it pays to understand

Page 76

Page 77

If you've noticed an error in this article please click here to report it so we can fix it.

your tax by R. H. Grimsley BCom. FIAC

17. Benefits in kind for directors and other employees

THE REVENUE have spent energy trying to prevent the man who owns and runs a business from taking tax free perquisites until by now all imaginable circumstances have been tied up. The shoe is now on the other foot and the director needs to watch that he is not being taxed more heavily than necessary on personal expense accounts, use of the company car and other benefits. These rules also fit all senior employees meaning anyone whose earnings are more than £2000 a year no matter what his position in the firm may be. It could even include some lorry drivers.

(a) The motor car.

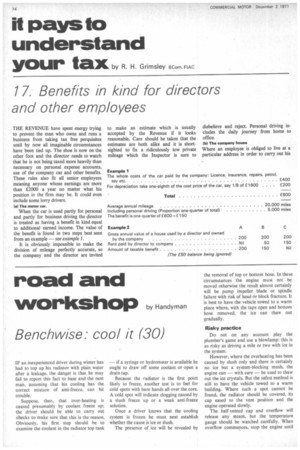

When the car is used partly for personal and partly for business driving the director is treated as having a benefit in kind equal to additional earned income. The value of the benefit is found in two steps best seen from an example — see example 1.

It is obviously impossible to make the division of mileage perfectly accurate, so the company and the director are invited

to make an estimate which is usually accepted by the Revenue if it looks reasonable. Care should be taken that the estimates are both alike and it is shortsighted to fix a ridiculously low private mileage which the Inspector is sure to

disbelieve and reject. Personal driving includes the daily journey from home to office.

(b) The company house

Where an employee is obliged to live at a particular address in order to carry out his work properly, as for example a resident caretaker at depot, there is no liability to tax on the value of the house or flat. However, if electricity, gas or other services are also provided, the value of these is always taxable and if their amount is not known exactly it must be estimated.

If the company provides a house for a director or for any other employee and there is no special connection between it and the man's duties, there is benefit equal to the gross annual value of the house. However, if a small rent is paid by the occupier, this will be deducted from the annual value to arrive at the taxable benefit. Or if a full commercial rent is paid even though it may be slightly less than the annual value there will be no taxable benefit — see example 2.

Careful thought should be given to the question of supplying company houses to directors and other employees. The house may be a marvellous magnet to attract a man to a job, particularly if it is associated with the opening of a new depot at some distance from the company's head office. There is no special tax saving but the very fact of a comfortable modern house being available will influence the man (and more important his wife) to take the job.

However, for a long-term proposition, particularly for directors and managers it may be better for the man to buy his own house, with the company helping him with either a loan for the deposit or a guarantee to the bank for a loan. For an individual a good modern house is not only somewhere pleasant to live, but also an appreciating investment with tax relief from the mortgage interest and exemption from capital gains tax when the house is eventually sold at a profit.

This exemption is not open to companies which own houses.