last year. The plant also handles LandRover and Volkswagen light commercials. Other major African markets include Zambia and Tanzania handled by Leyland Motors Zambia and Leyland Albion Tanzania respectively.

In the majority of African markets, Leyland supplies kits for local assmebly.

The mainstay of the Leyland export in these areas is the bonneted WE range, whose replacement — the T68 — is in the pipeline, and the Chieftain, Clydesdale and Reiver models.

On the bus side, significant quantities of Clydesdale, Viking and Victory chassis are sold.

Because of their operations in Israel, Leyland Vehicles were on the Arab blacklist until 1977. This effectively excluded them from the majority of Middle Eastern markets, but since the removal of the boycott Leyland has reappointed a new distributor network and is now actively selling vehicles again in the Middle East.

Leyland made a conscious decision not to rush back into the Middle East, according to Chris Braithwaite, marketing services manager, overseas operations. This was partly because of the new products which were (and are) in the pipeline — the Landtrain, for example. Significant recent developments include the appointment of a distributor in Saudi Arabia, General Contracting Company, to handle the full franchise. Quatar and Dubai now also have the Leyland franchise.

During 1979 over 1700 lorries were delivered to Sudan and over 1000 units to Egypt. On the passenger side, Leyland has just sold its first ten doubledeckers into Kuwait. Still on the subject of double-deckers. Four-hundred Atlanteans were delivered to Baghdad in 1977 and 200 more are on order.

Leyland also supports two major manufacturing plants in Morocco and Turkey. In Morocco, the company provides components to Berliet Maroc to build light/medium chassis. In Turkey, Leyland has a long association with BMC-Sanayi of which Leyland has a 26 per cent share with the rest being locally owned.

In Latin America, Leyland has been less successful mainly be cause of the insistence by the various governments on a minimum amount of local content. The building of complete factories by some of the European manufacturers like Scania and Daimler-Benz with their resultant extra government approval has also not ,Yielped. However, some Marathons have recently been supplied to Argentina with Ecuador being a customer for the Boxer. Argentina is currently very interested in the B21 with a sample shipment going out for evaluation.

In the Caribbean Leyland does particularly well in the bus sector, especially in Trinidad Jamaica and Barbados. Trinidad, for example has just ordered 50 National 2 buses — the first export order received in fact for this particular model. The cooling system for the National 2 features a frontmounted radiator and is now cleared for use in any climate anywhere in the world.

The Caribbean has also been a good market for the Viking and Victory chassis. The last six to eight weeks have been particularly hectic for full order books reported for the designed-forexport Guy Victory.

In the Far East, the Leyland successes have been concentrated in the passenger sector. As Chris Braithwaite put it, -it's difficult to complete with the Japanese in the Far East because of their short supply lines, but we've still got the lead on buses.

The three biggest customers for Leyland have been Singapore Bus Services and the two major bus fleets in Hong Kong (China Motor Bus and Kowloon Motor Bus). For example, during 1977 Singapore took delivery of 200 Atlantean doubledeckers.

Although competition from the Japanese is very strong on the truck side, Leyland Vehicles Still sell over 1000 truck chassis per year in this geographically large market mainly in Hong Kong, New Zealand, Sri Lanka and the Philippines.

According to Chris Braithwaite, the optimism at Leyland is now tremendous mainly because of vehicles like Landtrain. This is intended mainly for most of black Africa (especially

Nigeria), Saudi Arabia and the Gulf states. Guy has a production capacity of 4000 units per year and that is what Leyland is aiming for. Then, as I mentioned, the 168 is on its way. In Chris Braithwaite's words: ''We will shortly be the only company with a completely new model line specifically tailored for the export market."

The Leyland export scene in Europe is regarded as being split into two levels, according to Jay Hale, sales and marketing director — European Operations where Leyland has a significant presence in terms of market penetration, and secondly where the company has sold just. a few vehicles. In the first category, the successful Leyland markets are France, Belgium, Holland, Denmark, Republic of Ireland and Portugal.

