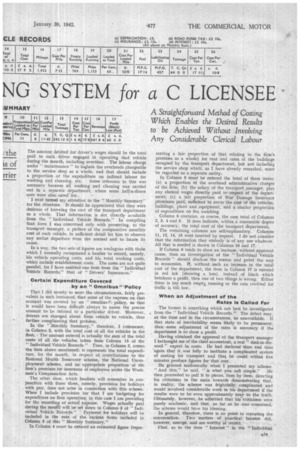

SIMPLE and PRACTICAL COS] NG SYSTEM for a C LICENSEE

Page 26

Page 27

Page 28

If you've noticed an error in this article please click here to report it so we can fix it.

A Way to Keep Track of Vehicle Costs and to Know What the Transport Department of an Organization as a Whole is Costing

Straightforward Method of Costing Which Enables the Desired Results to be Achieved Without Involving Any Considerable Clerical Labour

IHAD an interesting job to do recently, which was made more so because of several side issues arising in connection with it. A firm of C licensees asked me to draft a simple system of costing for their road-transport department. They operated 13 miscellaneous vehicles, of which the smallest was a 5-cwt. van and the largest a 6-ton lorry. The vehicles were of all ages and makes, some of them brand new and one verging on seven years old. Some were oil-engined

• and some were petrol driven, Two objectives had to be gained by the application of this costing system. The transport manager wanted means for checking the performance and .cost of individual vehicles, the directors wished to be sure that the department would not cost too much. They even hoped, as the result of setting tevenae against costs, that it would show a slight profit. There were two sources of revenue—that from the carriage paid for manufactured goods delivered to customers, and that from raw materials collected from suppliers, for the carriage of which the latter were agreeable to pay.

An important factor which I was urged to keep in mind was the need for simplicity, for reducing the clerical work to an absolute minimum. The transport manager himself. I gathered, would have to make the entries, there being no clerical staff available.

Data Needed for Presentation to the Directors In the summary for the directors, which the transport manager advised, it would be necessary to give data forthe proportion of loaded to total mileage, for the cost per mile, per ton and per cwt., these figures being requested fot examination at intervals not exceeding one calendar month. Certain °thee data were required in this monthly summary, the utility of which was, in my view, open to question. Of that more as this article proceeds.

The firm ran their own servicing and repair shop, in which all kinds of work, including reboring and resleeving of cylinders were carried out, as well as electrical servicing, repairs to bodywork and painting. This department was not solely concerned with the task of maintaining the firm's vehicles, but had other work of a similar nature to do for customers.

Any possible complication of costing was eliminated, so far as I was concerned, by a procedure already in force, whereby work done by the service shop for the transport department was charged out at cost, being based upon a charge for labour and for materials. The men the .shop booked their time against any vehicle upon which they were working; this was charged at cost, pins a percentage to cover overheads and profit. • Spares, etc., were purchased outside at trade prices and debited against the transport department at retail prices.

All these charges were properly allocated to the vehicle concerned, and. it seemed to me, therefore, that no difficulty should stand in the way of assessing the expenditure on maintenance and repairs on each vehicle—and with a tolerable degree of accuracy. I also found that reliable methods of ascertaining fuel and oil consumption, total mileage, loaded mileage, tonnage carried and number of days worked per month, in respect of each vehicle, were already in force, so that there was no need for me to devise procedure to those ends.

In one way at least this scheme of costing would differ from that which I should have recommended to a haulier. There was no need to include data for estimated cost of maintenance or expenditure on tyres. The data produced was not intended for use as a basis for calculating rates, but as only a month-by-month check on expenditure and revenue. There was not likely to be any misunderstanding or miscalculation because, in any one month, excessive expense in respect of either of these items was incurred.

In a fleet of 13 vehicles it is probable that one per month will be in dock for substantial repairs or overhaul so that, month by month, the total expenditure, which was all that really concerned the directors, would not vary to any appreciable extent. So far as the cost per individual vehicle was concerned, this would be scrutinized by only the transport manager, who would be well acquainted with the circumstances and, therefore, able to assess any seemingly exceptional result, plus or minus', at its proper value.

