management matters

Page 44

Page 45

Page 47

If you've noticed an error in this article please click here to report it so we can fix it.

WE have discussed the identification of areas of weakness in a company's operation by the interpretation of financial accounts, and the more detailed analysis of such areas by the appraisal of company operations. These are mainly diagnostic techniques used to identify the problems. We now need more detailed identification and a means of control, and this is provided by an accurate costing system. The production and use of accurate costing information is essential to successful road haulage operation.

In a previous article, we said that if the percentage of gross profit to revenue falls over successive periods, areas to examinf could be haulage rates, vehicle and capacity utilization, and such costs as wages, vehick maintenance and fuel. Last week we gav{ examples of vehicles operating at a loss although utilization was high, and this mus lead to a detailed examination of cost: and haulage rates. We can do this only if wi have an accurate costing system.

The main objectives of vehicle costinl are: 1. To ascertain the true cost of providin a unit of service and to enable charges to b fixed on a rational basis.

2. To provide a means of controllin expenditure.

3. To provide a guide to management to the relative profitability of alternatir courses of action.

The method of costing transpo operations most generally used, is ur costing. The total cost of operating vehict during a period is divided by the number units of cost incurred (vehicle—miles) or units of service rendered (ton--miles) give a cost per vehicle--mile, or p ton—mile.

Separation of costs The separation of costs is most importa in vehicle costing, and a great deal of t necessary information is available in nu haulage businesses. There are three tru groups of costs: 1. Vehicle fixed costs.

2. Administration costs.

3. Vehicle running costs.

Vehicle Fixed Costs and Administrati Costs ate combined to give us the Stand] cost, which is incurred simply to have 1 vehicle standing—before it moves ( Vehicle running costs are incurred as sc as the vehicle moves. The components each group are: 1. Vehicle fixed costs a) Road fund licence duty The actual amount is obtainable from vehicle log or registration book.

b) Motor insurance premium Obtainable from the debit or charge n received from your insurers.

c) Operator's licence fee d) Driver's wages This will be the gross cost to the employer, including employers' National Insurance contributions and Graduated Pension.

This item must also include provision for the cost of driver's annual and statutory holidays. It can be argued that drivers wages should be included under Vehicle running costs, but normally wages have to be paid even at times when the vehicle is not operating, The important point to remember is that wages and related costs must be allowed for in the haulage rate.

e) Vehicle depreciation It is essential that a realistic charge is made for this item when quoting haulage rates. There are two ways to calculate depreciation. The first is the "straight line" method which simply takes the purchase :rice of the vehicle, deducts cost of tyres and any anticipated residual value, and divides by the number of years y.ou expect it o operate. This gives the annual lepreciation. The second method is the "reducing balance" method, where the balance is reduced each year by a fixed percentage. Under this method, depreciation is higher during the early life of a vehicle, when repair charges are low, and reduces as the vehicle becomes older and repair charges increase. Of the two methods, the first is simpler to understand and easier to calculate.

2. Administration Costs These include such items as rent and rates, heat, light, office expenses, professional expenses, and can be obtained from the financial books of the business. All of these costs must be recovered from vehicle operation, by apportioning the total cost over the fleet.

3. Vehicle running costs (a) Fuel There must be a means of recording drawings from your own pump to individual vehicles and drawings for individual vehicles from agency sources.

(b) Lubricants Records of oil consumption should be kept.

(c) Tyres Provided that accurate records are .kept of mileage per vehicle and details of tyre changes, then arriving at an accurate cost per mile is not difficult.

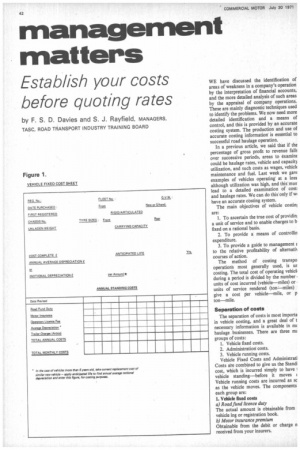

(d) Repairs and maintenance This item should include gross wages paid to fitters, cost of spares and materials and all charges received from outside repairers. These various items of cost have to be assembled in such a way as to provide relevant information and necessary control. The ordinary financial books and accounts of a business are usually unsuitable for costing purposes and so separate cost sheets are prepared. A set of such sheets is shown at figures I, 2, 3, 4 and 5.

Vehicle fixed cost sheet—figure I This form need only be completed once for each vehicle.

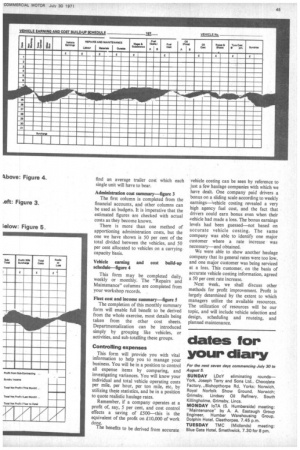

Trailers: fixed cost sheet—figure 2 Where we have articulated vehicles and semi-trailers in the fleet, this form is completed. The purpose of the form is to find an average trailer cost which each single unit will have to bear.

Administration cost summary—figure 3 The first column is completed from the financial accounts, and other columns can be used as budgets. It is imperative that the estimated figures are checked with actual costs as they become known.

There is more than one method of apportioning administration costs, but the one we have shown is 50 per cent of the total divided between the vehicles. and 50 per cent allocated to vehicles on a carrying capacity basis.

Vehicle earning and cost build-up schedule—figure 4 This form may be completed daily. weekly or monthly. The "Repairs and Maintenance" columns are completed from your workshop records.

fleet cost and income summary—figure 5 The completion of this monthly summary form will enable full benefit to be derived from the whole exercise. most details being taken from the other cost sheets. Departmentalization can be introduced simply by grouping like vehicles, or activities, and sub-totalling these groups.

Controlling expenses This form will provide you with vital information to help you to manage your business. You will be in a position to control all expense items by comparing, and investigating variances. You will know your individual and total vehicle operating costs per mile, per hour, per ton mile, etc, by utilizing these statistics, and be in a position to quote realistic haulage rates.

Remember, if a company operates at a profit of, say, 5 per cent, and cost control effects a saving of f500—this is the equivalent of the profit on £.10.000 of work done.

The benefits to be derived from accurate vehicle costing can be seen by reference to just a few haulage companies with which we have dealt. One company paid drivers a bonus on a sliding scale according to weekly earnings—vehicle costing revealed a very high agency fuel cost, and the fact that drivers could earn bonus even when their vehicle had made a loss. The bonus earnings levels had been guessed—not based on accurate vehicle costing. The same company was able to identify one major customer where a rate increase was necessary—and obtained.

We were able to show another haulage company that its general rates were too low, and one major customer was being serviced at a loss. This customer, on the basis of accurate vehicle costing information, agreed a 50 per cent rate increase.

Next week, we shall discuss other methods for profit improvement. Profit is largely determined by the extent to which managers utilize the available resources. The utilization of resources will be our topic, and will include vehicle selection and design. scheduling and routeing, and planned maintenance.