France is regarded as the biggest challenge in Europe by Jay Hale because of its size and nearness and also because France, like the UK, is not opposed to imported vehicles. The French market has reacted favourably to the UK launch of the Roadtrain. Although the export version was scheduled to make its debut in 1982, Leyland is hoping that it might be earlier. The main constraint according to Leyland, has been the time taken for homologation.

A lot is happening in Ireland for Leyland Vehicles at the moment with the launch of Roadtrain and the Sherpa which up till now has not been 'available in the Republic. It is worth pointing out at this point that the Sherpa is handled by Leyland Vehicles as far as the export markets are concerned in direct contrast to the situation in the UK where it is sold via the car division.

Because Ireland is now in the EEC, import restriction will have. to be phased out by 1985, and Jay Hale is optimistic about Leyland's future in this market.

In Portugal Leyland is well known because 70 per cent of the buses are Leylands in cluding a large number of double-deckers. The Leyland importer is Utic, which assembles chassis from ckd kits. These are mainly from the Redline range (Terriers, Boxers and Mastiffs) with a few Marathons thrown in for good measure.

Domi is the Danish importer for LV with a distribution network throughout the country.

• Leyland in fact has a minority shareholding in this particular company. Denmark takes the full Redline range plus the Marathon.

Leyland does not sell in Germany at the moment because, as Jay Hale puts it, "it would not be a sensible investment with the current range but the new models will change this.—

Deutsche Leyland, based at Aschaffenburg (south east of Frankfurt) has a network of 60 service dealers to cater for Leyland users passing through on the major TIR routes.

Sherpa is currently selling well in Italy, particularly in the diesel/overdrive specification. This light competitor in the Leyland range will be used as a base on which to bring the trucks in.

For the future, Jay Hale sees Leyland export efforts in Europe being concentrated in France, Belgium, Holland and the Republic of Ireland with France being the prime target. Sherpa is the high-volume product which is already selling well and this will be backed up by the Redline range, in particular the Terrier and Boxer.

New Zealand and Ghana are the main export markets for Seddon Atkinson. The former takes the 400-Series which are sold as Seddon Atkinsons via the International Harvester network. The reason I emphasised the marque name is that Australia still has the Atkinson name on its own but, although this is also handled by IH, it has nothing to do with Seddon Atkinson.

Ghana takes the 200-Series, which is fitted with a Perkins engine for export markets in

contrast to the IH engine for UK use,

The Seddon bus chassis figure high on Oldham's export list with Bermuda, for example, having a completely Seddon bus fleet. Fiji is another customet for the Pennine fitted with a front-mounted Perkins V8 engine. Like Leyland, Seddon Atkinson is very interested in the Republic of Ireland and the company's penetration there is increasing thanks mainly to the 400-Series tractive units and the eight-wheeler.

The Middle East has gone quiet for many people on the export side but Seddon Atkinson has recently delivered 12 200-Series chassis to Quatar.

Reynolds Boughton has an export record which can match the best of them. The crashtender side, for example, exports 90 per cent of its production judged on a financial basis.

The biggest seller has been the top-of-the range 6x6 which has a gross weight capability of 38 tonnes. This is known as the Griffin in chassis-cab form as listed by Reynolds Boughton and as the Pathfinder when marketed complete with bodywork, etc, by Chubb. This model has been particularly successful in the USA (Saudi Arabia is a 100 per cent Reynolds Boughton user).

Although the crash-tender division produces relatively few chassis (eight in a good month) compared with the giants of the industry, it is worth considering that each Grifin chassis costs around £100,000 in basic form which rises to over £300,000 fully equipped. As general sales manager Derek Lambert puts it "it's useful money!"

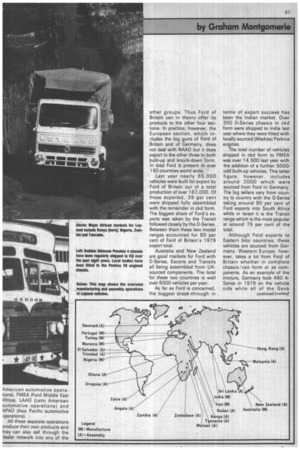

Like Leyland, Ford divides the world up into sections, in this firm's case five. These are EA0 (European automotive operations) NAAO (North American automotive operations), FMEA (Ford Middle East Africa), LAAO (Latin American automotive operations) and 4PAO (Asia Pacific automotive Dperations).

