Establishment Costs Do Exist W HEN I talk to hauliers about

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

their charges and the way they should estimate them, I tell them that there are three factors which they aust take into consideration. Those are the cost of ,perating. their vehicles, the cost of running their busiless and, last and often, I am afraid, least, the profit. Vhen I use that word,. I mean net profit, free from all llowances.

That, indeed, is so often the difficulty. A haulier tates that he has made what he calls a clear profit of

a week. When, however, I go into details, I nearly lways find that there are this and that to be taken off, ,nd the whittling-down process often goes. on to such degree that the actual profit is no more than £1; ometimes it does not reach even that meagre figure. The allowance, the " this and that," to which I have eferred above, are all what I have termed "cost of -tinning, the business," or, otherwise, establishment ;osts. Most small hauliers aver that they are subject o no establishment costs. Always these are the very nen whose profit is, as to most of it, imaginary, being nade up., in the main, of just these establishment costs vhich they say have no existence in their businesses.

Establishment Costs Never Non-existent.

It is certainly true that, in some cases, these establishrient costs are low. They are, however, never nonxistent, nor even negligible: sometimes they are coniderable, Hitherto, in this series, I have contented ay-self with variations in vehicle operating costs. In he previous article I showed nine possible totals for the iperating costs of a :l-ton lorry, ranging from what I ■ elieve to be the minimum compatible with reasonable ■ peration, to a fair maximum.

Now, it is much more difficult to estimate the amount if establishment costs. Only the man who keeps ,ccurate records of every halfpenny he spends on his iusiness, and, moreover, keeps those records in such a vay that it is possible to differentiate between the

• arious items, separating those which are really vehicle B4

operating costs from those which are really establishment costs, and, again, taking apart certain special exPenses—non-recurrent is another term for them— which are of neither of the two main categories, can say what his establishment costs actually are.'

I am going to try to deal with these costs in the same • way as the vehicle operating costs, first assessing them at a maximum, then at a minimum, finally citing some intermediate case.

First, I should state that I have just examined the books of an operator of 24 vehicles of various sizes. Ho is a haulier who does keep track of his costs in the way I have described. I would go farther and state that from the point of view of road-transport organization, his accounts are the best and most usefully informative that I have ever seen.

Overheads Total £.1,800 a Year.

The total of establishment costs is £1,800. Assuming —which is not the case—that the vehicles were all of the same size, each would have to be debited with £75 per annum, 305. per week, or 71c1.' per hour. Think over that—those .hauliers who doubt the need for taking establishment costs into consideration.

And I will shortly show that this figure is far from being the maximum. Equally is it true that it is not a minimum. Indeed, it is not far from being a reasonable average. I must not give details of the fleet, as, by so doing, I might disclose the source of my information, which is undesirable.

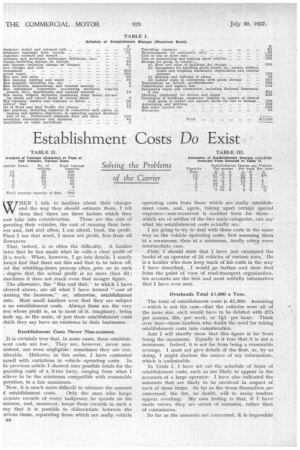

In Table I, I have set out the schedule of items of establishment costs, such as are likely to appear in the accounts of a large operator. I have also indicated the amounts that are likely to be involved in respect of each of those items. So far as the items themselves are concerned, the list, no doubt, will to many readers appear overlong. My own feeling is that, if I have made errors, they are errors of omission, rather than of commission. • So far as the amounts are concerned, it is impossible

to avoid making a plea for a certain amount of licence. Some items may be considerably below the amounts which a particular operator will have to find, but that deficiency will; I think, be balanced by . an increase under other headings. The total, however, I do know from experience, is not far from correct.

Most of the items need no explanation. Looking down the list and having in mind, in doing so, the actual amounts scheduled, the first which is likely to call for • comment is, I think, that of legal expenses. At £100, thatitem is probably underestimated, Certain operators can quote much higher figures as the result of the past year's working.

The provision for. storage is one which no operator in a big way can avoid, If anything, I have again underestimated the amount set down for labour ; especially is that the case if there be a certain amount of clearing-house business done.

Three Inter-related Items.

There are three items which go together, namely, expenditure on branch establishments, commission and agency fees, and salesmen's wages and commissions. Doubt may be raised as to whether all three of these would be involved in any particular business. I can only state that it is so and, as this schedule purports to be one of maximum amount, I am bound to include them.

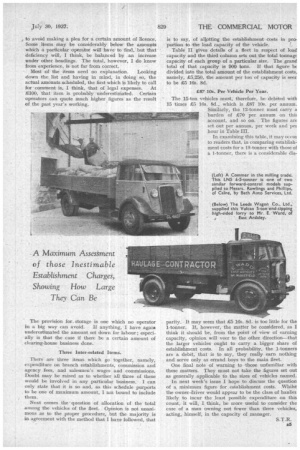

Next comes the ' question of allocation of the total among the vehicles of the fleet. Opinion is not unanimous as to the proper procedure, but the majority is in agreement with the method that I have followed, that is to say, of allptting the establishment costs in proportion to the load capacity of the vehicle.

Table II gives details of a fleet in respect of load capacity and the third column sets out the total tonnagr capacity of each group of a particular size, The grand total of that capacity is 900 tons. If that figure be divided into the total amount of the establishment costs, namely, £5,250, the amount per ton of capacity is seer to be £5 16s. 8d.

£87 10s. Per Vehicle Per Year.

The 15-ton vehicles must, therefore, be debited with 15 times £5 16s. 8d„ which is £87 10s. per annum. Similarly, the 12-tonner must carry a burden of £70 per annum on this account, and so on. The figures are set out per annum, per week and pei hour in Table III.

In examining this table, it may occui to readers that, in comparing establishment costs for a 15-tonner with those of a 1-tonner, there is a considerable dis parity. It may seem that £5 10s. 8d. is too little for the 1-tonner. If, however, the matter be considered, as I think it should be, from the point of view of earning capacity, opinion, will veer to the other direction—that the larger vehicles ought to carry a bigger share of establishment costs. In all probability, the 1-tonners are a debit,' that is to say, they really earn nothing and serve only as errand boys to the main fleet.

One final note of warning to those unfamiliar with these matters. They must not take the figures set out as generally applicable to the sizes of vehicles named.

In next week's issue I hope to discuss the question of a minimum figure for establishment costs. Whilst the owner-driver would appear to be the class of hauliet likely to incur the least possible expenditure on this count, it will, I think, be more useful to consider the case of a man owning not fewer than three vehicles, acting, himself, in the capacity of manager.

S.T.R. B5