Britain might be adopting a wait-andsee policy on monetary union, but its international hauliers are adamant: they want in.

Page 30

Page 31

If you've noticed an error in this article please click here to report it so we can fix it.

Although Britain is not among the 11 countries entering monetary union this week, its international hauliers will have no choice other than to join the club if they are to continue doing business on the Continent.

Although euro-scepticism still seems to prevail among many British people and the Government waits and sees, international hauliers big and small seem to be tilting in the opposite direction. As if to underline the contrast with governmental inertia, Robert Coulthard, European director of Dumfries-based Curries European Transport, said recently: "We will be euro-ready on 1 January." The company has depots in the Midlands, London, the Netherlands and France and works just over 900 trailers on to the Continent carrying mostly electronic equipment and partly-manufactured products. "Some of our bigger customers in Europe intend trading in euros and they expect us to reciprocate."

Coulthard can see the benefits that a single currency across Europe will bring to his operation. "An on-going cost for us is currency exchange," he says. "No matter how well you budget your situation can be turned on its head through the exchange mechanism. For budgeting and tendering purposes, costing in euros has to have a benefit."

It is not just the big operators that are welcoming the Euro. Ken Jeavons, managing director of Birmingham-based Jeavons Transport, runs 19 vehicles on groupage work into Italy. He says it is a mistake to stay out of monetary union. 'We would be foolish not to work in the euro as much as we can," he says. "I am a strong European and I think that our country is dragging its feet. Most international companies will be dealing in the euro whether the Government takes us in or not. I can't see the sense of staying out. The point is, whether we like it or not, we are going to have to trade in it.'

Isolated

Jeavons also feels he will save money on currency conversions inside Europe but is nervous about the vulnerability of an isolated pound. "It is commonsense to see that the dollar and the euro are not going to be attacked by speculators."

The unpredictability of dealing in a multitude of European currencies will not be missed by David Croome, managing director of Croome International which runs more than 50 vehicles on express deliveries of high-value products on to the Continent from its base in Kent.

He says: "From the point of view of buying fuel, one of our largest expenditures, we are probably dealing in 15 currencies and various rates of VAT. To try to run a specific policy and to cope with all that is very difficult, so to have one currency will assist us.

But it is a shame that we haven't gone the whole hog." John Holt, manager of Laser Transport, which runs a fleet of 38 artics out of Hythe, Kent, to Spain, Portugal, Italy, France, Benelux and Germany, is also backing the euro. But he has noticed a lack of interest on the Continent. "We have opened an account for anybody who wants to trade in euros, but most of the companies we deal with are going to continue to trade in their own currencies."

And Lee Davison, international operations director of Fast Forward International, which runs six vehicles into France on a groupage service out of Sittingbourne, is concerned about the continuing uncertainty.

Seminars

Even though he and his fellow directors have attended seminars on the single currency run by Barclays Bank he is still unclear what the changes will mean for his business. He says: "They didn't give us any clear signals as to what will happen. They said that the situation could go either way depending on the interest rates at the time. We keep a French franc account for our French clients so we don't lose on conversions as they pay directly into that. We'll keep the franc account going for the time being but will probably set up a similar account in euros." Whether the UK eventually joins the single currency remains unclear. Chancellor of the Exchequer Gordon Brown has indicated that the UK could be ready for monetary union early in the next parliament-2002 or 2003.

But Government jitters will not be helped by a recent British and Social European Attitudes survey which revealed that the public's support for the euro is declining steeply. In the meantime British international hauliers will be left feeling like prospective members at an exclusive dub: sitting politely in the background as the in-crowd revels. r by Paul Newman • The notes and coins in the former national currencies will remain in use until euro notes and coins come into circulation on 1 January 2002.

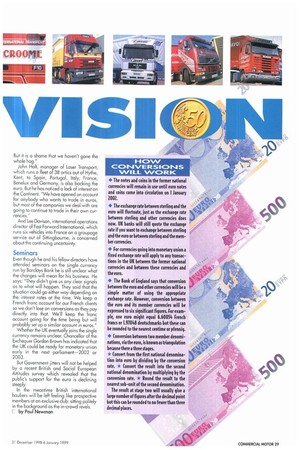

• The exchange rate between sterling and the euro will fluctuate, just as the exchange rate between sterling and other currencies does now. UK banks will still quote the exchange rate if you want to exchange between sterling and the euro or between sterling and the member currencies.

• For currencies going into monetary union a fixed exchange rate will apply to any transactions in the UK between the former national currencies and between these currencies and the euro.

* The Bank of England says that conversion between the euro and other currencies will be a simple matter of using the appropriate exchange rate. However, conversion between the euro and its member currencies will be expressed to six significant figures. For example, one euro might equal 6.60054 French francs or 1,91048 deutschmarks but these can be rounded to the nearest centime or pfennig,

4. Conversion between two member denominations, via the euro, is known as triangulation because there a three stages.

* Convert from the first national denomination into euro by dividing by the conversion rate. * Convert the result into the second national denomination by multiplying by the conversion rate. * Round the result to the nearest sub-unit of the second denomination,

The result at stage two will usually give a large number of figures after the decimal point but this can be rounded to no fewer than three decimal places.

THE GOVERNMENT'S POSITION ON EMU

• Chancellor Gordon Brown has set out his stall on the euro and Britain's part in it. But the words wait and we sprung to mind when he said: If the single currency is successful and the economic case is clear and unambiguous, then the Government believes Britain should be a part of it!'

Any decision to join will be based on what the Government sees as the national economic interest. The criteria that must be met are: • Whether joining would create better conditions for firms making long-term decisions to invest in the UK.

• flow a single currency would affect the UK's financial services.

• The compatibility of UK business cycles with those of euro nations. Importantly it would be a measure of whether British business can live comfortably with euro interest rates.

• If problems emerge, is there suffident flexibility to deal with them?

• Will monetary union help to promote higher growth, stability and a lasting increase in jobs? The Government says that the UK would not necessarily follow the same timetable as those countries joining this week. Indeed the changeover could be shorter because: • The euro will already be a currency.

• The [uropean Central Bank will be in operation.

• Some UK businesses will already have experience of using the euro.

• If the UK were to join after I January Ng euro bank notes and coins would already be legal tender in other furopean countries and the currency might be in limited use in the UK.