All these separate operations produce their own products and they can also sell through the Jealer network into any of the other groups. Thus Ford of Britain can in theory offer its products to the other four sections. In practice, however, the European section, which in-.dudes the big guns of Ford of Britain and of Germany, does not deal with NAAO but it does export to the other three in both bulit-up and knock-down form. In total Ford is present in over 150 countries world wide.

Last year nearly 65,000 vehicles were built for export by Ford of Britain out of a total production of over 167,000. Of those ecported, 39 per cent were shipped fully assembled with the remainder in ckd form. The biggest share of Ford's exports was taken by the Transit followed closely by the D-Series. Between them these two model ranges accounted for 80 per cent of Ford of Britain's 1979 export total.

Australia and New Zealand are good markets for Ford with D-Series, Escorts and Transits all being assembled from UKsourced components. The total for these two countries is well over 6000 vehicles per year.

As far as Ford is concerned, the biggest break-through in terms of export success has been the Indian market. Over 300 0-Series chassis in ckd form were shipped to India last year where they were fitted with locally sourced (Madras) Perkins engines.

The total number of vehicles shipped in ckd form to FMEA was over 14,500 last year with the addition of a further 5000odd built-up vehicles. This latter figure, however, includes around 2000 which were sourced from Ford in Germany. The big sellers vary from country to country with the D-Series taking around 80 per cent of Ford exports into South Africa while in Israel it is the Transit range which is the most popular at around 75 per cent of the total.

Although Ford exports to Eastern bloc countries, these vehicles are sourced from Germany. Western Europe, however, takes a lot from Ford of Britain whether in complete chassis/van form or as components. As an example of the mixture, Germany took 480 ASeries in 1979 on the vehicle side while all of the Genk sourced diesel-engined Transits received their power units from Dagenham.

The Escort van is a popular import for many markets including Denmark, Repulbic of Ireland and Holland, all of whom take well over a thousand Escort variants per year.

In Portugal Ford has over 14 per cent of the heavy truck market (which by the Ford definition is 3.5 tons plus) averaging about 1900 locally assembled D-Series per year from components supplied in the main by Ford of Britain. Moving down the weight scale, the Transit holds over 30 per cent of its market. This range is again assembled locally from Southampton sourced ckd kits.

To put the Ford achievement in Europe into perspective, the company has overhauled Renault Vehicules IndustrieIs and is now in third place behind Daimler-Benz and IVECO in terms of vehicle production in the over-31/2-ton category.

Bedford exports from the UK to the rest of the world have nearly doubled over the past four years from 14,200 to over 27,000 vehicles. In fact exports account for over 60 per cent of the total UK production.

Italy is the biggest export territory with over 10,000 vehicles being shipped there alone during 1979. Bedford has around 10 per cent of the total market in Italy primarily with the CF range but the TM is now starting to make progress owing to the 44-tonner with the8V92T Detroit Diesel engine. This particular TM variant was designed specifically for the Italian market with its 8bhp/ton minimum power-to-weight ratio requirement.

The second highest Bedford export market is currently Pakistan with nearly 7000 chassis exported last year. These were mainly TJs which are also popular in New Zealand and Nigeria. The latter market is supplied by locally assembled chassis produced by Federated Motor Industries from ckd kits exported from the UK. Increasing numbers of TK and CF variants are now also being sold in Nigeria. Other countries which have major local assembly facilities for both the TJ and TK ranges include Australia, New Zealand and South Africa, During 1979, over 25 per cent of Bedford sales were made outside Europe.

In 1979, Dodge Trucks exported 3350 vehicles to markets around the world out of a total production of around 10,000 units. As with many other companies, these exports were partly in ckd form for local assembly and partly as complete chassis.

Although it has now been phased out, the Walk Thru was a great export success for Dodge with the Dutch Railways for example taking no less than 1500 chassis.

