Oppressive Taxation

Page 96

Page 97

If you've noticed an error in this article please click here to report it so we can fix it.

Hampering Farm Transport

Derbyshire—a County in which Only One Farmer Directly Uses Road Mechanical Transport. Complete Freedom from Road-licence Dues Advocated in an Interview with Our Special Correspondent

T0 be told, in the year 1933, when the use of mechanical transport appears to be approaching its zenith, that farmers in Derbyshire cannot economically make direct use of commercial motors, was the last thing I expected when I set out to investigate the conditions of agricultural transport in that comity. Even more surprising is the fact that the statement came from the only farmer in Derbyshire who actually makes such direct n o.,.... ET ....MM. use, in the face of his ow mo dii Moreover, there are over 9,000 farmers in the county !

Actually, I suppose, I ought to have been prepared for the shock, for, when I wrote to Mr. J. R. Bond, the agricultural organizer for the county, asking him to give me the names of one or two farmers who employed mechanical transPort, he replied that Mr. J. W. Brown, of Moor ,Close, Yeldesley, Ashbourne, was the only man known to him as a user. Even then I did not apprehend the true state of affairs. I merely concluded that Mr. Bond bad rather ambitious views on the subject, and did not rate a farmer as a user unless he had a fleet of vehicles, Enlightenment, swift and sudden, came from Mr. Brown.

"I am told, Mr. Brown," I said, as I settled myself in his comfortable farm kitchen, "that you are the only farmer in Derbyshire who is known to be a user of commercial motors."

" I shouldn't be at all surprised if that is correct," he replied. "I don't know any other!'

"But, goodness gracious !" I said, "'whatever is the reason?"

"The reason is the heavy taxation," be answered. "Farmers cannot afford it."

Still I did not understand, as, quite obviously, Mr. Brown realized, for he continued:—

"A farmer's motor lorry does not cover an annual mileage sufficient to justify the payment of the annual tax, let alone the insurance and other inddentals. Take my own case. The tax on my Ford 7-cwt. lorry is £15. It does not run more than 2,500 miles a year, so that the tax alone is equivalent to 1-id. per mile. It's simply outrageous. It was bad enough to have to pay the tax alone. When the Government added

the compulsory insurance, I nearly gave

up.,

"But you didn't?"

"No, but I divided my transport with my son, who also farms. Instead of a car and a lorry each, we now have only one car and one lorry between us. My lorry does the work for the two farms."

"What do you use it for?"

"Taking milk over to the factory." " Nothing else?" .

"But can't you make more profitable use of it by fetching foodstuffs, seeds, and the like, for your needs?"

"It wouldn't be worth while. The railway company delivers to the door for half-a-crown a ton, and I cannot beat that rate, using a 7-cwt. lorry, which is big enough for milk transport. I should have to make three journeys

and travel 15 miles to bring a ton of cake.

"Since 1920 I have paid *.500 in taxation for a car and a lorry.

For 15s. per annum I could have' had a horse-drawn vehicle, and the horse's iron-shod hooves and the iron-tyred wheels of the vehicle would have done much more harm to the roads.

"Moreover," he continued, "when I was paying ;LS. per annum in taxation for a car and a lorry, I had two specific vehicles at my disposal. For 15s. a year I could use as many horsed vehicles as I liked."

"Yet you yourself stick to the motor, Mr. Brown."

"I do," he said earnestly, " because I am a believer in the internal-combustion engine as an aid to efficient farming. On the land it is essential. Farmers in Great Britain are largely at the mercy of the weather. By the use of power-driven implements it is possible to take advantage of favourable conditions, no matter how fleeting, to get a field tilled, for example, while the weather is good. That is impossible with horses, because they jack the necessary speed.

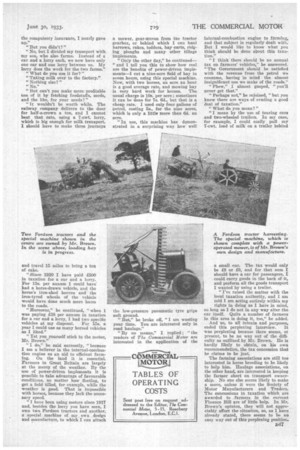

"1 have been using motors since 1917 and, besides the lorry you have seen, I own two Ferdson tractors and another, a specjal machine of my own design and manufacture, to which I can attach

a mower, gear-ariven from the tractor gearbox, or behind which I can haul harrows, rakes, tedders, hay carts, ridging ploughs and many other tillage implements.

" Only the other day," he continued" and I tell you this to shoes, how real are the benefits of power-driven implements—I cut a nine-acre field of hay in seven hours, using this special machine. Now, with two horses, an acre an hour is a good average rate, and mowing hay is very hard work for horses. The usual charge is 10s. per acre ; sometimes it can be done for 7s. 6d., but that is a cheap rate. I used only four gallons of petrol, costing 5s., for the nine acres, -which is only a little snore than 6d. an acre.

"In use, this machine has demonstrated in a surprising way how well the low-pressure pneumatic tyre grips soft ground.

"But," he broke off, "1 ran wasting your time. You are interested only in road haulage."

"By no means," I replied.; 'the readers of The Commercial Motor are interested in the application of the

internal-combustion engine to _famine. and that subject is regularly' dealt But I would like to know what you think should be done about this taxation." • " I think there should be no annual tax on farmers' vehicles," he answered. "The Government should be satisfied with the revenue from the petrol we consume, having in mind the almost insignificant use we make of the roads."

" Phew," I almost gasped, "you'll never get that."

"Perhaps not," he rejoined, "but you know there are ways of evading a good deal of taxation."

"What do you mean?"

"I mean by the use of touring care and two-wheeled trailers. In my case, for example, I could easily pull my 7-cwt. load of milk on a trailer behind a small car. The tax would only be £8 or £0, and for that sum IC should have a car for passengers, I could carry goods in the back of it, and perform all the goods transport I wanted by using a trailer.

" I've raised the matter with the local taxation authority, and I am told I am acting entirely within my rights in doing as I have in mind, so long as I do not in any way alter the car itself. Quite a number of farmers in this area is doing it, too," he added.

And tor to all intents and purposes,

ended this perplexing interview. It was perplexing because there seems, at present, to be no way out of the difficulty as outlined by Mr. Brown. He is hardly likely to obtain, on his own recommendation, the tax concession that he claims to be just.

The farming associations are still too interested in horse breeding to be likely to help him. Haulage associations,. on the other hand, are interested in keeping the farmer short on transport ownership. No one else seems likely to make a move, unless it were the Society of Motor Manufacturers and Traders. The concessions in taxation which. are awarded to farmers in the current Finance Bill are of little help. In Mi. Brown's opinion, they will not appreciably affect the situation, so, as I have already stated, there seems to be no easy way out of this perplexing position..