THE LOS I LEADERS International hauliers who suffer losses from

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

strikes, blockades and riots can take out insurance against the risk. But the cost per truck can be high. Guy Sheppard examines how such schemes work and warns that it is important to read the small print.

0 wner-driver John Smith liked a new insurance package offered by Leyland Daf Truck Finance so much that he bought one of the company's trucks as well.

The scheme, launched last month, provides cover of £250 a day to hauliers left stranded by strikes, riots and other civil disorder on the Continent.

Smith, who trades as Corliss Transport and is based in County Down, says he was nearly put out of business by the French lorry driver blockade at the end of 1996. "I was stuck there for seven days but it probably cost me two weeks-worth of money; it just about crippled me and I seriously considered going back to work for someone else."

As a result of this experience, he says the insurance policy became a deciding factor in choosing a Daf XF. "It clinched it for me. I have heard of another scheme but it doesn't insure Northern Ireland risks."

Although government compensation is notoriously difficult to extract from countries when hauliers are caught by industrial action, insuring against the risk is still rare. Roberts & Davis Schemes launched a policy more than a year ago but senior partner Gordon Smart says: "There are not as many people on it as I would have anticipated.! am surprised that more have not taken it up."

Tony Pain, marketing director of Leyland Daf Trucks, says the company's finance arm, which is jointly owned with a Dutch finance company, launched its strike assurance policy after consulting operators and dealers.

"Suddenly, at almost no notice, operators can lose several days' work but are powerless to do anything about it. The policy is one of the things we break even on if we are lucky It demonstrates that in financing a truck we can be a little bit more creative than the average bank." About 10 companies have signed up so far but Pain says it is still early days.

However, within the insurance industry there is scepticism about the demand for and viability of such schemes. Rob Cook, a manager specialising in transit insurance for Royal & SunAlliance, says: "You get a flurry of interest with each blockade then it tends to die down. There would be no problem underwriting it but whether the insured would be prepared to buy it is another question."

Thomas Buxton, a Macclesfield-based owner-driver trading as DL Transport International, took out cover with Roberts & Davis Schemes during the last French lorry drivers' blockade three months ago. "I've been caught out four or five times over the past 10 years. On one strike in Spain I lost two trips which was approximately £5,000-worth of work. It can happen any time every year.! have taken the insurance cover out for the simple reason that it guarantees to pay so much money per day" Francis Transport in Washington, Tyne & Wear, took out cover through RHA Insurance Services more than four years ago and successfully claimed £250 per day when one of its trucks was caught in the French blockade of 1996.

Payment was received within six weeks. The premium for four vehicles was originally £30 per vehicle but the policy was not renewed when this was increased to £125 per vehicle last year.

John Francis, managing director of the company, which has a fleet of 18 vehicles, says another disincentive was a clause suggesting his vehicles should stay out of France if there was any hint of industrial problems.

"I would welcome a policy that was economically viable for me. Apart from using the short ferry crossings to go to Belgium, we are hardly ever in France," John Allan, managing director of Strike Risks Management (SRM) which developed the RHA policy, says the clause should not stop operators going about their normal business but it should encourage them to take alternative routes if possible to avoid delays. "It is sensible because it costs operators money as well as us if they are caught in a strike."

A similar stance is adopted by other insurers. AXA Provincial, a specialist in Goods in Transit insurance, says hauliers may have no defence if their drivers knowingly enter a blockade and their loads are subsequently damaged. "If they don't take precautions to avoid potential losses they knew existed at the time, it could jeopardise their cover," says Chris Newton of AXA.

Both SRM and Roberts & Davis Schemes say that if hauliers are compensated for delays by the country in which they took place, then that money should be repaid to the insurer. But Smart says there are still advantages in joining the scheme. "Because we pay out quickly, it helps keep them in business because money is coming in."

Compensation claims made by 229 UK hauliers as a result of the 1996 French blockade total about £1.8 million but. so far, only a few have been settled. A spokesman for the Department of the Environment, Transport & the Regions, says that although the procedure for making claims has now been sorted out, there is still no indication about when payments will be received.

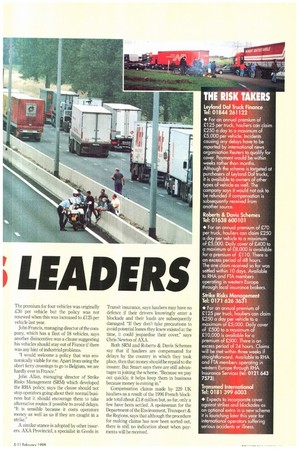

THE RISK TAKERS

Leyland Daf Truck Finance Tel: 01844 261122 • For an annual premium of £125 per truck, hauliers can claim £250 a day to a maximum of £5,000 per vehicle. Incidents causing any delays have to be reported by international news organisation Reuters to qualify for cover. Payment would be within weeks rather than months. Although the scheme is targeted at purchasers of Leyland Daf trucks, it is available to owners of other types of vehicle as well. The company says it would not ask to be refunded if compensation is subsequently received from another source.

Roberts & Davis Schemes Tel: 01638 600101 • For an annual premium of 270 per truck, hauliers can claim £250 a day per vehicle to a maximum of £5,000. Daily cover of £400 to a maximum of £8,000 is available for a premium of £110. There is an excess period of 48 hours. The one claim received so far was settled within 10 days. Available to RHA and FTA members operating in western Europe through focal insurance brokers.

Strike Risks Management Tel: 0171 626 3631 • For an annual premium of £125 per truck, hauliers can claim £250 a day per vehicle to a maximum of £5,000. Daily cover of £500 to a maximum of £10,000 is available for a premium of £500. There is an excess period of 24 hours. Claims will be met within three weeks if straightforward. Available to RHA and FTA members operating in western Europe through RHA Insurance Services (teI: 0121 643 7573).

Transmed International Tel: 0181 399 6003 • Expects to incorporate cover against strikes and blockades as an optional extra in a new scheme it is launching later this year for international operators suffering serious accidents or illness.