The Space Van is exported in ckd form to Portugal and completely built up to Sri Lanka, Formosa, Republic of Ireland and Portugal again. The 100Series (Commando) is sent in ckd form to New Zeland (G11 and 013) and Sri Lanka (G10). The Commando is exported built up to New Zealand (G13), Egypt and Hong Kong (G13 and G16).

Dodge production for export is divided neatly into two with half going to Europe and the other half for the rest of the world. Of the 1600-odd chassis sold in Europe, around 60 per cent are from the Commando range with the rest being Spacevans. The major Dodge markets in Europe are Belgium, Denmark, France, Republic of Ireland and Holland.

Exports from Fodens Ltd at Sandbach are centred primarily around the Super Haulmaster and the dumpers.

In Tanzania, for example, seven 6x4 Super Haulmasters have been sold to operate as drawbar outfits at 50 tons gross. The power unit is the RollsRoyce Eagle 265L. There is an interesting tale behind this Tanzanian order as the mechanical specification of this particular model is identical to that sold for snow plough work in this country thus qualifying Fodens for the title of the only company which could sell a snow plough in Africa!

The Ministry of Reconstruction in Uganda (based at Kampala) has ordered five FC 1 7 dump trucks and Fodens are in the process of tendering for a repeat order.

Super Haulmasters have found a ready market in the Middle East and in particular in Dubai and Saudi Arabia. Fodens are at the moment supplying either chassis consisting of six

40-ton tippers and two 65-ton tractive units for work on a road extension in Dubai while Artec. in Saudi Arabia has taken six Super Haulmasters to operate at 65 tons gross hauling marble chippings.

The biggest single order for heavy tractive units ever placed in India was collected by Fodens with a request for 20 6x4 tractive units for the Central Water Commission. The technical specification includes a Cummins 335 engine, Foden gearbox coupled to a Brockhouse torque converter and a 32-ton rear bogie. They have a gross weight capability of 100 tons.

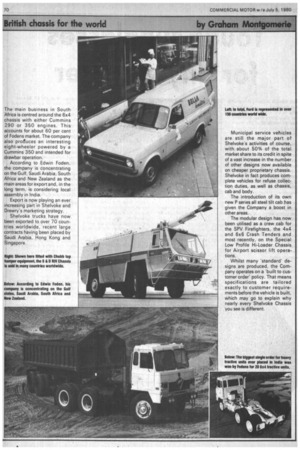

Fodens are also assembled in South Africa for use there and for export to Zimbabwe and Zambia. At the moment Fodens have orders for 150 chassis for South Africa with 50 intended for the South African Railways. The main business in South 'Africa is centred around the 6x4 chassis with either Cummins 290 or 350 engines. This accounts for about 60 per cent of Fodens market. The company also produces an interesting eight-wheeler powered by a Cummins 350 and intended for drawbar operation.

According to Edwin Foden, the company is concentrating on the Gulf, Saudi Arabia, South Africa and New Zealand as the main areas for export and, in the long term, is considering local assembly in India.

Export is now playing an ever increasing part in She!yoke and Drewry's marketing strategy.

She[yoke trucks have now been exported to over 70 countries worldwide, recent large contracts having been placed by Saudi Arabia, Hong Kong and Singapore. Municipal service vehicles are still the major part of Shelvoke's activities of course, with about 50% of the total market share to its credit in spite of a vast increase in the number of other designs now available on cheaper proprietary chassis.

Shelvoke in fact produces complete vehicles for refuse collection duties, as well as chassis, cab and body.

The introduction of its own new P series all steel tilt cab has given the Company a boost in other areas.

The modular design has now been utilised as a crew cab for the SPV Firefighters, the 4x4 and 6x6 Crash Tenders and most recently, on the Special Low Profile Hi-Loader Chassis for Airport scissor lift operations.

Whilst many 'standard' designs are produced, the Com pany operates on a 'built to cus tomer order' policy. That means specifications are tailored exactly to customer requirements before the vehicle is built, which may go to explain why nearly every SheIvoke Chassis you see is different.