Rigids or "Artics" for Tipping ?

Page 70

Page 75

If you've noticed an error in this article please click here to report it so we can fix it.

RECENTLYimportant improvements have been announced in semi-trailer construction, particularly in relation to axle design and suspension of heavier types. As a result, claims are now made that more efficient operation can be obtained because of reduced fuel consumpnon and tyre wear, or increased loads at the same cost.

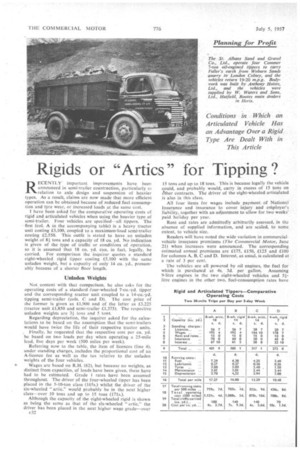

I have been asked for the comparative operating costs of rigid and articulated vehicles when using the heavier type of semi-trailer. Four vehicles are specified-all tippers. The first (col. A in the accompanying table) is a heavy tractor unit costing £3,100, coupled to a maximum-load semi-trailer costing £2.550. This outfit is stated to have an unladen weight a 81 tons and a capacity of 18 Cuyd. No indication is given of the type of traffic or conditions of operation, so it is assumed that 18 cu. yd, can, in fact, legally, he carried. For comparison the inquirer quotes a standard eight-wheeled rigid tipper costing £5.100 with the same unladen weight, but a capacity of only 14 Cuyd., presumably because of a shorter floor length.

Unladen Weights

Not content with that comparison, he also asks for the operating costs of a standard Jour-wheeled 7-cu.-yd. tipper and the corresponding tractor unit coupled to a 14-cu.-yd. tipping semi-trailer (cols. C and D). The cost price of the former is given as £1,900 and of the latter as £3,225 (tractor unit £1,850 and semi-trailer £1,375). The respective unladen weights are 34 tons and 5 tons.

Regarding depreciation, the inquirer asked for the calculations to be based on the assumption that the semi-trailers would have twice the life of their respective tractor units.

Finally, he requested that the respective cost per cu. yd. be based on two loads per day when operating a 25-mile lead, five days per week (500 miles per week).

Referring now to the table, the item of licences (line 4), under standing charges, includes the proportional cost of an A-licence fee as well as the tax relative to the unladen weights of the four vehicles.

• Wages are based on R.H. (62), but because no weights, as distinct from capacities, of loads have been given, these have had to be estimated. Grade 1 rates have been assumed throughout. The driver of the four-wheeled tipper has been placed in the 5-10-ton class (165s.) whilst the driver of the six-wheeled " artic." would Probably be in the next higher class-over 10 tons and up to 15 tons (171s.).

Although the capacity of the eight-wheeled rigid is shown as being the same as that of the six-wheeled " artic," the driver has been placed in the next higher wage grade-over e32

15 tons and up to 18 tons. This is because legally the vehicle could, and probably would, carry in excess of 15 tons on &her contracts. The driver of the eight-wheeled. articulated is also in this class.

All four items for wages include payment of National Insurance and insurance to cover injury and eniployer's liability, together with an adjustment to allow for two weeks' paid holiday per year.

Rent and rates are admittedly arbitrarily assessed, in the absence of supplied information, and are scaled, to some extent, to vehicle size.

Readers will have noted the wide variation in commercialvehicle insurance premiums (The Commercial Motor, June 21) when increases were announced. The corresponding estimated annual premiums are £175, £150, £125 and £100 for columns A, B, C and D. Interest, as usual, is calculated at a rate of 3 per cent.

The vehicles are all powered by oil engines, the fuel for which is purchaSed at 4s. 3d. per gallon. Assuming 9-litre engines in the two eight-wheeled vehicles and 5litre engines in the other two, fuel-consumption rates have been estimated at 7 m.p.g., 8 m.p.g., 12 m.p.g., and 15 m.p.g.,. respectively, the limited use of the tipping gear being noted in this respect.

Tyres—appropriately line 13—will probably be the most controversial item. There are undoubtedly wide variations in Operators' experiences, and opinions, as to the expected tyre life when fitted to rigid eight-wheelers and " artics." Variables are introduced as between singleand double-drive axles on rigids, whilst differing axle and suspension arrange% ments on semi-trailers must obviously have their effect in the number, size and wear of the tyres.

As a compromise a tyre mileage life of 40,000 has been estimated for all four vehicles, making allowance for the overall improvement in tyre performance that has recently been reported. The tyre running costs of the four vehicles are, therefore, directly related to their respective initial cost. These have been assessed, from A to D, at 1500, £500, £400 and £250 per set.

In maintenance costs, allowance has been made for recent price increases, together with an addition, because of tipper operation.

Twice the Life Because of the inquirer's stipulation that semi-trailers should be deemed to have twice the life of their respective units, some departure from normal practice is required. Estimated life of the four-wheeler and of the tractor of the six-wheeled articulated outfit is 125,000, that of the semi-trailer being 250,000. The eight-wheeler and heavy tractor unit are also depreciated on a basis of 250,000 miles, with double that figure for the larger semi-trailer.

From the initial cost of £3,100 for the heavy tractor unit, £250 is deducted as the estimated cost of its set of tyres. A further £100 is deducted as residual value, leaving £2,750 as the basis of depreciation. A similar deduction is made from the initial cost price of £2,550 of the heavy semitrailer, leaving 12,200. Incidentally, the even split of the cost of a set of tyres between tractor and semi-trailer is arbitrary, in the absence of precise details.

The deduction of £500, as the price of a sef of tyres, from the cost price of the rigid eight-wheeler leaves a balance of £4,600, which is further reduced to £4,400 by the deduction of £200 as residual value.

The cost price of the six-wheeled " artic" is £1,850 for the tractor and £1,375 for the semi-trailer, from which £200 for tyres is deducted in each case. A residaal. value of £150 is then allowed for the.tractive unit and 175 for the semi-trailer, leaving a balance of £1,500 for the tractor and £1,100 for the semi-trailer on which to base depreciation.

Finally, from the cost price of £1,900 for the four-wheeled tipper, £250 is deducted for tyres and £150 for residual value, leaving £1,500 to be depreciated over 125,000 miles.

Depreciation Per Mile

The resulting cost of depreciation per mile would then be: Eight-wheeled " artic," 3.7d. (tractor, 2,64d., semi-trailer, 1.06d.); eight-wheeled rigid, 4.22d.; six-wheeled " artic," 3.94d. (tractor, 2.88d., semi-trailer, 1.06d.); four-wheeler, 2.88d.

Assuming that each vehicle is in fact able to load to its capacity on each trip, its total traffic for the week would then be 10 times its respective cubic capacity, it being stipulated that two trips per day would be made five days per week. I must emphasize that the respective capacities of the four vehicles are as supplied by the inquirer.

Commenting on the final calculations shown in line 20— the cost per cu. yd.—in fairness to the eight-wheeled rigid vehicle, in comparison with the six-wheeled " artic," it would appear slightly underloaded on the figures given. It is significant that in highest cost per cu. yd. the labour content exceeds 38 per cent., whilst it is less than 18 per cent. for the larger " artic." Nevertheless, on the basis of the data supplied the articulated vehicle has the advantage over its rigid counterpart in the stated circumstances. S.B.