WAYS OF RECORDING ESTABLISHMENT COSTS

Page 48

Page 51

Page 52

If you've noticed an error in this article please click here to report it so we can fix it.

A Small Operator Asks S.T.R. to Outline Methods of Keeping Track of Those Items of Cost which are Easily Overlooked HAD a visit from a newcomer, the other day, who had 'been demobilized quite recently and had obtained a post as secretary to a small haulage company. He discovered to his amazement that the company had no proper record of the cost of operating its vehicles. That did not surprise me and I told him that 70 to 80 per cent, of small operators are in the same position. He decided that his company was not going to be in that position any longer than he could help, and he made his first job that of arranging to keep such records. " I have a copy of your Cost Recording Made Easy,'" he said, "and have been through it carefully. There are one or two questions I should like to ask you about it and that is why I am here." We then discussed cost recording in general and the methods recommended in that book in particular. He put forward quite a number of interesting points.

First he said: "You have dealt with establishment costs in Chapter 7 but nowhere do you suggest a method of recording those costs which seems to me to be rather peculiar, having in mind the title of the publication." "To tell you the truth,' / replied. "it never occurred to me to do so. I was concerned with the recording of operating costs of the vehicle. Chapter 7 was intended more than anything as a kind of warning so that operators would not overlook such things as establishment costs."

Nevertheless," he repliec, "1 would like to know a good way of recording these establishment costs."

"For a small concern I have always recommended that the operator enters expenditure under that heading in a small cash book, item by item, totting up monthly, quarterly, or at the end of the year, according to the number of items and the amounts involved."

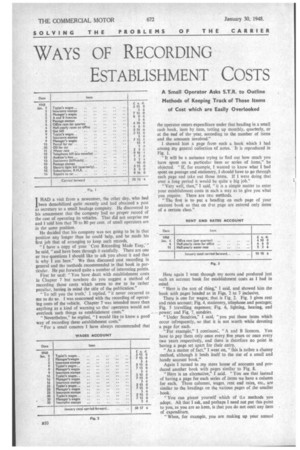

I showed him a page from such a book which I had among my general collection of notes. It is reproduced in Fig. 1.

It will be a nuisance trying to find out how much you have spent on a particular item or series of items," he objected. "If, for example, I wanted to know what I had spent on postage and stationery, I should have to go through each page and take out those items. If I were doing that over a long period it would be quite a big job."

"Very well, then," I said, " it is a simple matter to enter your establishment costs in such a way as to give you what you require. There are two methods.

The first is to put a heading on each page of your account book so that on that page are entered only items of a certain class."

Here again I went through my notes and produced just such an account book for establishment costs as I had in mind.

"Here is the sort of thing," I said, and showed him the book with pages headed as in Figs. 2 to 7 inclusive, There is one for wages; that is Fig. 2. Fig, 3 gives rent and rates account; Fig. 4, stationery, telephone and postages; Fig. 5 travelling expenses; Fig. 6, lighting, heating, and power; and Fig. 7, sundries.

"tinder Sundries," I said, "you put those items which occur infrequently, so that it is not worth while devoting a page for each.

"For example," I continued, "A and B licences. You have to pay them only once every five years or once every two years respectively, and there is therefore no point in having a page set apart for their entry.

"As a matter of fact," I went on, "this is rather a clumsy method, although it lends itself to the Use of a small and handy account book."

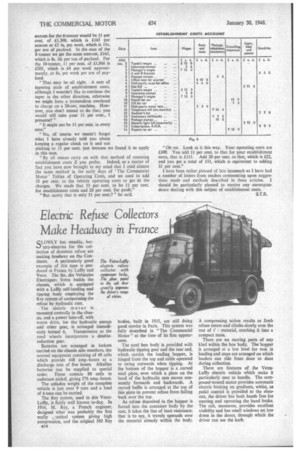

Again I turned to my store house of accounts and produced another book with pages similar to Fig. 8.

"Here is an alternative," I said. "You see that instead of having a page for each series of items we have a column for each. These columns, wages, rent and rates, etc., are similar to the headings on the various paces of the smaller book.

"You can please yourself which of tl.e methods you adopt. All that I ask, and perhaps I need not put this point to you, as you are so keen, is that you do not omit any item of expenditure.

"When, for example, you are making up your annual summary for establishment costs," I reminded him, " there may be one or two items still not entered."

" Oh!" he said. "What are they? "

" Depreciation of ear,ige fixtures, possibly bank charges, which I find are easily overlooked. and interest on hirepurchase if any, as that does not appear as an actual expenditure but is paid out as part cf any instalments you may have to pay following the purchase of new vehicles.

" You must add those to the total at the end of the year." " Now that brings me to another point," he said. " It is quite clear, as 1 have no previous accounts to go upon, that I shall have to wait until the end of the first year before I really know what our total annual establishment costs are." " Yes, I see that."

"How then should I deal with it in the meantime? " he • said.

" You cannot do better," I replied, " than take the medium figure quoted towards the end of my chapter, that is the average figure, 10s. 6d. per ton of payload," " What do I do at the end of the year then," he said, " if I find that according to my accounts my allocation of establishment costs should be more or less than that 10s. 6d. per ton which you recommend?"

