Ike other businesses involved in road transport, recovery firms pride

Page 46

Page 47

If you've noticed an error in this article please click here to report it so we can fix it.

themselves on the high standards of efficiency and professionalism they have achieved in recent years.

But the recovery trade's image has not always been quite so respectable. Legend has it that some of the industry's established operators carved out their niches many years ago by literally fighting their rivals for the business.

One famous anecdote of the post-war recovery trade in London tells of rival gangs tuning in to police radios for news of accidents, racing to the scene in beaten-up old Land Rovers and then engaging in a pitched battle for the booty.

Thankfully, the way road transport businesses go about competing with each other has become much more sophisticated. Yet it seems that even in these civilised times, there may still be pockets of the industry where operators are prepared to resort to criminal activity to get what they want.

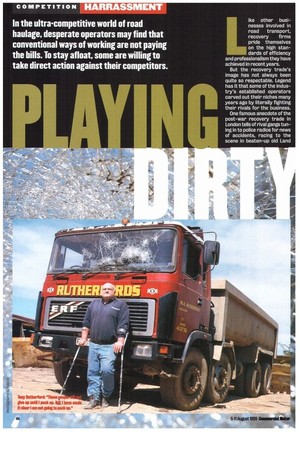

Tony Rutherford, (right) of Rutherford's Skips in Hempsted, Glos, is convinced that his company has been the victim of a vendetta by a rival firm. Premises and vehicles have been attacked four times in less than a year—raids which seem to have little to do with opportunistic theft and a lot to to do with systematic destruction. "The first time they smashed every window in our eight vehicles, plus indicators, headlights and tachographs," he adds. "They also ruined three machines—grabs—that we kept in the yard.

We've got four acres of land, and it's a big site, so they must have been there an hour or so."

Nothing was stolen in that first raid. But a few months later, when the firm's site was broken into again, thousands of pounds' worth of equipment was taken, including every single tool in the workshop, from everyday tools to air equipment.

"I had been in the business for 25 years and accumulated an awful lot of tools worth thousands of pounds, but they took everything," says Rutherford. "And they smashed all the same vehicles again. It certainly set me back a bit."

Several months passed without incident. But two more break-ins—one at the end of May and another just three weeks later—have left Rutherford in little doubt that he is the victim of a targeted campaign, although there is no evidence.

Once again, all eight vehicles were wrecked in a night-time crime spree that went undetected until the next morning.

"I have never had anything like this before," he says. "True, we have had people break in and steal stuff, but nothing like this."

Because it is almost impossible to prove that crime against hauliers is due to socalled "turf wars", it is extremely difficult to assess the scale of the problem.

Some firms that specialise in livestock transport have risk of attack by animal rights "activists". But when a company falls victim to seemingly mindless vandalism, suspicions are bound to be aroused about who has a motive.

The skip hire trade— no stranger to cutthroat competition—is regularly beset by this kind of no-holds-barred rivalry, but it's by no means the only sector to be affected. Last year a general haulier based in the Midlands said he suspected competitors might be responsible for an arson attack which took his biggestearning truck out of action for several months. An intruder broke into the firm's premises one weekend and torched the vehicle without any apparent motive.

And a Newcastle operator had to lay off several drivers last year after months of vandalism and thefts left the company thousands of pounds out of pocket.

One of the biggest problems facing hauliers who suffer repeated attacks is the potentially crippling effect on their insurance premiums. Tony Rutherford patched up his broken trucks himself rather than claim on his policies and risk sending his premiums through the roof.

That was a wise move: specialist haulage insurers say there is little they can do to offer preferential treatment to firms who claim they are being victimised.

"The effect on premiums depends on the policy, but insurance companies still have to pay out in claims," says Ian Bowes, operations manager with prominent Newmarket-based broker Roberts and Davis.

"If claims are happening on a regular basis then insurance companies will investigate, but there's little they can do. And if there are lots of claims and say they are withdrawing that aspect of cover," he adds. "One example might be windscreen cover on fleet policies. If a firm has a lot of claims the insurer might say it will not give that cover any more."

Diane Woodhead, of brokers Thompson, Heath and Bond, agrees it is difficult for insurers to make a special case when a claimant alleges it is being victimised: "If a company does make several claims premiums will go absolutely sky high. And they will lose all their bonuses, too," she warns.

Tighter security is an option, but there is no failsafe way of ensuring property is safe. Insurance specialists say investing in security cameras, guard dogs and night lights are all good ways to try to keep the lid on premiums. But Bowes warns: "If somebody is good enough and determined enough to get in, then they will do it whatever you do."

In a bid to stop the criminals Rutherford implemented tougher security measures at his site.

"We put in cameras, but the cables were cut and the thieves stole everything in the office—video recorder, fax and telephones," he says. "Now my father and I go down to the yard at all hours of the night, and we even stay down there some nights in a camper. These people will not give up until I pack up. But I have made it clear I am not going to pack up."

by Pat Hagan