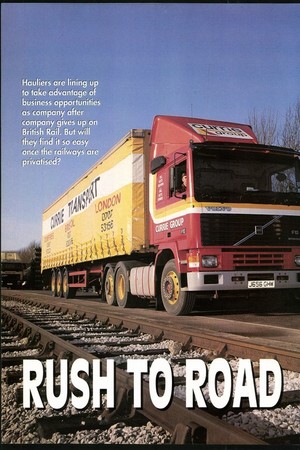

Early next month a Curries of Dumfries 38-thriller will pull

Page 28

Page 29

Page 30

If you've noticed an error in this article please click here to report it so we can fix it.

into Taunton Cider's mill in the Somerset village of Norton Fitzwarren, load up with pallets and kegs of the famous drink, and set off up the A361 en route for Glasgow.

The contract, for around five truck loads a week,would hardly merit a mention on Commercial Motor's business pages were it not for the fact that it symbolises the steady, unstoppable decline of rail freight.

Taunton Cider is one of at least 10 major rail users who, in the 21 months since the then Transport Secretary Malcolm Rifkind pledged to encourage more goods on to the rails, have switched more than a million tonnes on to the roads.

In the case of Taunton Cider it's a question of did it jump or was it pushed? The company was a loyal user of British Rail's split-wagon Speedlink until it closed the in summer of 1991. Taunton duly changed to BR's whole-wagon operation but was forced to switch to road haulage because the rail option was too costly, inflexible and infrequent.

From BR's point of view, something is going very wrong. Rifkind's successor John MacGregor is putting on a brave face. He says the imminent privatisation of BR's freight arm will encourage new operators into the market with attractive rates and flexible services. "If you want to stop the decline of freight on rail and stop it going on the road, you have to open the system to competition," he said last month.

But will it? Without huge public investment in infrastructure—railheads, track, container wagons—what firm is going to spend the millions it would need to set up an operation to rival trucks for economy, responsiveness and speed?

Consignors such as Taunton Cider know that if a haulier's standards slip or its rates rocket, it has plenty of rivals ready to step in with a better deal.

Taunton says it regrets having to move its last 525 tonnes a week on to the roadNFC susbisidiary BRS picked up the rest of the business—but says BR left it no option.

Curries says its service is not only more flexible than BR's, it's faster: "We can do Taunton to Glasgow in nine hours by swapping drivers in Manchester," says general manager Nigel Wakeling. "We don't feel guilty about taking freight from the railways—we're in the business of making money. Taunton Cider tried BR, but rail couldn't meet its demands."

The closure of Speedlink was not the only factor in the exodus from rail to road. Escalating rates forced Lincolnshire-based shipping agent Read & Sutcliffe Transport to transfer 120,000 tonnes of steel a year on to the roads at the beginning of this month: "BR's price increase made it quite impossible to go on using them," says managing director Charles Sutcliffe. "We could not commit ourselves to the minimum tonnage of 160,000 tonnes they wanted." He says the company's steel products are a "perfect" consignment for rail which will put another 20 truck loads a day on to Britain's crowded roads.

Buxton Lime Industries looks set to follow suit. It moves 400,000 tonnes of limestone a year out of Buxton, but at a time when hauliers are forced to peg or even cut rates, BR has hit it with a 280% rates hike.

Julia Clarke of the Rail Freight Group, which represents 61 rail suppliers and users, says switching such a volume of freight to road would be disastrous for the environment If it goes to road, as it seems certain to do, there will be 160 lorries per working day," she says. "That is a lorry every three minutes going through one of our most beautiful Peak District towns."

Other huge rail users could be preparing to follow. Ratcliffe Power Station in Nottinghamshire will need 80,000 tonnes of limestone a year from July, rising to 350,000 tonnes by 1995, for a flue gas desulphurisation plant.

Ratcliffe's operator, PowerGen, is currently evaluating its transport options. If it opts for road transport the quarry chosen to supply the limestone will also handle the haulage. It leans towards rail for the public relations benefits, but will go for road if it proves cheaper.

Even BR seems unsure of the market it can claim as its own. At a conference on rail privatisation last month, BR board member James Jerram said rail traffic should ideally meet certain criteria. Volume should be "significant"—typically above 100,000 tonnes a year—and trains should run from loading point to destination without marshalling stops. Movements should be "regular", at least once a day, and trains should be as big as locomotives can cope with.

In fact, says Julia Clarke, most of the freight lost by the railways in the past year has met most of these requirements. She believes that BR should be able to operate at a profit with traffic of 25-30,000 tonnes a year. Clarke welcomes rail privatisation but says the Government should "bite the bullet" and underwrite rail freight's losses for the next 15 months to give privatisation a chance.

So where does this leave the prospects for road hauliers? Operators such as P&O Roadtanks, which have been winning business for rail, are bullish about what they can offer. The company has recently won a contract to transport bitumen from Essex to Somerset for Mobil and says haulage is cheaper, more efficient and flexible. "An urgent order can be processed, loaded and delivered within a few hours," it says. "Arranging rail transport would take considerably longer."

The Freight Transport Association, representing the consignors, believes that any extension of choice would be welcome, including a privatised rail service with more private operators. But Julia Clarke hopes the Government will take action to give privatisation a chance. She believes that up to 2.5m more tonnes of freight, representing up to 100,000 extra lorry journeys, is "in danger" of moving to road in the near future. To hardpressed hauliers that would be a dream come true: to the pro-rail lobby groups it would be a nightmare.

CI by Juliet Parish Changing track:recent moves from rail to road tonnages are weekly Mobil: 960 tonnes of bitumen from Essex to Somerset, using P&O Roadtanks. Blue Circle: 9,615 tonnes of cement within County Durham and Kent Castle Cement: 4,200 tonnes of cement from Lancs to Scotland and the North-East;2,400 tonnes from Lincs to London may follow next year. Read & Sutcliffe: 2,400 tonnes of steel goods from Lincs to the Midlands. Taunton Cider: 525 tonnes of cans, bottles and kegs from Taunton to Glasgow, using BRS, Curries and own fleet. BP, Shell and Esso: 1,300 tonnes from Grangemouth and Bowling to Oban, Connelferry, Fort William and Mallaig starting in April due to the closure of the West Highland route. PowerGen: considering moving 1,900 tonnes of limestone, increasing to 6,700 tonnes into Notts. Buxton Lime Industries considering moving 7,700 tonnes within Derbys.

NB. Every million tonnes of freight coming off the railways equates to 40,000 truck movements.