Going up in the world

Page 32

Page 34

Page 35

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

It's all about the biggest, heaviest and most difficult loads on earth for Abnormal Load Engineering, but CM learns how continued investment, a concise marketing strategy and new branding will launch the firm into new growth areas.

Words / imag: Tom Cunningham As you drive through the tranquil, leafy lanes of Staffordshire, almost the last thing you'd expect to see is the bright red gantry crane of AlE looming large on the horizon.

Founded by ex-Wynns Engineering manager Roger Harries in 1983, the firm is now steered by his son. Mark, who carries the title of executive director.

While maybe not unique. Harries is aware that the firm is part of a select club of world-class heavy transport and lifting companies -with the ability to lift and shift anything. anywhere.

Power generation products (in various forms) still form the core of the company's business, and in terms of worldwide rankings, most industry lists place ALE at number three. "The company has always had deep routes in engineering. I know it might sound very grand, but, from the outset, we provided solutions to people who wanted to move a given project from A to B. The core product was (and still is) an engineered transportation solution but without hiring the plant to do it."

Some growth has been organic, but in 2000, the company started on an acquisition trail that kicked off with a Far East crane business.

Acquiring businesses

In 2002. ALE snapped up Brambles Heavy Contracting. which, as a group. owned what was formerly Econofreight in the UK and Lastra in Spain and the Netherlands.

Harries then went on to oversee the buyout of Alstom': Distribution Services Division (DSD) in 2005 and John Gibson Projects in 2007 -Looking back, I think the most significant turning point in the company's recent history will be the Brambles acquisition. Overnight, we doubled the size of the business, going from a El5m (£13m) yearly turnover to €30m (f.26m), in addition to having a strong presence in three new markets.

"In summary. the deal gave ALE the size and critical mass to quote for big projects out there in the marketplace. As two separate businesses, ALE and Brambles were definitely being marginalised." Harries claims.

There was some luck thrown in. too, as Harries points out that in 2002. the world was starting to recover from another downturn. "We managed to buy just at the right time: as demand was starting to head back up," he adds.

Neglected areas

Harries readily admits that ALE had previously overlooked both internal and external communications. He explains: "We felt the soft sides of the business, HR being one, marketing being another, really weren't being pushed forwards enough. I'm talking about the areas you wouldn't necessarily call frontline, hut they were important areas we'd increasingly let slip.

"In a company like this. you can easily get yourself into a position where you're solely concentrating on the hard issues We had [understandably] prioritised the growing of the business: winning work contract by contract, buying equipment and, of course, buying other businesses," he acknowledges.

Allied to the marketing issue. Harries was aware of the fact ALE had become, in his own words, "too reliant upon its existing customer base': He goes further, stating that 65% of ALE's work came from repeat business a figure that concerned him.

Having started the roll-out at the end of January. has Harries seen any tangible benefits'? "We're definitely a lot slicker than we were! The feel of the marketing is a lot different. with the likes of decent, high-quality brochures. But I'm not so sure we will he able to put our finger on one particular business gain and say it was solely attributable to a marketing strategy, but either way the company can only benefit from the changes put in place."

As he continues to explain the theory behind the rebranding exercise, Harries is swift to point out that ALE is playing catch-up with its competitors: "The two or three major companies we compete with have been extremely slick on the marketing side for seven or eight years now. In my book, that's lost time we obviously can't make up. But I would much rather we started now than never," he quips. Harries can take some consolation from the fact that while the company may have been guilty of having poor marketing and communication skills in the past. the business had still grown and become a successful player nevertheless. "The business has grown somewhere in the region of 30% year on year; it's easily It) times the size it was 10 years ago."

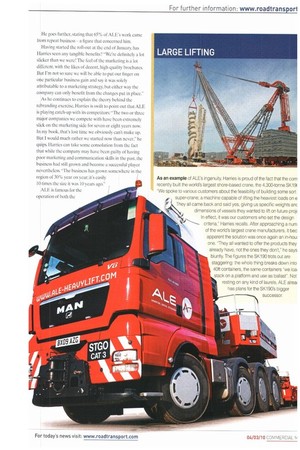

ALE is famous for the operation of both the largest frame trailers and the biggest. all-wheel-drive tractor units.

But here's a real dilemma: you currently own a selection of FAUN and Unipower ballast tractors. in both 8x8 and 6x6 forms, some of which are getting on for 20 years old running at full capacity. What on earth would you buy? You've ruled out MAN's 8x4 TGX and the Mercedes-Benz 8x4'litan (mainly because they're too small to operate with large frame t railers, there isn't enough traction and the axle track is too narrow). You think the N icholas Tractomas is just too unwieldy for European use. We've had our thinking caps on too, coming up with something along the lines of Kenworth's oilfield-spec equipment. or maybe even an adapted.shorter wheelbase road-going version of MAN's military SX series. Either way it's a tough call, and with the level of investment required, one you won't want to get wrong. -We've looked at many different options. including building something ourselves,remarks Dave Purslow. general manager of operations. "At 20 years old, you either look for a replacement or commence a gound-up rebuild. Realistically, we need to be placing orders in the next couple of months," Harries adds.

Second-hand vehicle

In addition to FAUN, ALE also operates an Alvis Unipower M-series 8x8 circa 1997, built to tender for an Army tank transport contract that Oshkosh went on to win. Purslow tells us the company has bought the truck less a few essential parts! "We had to make a few modifications to make the Unipower suitable for road-going operations, the most notable being the addition of a gearbox: ZF had taken it back at the end of the British Army trials," he recalls.

With slightly less traction (or what Purslow refers to as 'the lighter end') is a fleet of 8x4 tractors headed by MAN's latest TGX XXL V8 680. 'As a general rule we operate the

biggest ballast tractors at somewhere in the region of 300 tonnes, with the remainder down nearer 240 tonnes to 250 tonnes The MANs are plated for 250 tonnes, too, but in our operation we wouldn't run them anywhere near that weight. Experience tells us the lifespan of the truck would be diminished greatly if you took one of those 8x4s and ran it at full weight for longer than necessary We tend to operate the lighter equipment with more conventional trailers, or as a third (back up) ballast tractor."

'Faking care of the other end of an ALE road-going combination is a mind-boggling array of trailers, axle rows, beams, frames and cradles, not to mention a huge fleet of self-propelled machines (with a further 150 Schcuerle SPMT lines to be delivered in March). Late last year, the

ALE'S executive company hit the trade headlines when Goldhofer director Mark Harries announced that ALE had purchased 64 heavy-duty T has already seen SL modular axle lines, a gooseneck. a low-profile decl benefits from changes and a dedicated vessel deck.

to the company's When we looked at buying some conventional Ira marketing strategy Goldholer. Nicholas and Scheuerle were the only thri contenders. On price there was nothing in it, so the decision to go for Goldhofer was purely a technical o -we felt they were more robust, with a better build quality. All in all we felt there would be less maintenance,Harries concedes.

Rounding up, Harries appears understandably confident that the future looks stable: "I would love ti grow the transport side of the business, but road is a v mature part of the company. We've got a reasonable dominance of the market; ifs one we see as operating (pretty much) at its full potential. We already own on barge, with a second on its way. But shipping isn't goir be a huge market for us either.

"The lifting side is something we will definitely dev further. Until 2000. we didn't operate a single crane. I takes a long time to earn a track record in this busine: but we're definitely moving forward." he concludes II