" That's easy," I said. " What you do is to alter your allocation for the next year in accordance with your actual experience but," I added. "you should use a certain amount of discretion. If there are any unusual expenses in this year which in your view are not likely to recur, you should deduct those before making your allocation.

"You should," I said, "check your establishment costs like this every year. The establishment cost figure, that is the 10s. 6d. per ton of payload or whatever it is, which you use, is always to a certain extent an estimated provision for your indirect expenses. It needs constant checking and revision. It is your records of establishment costs that are the reality and the establishment cost figure which you use is an attempt to represent them in your cost accounts. On the success of your attempt to represent them depends the accuracy of your costing and the fairness of your charges," " Wauld it not be better than, perhaps." he said, " to make a check at more frequent intervals, say once 8 month? "

" I'm afraid that is not practicable," I said, "for the reason that a set of figures relating to one month would not he representative. • I'm afraid a year is the minimum period which you can take," " Next," he said, "I should like to know what is the reason for allocating establishment costs on the basis of per ton of payload." "It is purely arbitrary," I replied, "and I cannot even give you a reason. You see, these establishment costs in a haulage business are practically the same in essence as what are called indirect charges' or 'on-costs' in any ordinary works or factory. There it is usual to assess the on-costs or overheads on the basis of wages paid to operatives and you will read that on-costs are 50 per cent., 100 per cent., 200 per cent. on the direct labour costs current in the establishment, "In a haulage business that would hardly meet the needs of the case. The difference in wages paid to the driver of a 5-tonner and the driver of a 12-tonner is nothing like comparable with the work done and the tonnage shifted, so to meet the particular circumstances of the case, per ton of payload is usually selected as the basis of assessment."

"How do you think it ought to be done?"

"It should be related, I think, in some way or other to costs of operation rather than tonnage capacity." As a matter of fact I have an open mind on the subject as have most operators. I must admit I have only once beard the matter discussed at any length. Then I was talking to a person in the industry who had made a particular study of costs of operation and related subjects. ' Even he could find only one objection to the capacity method and that I think was due to the peculiar conditions under which his vehicles operated, inasmuch as his trade was a fluctuating one and quite often he had vehielles out of use for considerable periods. Moreover, it often happened that it was his largest vehicles which were laid up. It seemed to him that he lost a lot of his establishment costs on those vehicles, as they were being charged all the time they were doing nothing."

Have you yourself any ideas on the subject?"

" Yes. Why not assess the establishment costs on the basis of vehicle operating costs?"

You mean compare the establishment costs when you know them with the cost of the fleet on a percentage basis and apply that percentage to each vehicle? "

"Yes, why not?"

"1 can't see any real objection to that, but suppose we try it out. I'll apply it to the fleet of vehicles mentioned in Chapter 7. I see it comprises two 6-tonners, one 8-tonner and one 10-tonner_ Now suppose the 6-tonners each run 40.000 miles per annum at an all-in vehicle-operating cost of 9d. per mile; the 8-tonner, which we will take to be an oiler, runs 36,000 miles at 10d. per mile, and the 10-tonner, also an oiler. 32,000 miles at is. 2d.

"The total costs are: for the 6-tonner £1,500 per annum, or £3,000 for the two; the 8-tonner £1,500 per annum and the 10-tonner £1,866, which is £6,366 in all.

"Now we'll assume that the establishment costs are the average or probable' set out in the Table on page 14. That is £796 10s. per annum."

I then worked out that as a percentage on £6,366 and said, "That is 11 per cent, of the total cost.

"Now then," I said, "your establishment costs per annum for the 6-tonner would be 11 per cent. of £1,500, which is £165 per annum or £3 6s. pet week, which is lls. per ton of payload. In the case of the 8-tonner we get the same amount, £165, which is 8s. 3d. per ton of payload. For the 10-tonner, 11 per cent. of £1,866 is £205, which is £4 per week approximately, or 8s, per week per ton of payload.

That may be all right. A sort of tapering scale of establishment costs, although I wouldn't like to continue the taper in the other direction, otherwise we might have a tremendous overhead to charge on a 30-cwt. machine. However, you don't intend to do that; you would still take your 1I per cent., I presume?"

"It might not be 11 per cent, in every case."

" No, of course we mustn't forget what I have already told you about keeping a regular check on it and not sticking to 11 per cent. just because we found it to apply in this case.

"By all means carry on with that method of assessing establishment costs if you prefer. Indeed, as a matter of fact you have now brought to my mind that I used almost the same method in the early days of 'The Commercial Motor' Tables of Operating Costs, and we used to add 33 per cent. to the vehicle operating costs to get at the charges. We made that 33 per cent, to be 11 per cent. for establishment costs and 20 per cent, for profit."

"But surely that is only 31 per cent.? " he said. "Oh no. Look at it this way. Your operating costs are £100. You add 11 per cent, to that for your establishment costs, that is £111. Add 20 per cent, to that, which is £22, and you act a total of 133, which is equivalent to adding 33 per cent."

I have been rather pleased of late inasmuch as I have had a number of letters from readers commenting upon suggestions made and methods described in these articles. I should be particularly pleased to receive any correspondence dealing with this subject of establishment costs.

S.T.R.