Monthly Summary of Cost Figures Makes for Simplicity Remembering all these features, and keeping well in view the need for simplicity. I decided that it would also meet the needs of the transport manager to summarize his cost figures not more often than once per month. I, therefore, drew up the form entitled " I,ndividual Vehicle Records " for his use; it is reproduced herewith.

Typical figures relating to a month's use of one of the 13 vehicles are included, in order to assist the reader in understanding the form and its practical application. I should add that I recommended that each sheet should have space for not fewer than 24 monthly entries, so that a completed sheet would embody entries for two years. Bearing in mind the strict injunction that the method must be simple, not involving much in the way of clerical work, I rather expected a strong protest from the transport manager when he saw the 26. columns of this form and realized that they had to be completed for every one of 13 vehicles. But no, he took it like a lamb.

I discovered that he was a man after my own heart, and was really desirous of being able to check up on the performance of his various machines. He appreciated that the data at the top of each sheet would probably stand unaltered for the duration of the sheet, that is, for two years and probably longer, also that the other entries were needed only once per month.

With the draft I issued these brief explanatory notes. The reference to type was as to the fuel used, petrol Or oil fuel. All the vehicles were ordinary four-wheelers, so that no further discrimination was necessary. The term !` payload " referred to the load which the vehicle was designed to carry. Interest to be calculated at 4 per cent. per annum on the original capital sum expended on the vehicles.

The amount debited for driver's wages should be the total paid to each driver engaged in operating that vehicle during the month, including overtime. The labour charge under " maintenance " to innlude the overheads chargeable to the service shop as a whole, and that should include a proportion of the expenditure on indirect labour for washing and cleaning, etc. Some reference to this was necessary because all washing and cleaning was carried out in a separate department, where some half-a-dozen cars were also cared' for.

I next turned my attention to the "Monthly Summary" for the directors. It should be appreciated that they were desirous of knowing the cost of the transport department as a whole. That information is riot directly available from the "Individual Vehicle Records." In compiling that form I was concerned only with presenting, to the transport manager, a picture of the comparative monthly cost of each vehicle, in sufficient detail for him to observe any undue departure from the normal and to locate its cause.

In a way, the two sets of figures are analogous with those which I normally recommend a haulier to record, namely, his vehicle operating costs, and his total working costs, which include establishment costs. The cases are not quite parallel, for I have omitted one item from the "Individual Vehicle Records," that of " Drivers' Insurances."

Certain Expenditure Covered by an "Omnibus" Policy That 1 did merely to meet the circumstances, fairly prevalent in such instances', that some of the expense on that account was covered by an "omnibus/'. policy, so that it would have been difficult always to assess the precise amount to be debited to a particular driver. Moreover, drivers are changed about from vehicle to vehicle, thus further complicating that problem.

In the "Monthly Summary," therefore, I commence, in Column 2, with the total cost of all the vehicles in the fleet. The' amount entered is actually the sum of the total costs of all the vehicles taken from Column 15 of the "Individual Vehicle Records," Then, in Column 3, comes the item above mentioned: it represents the total expenditure, for the month, in respect of. contributions to the National Health Insurance scheme, the National Unemployment scheme, and an appropriate proportion of the firm's premium for insurance of employees under the Workmen's Compensation Acts.

The other item, which hauliers will remember in .conjunction with these three, namely, provision for holidays with pay, does not arise in connection with this scheme. When I include provision for that I am budgeting for expenditure on fleet operation; in this case I am providing for the recording of actual expense. Wages actually paid during the month will be set down in Column 3 of "Individual Vehicle Records." Payment for holidays will be included in the sum of the. various items included in Column 5 of this "Monthly Summary."

In Column 4 must be entered an estimated figure (repre senting a fair proportion of that relating to the Erra's premises as 'a whole) for rent and rates of the buildings occupied by the transport department, but not including the service shop which, as I have already remarked, must be regarded as a separate entity.

In Column 5 must be entered the total of three items: (a) a proportion of the overhead administrative charges of the firm; (b) the salary of the transport manager, plus any clerical wages directly paid in respect of the department; (c) a fair proportion of War Damage Insurance premiums paid, sufficient to cover the cost of the vehicles, buildings, plant and ,equipment, and a similar proportion of expenditure on fire watching.

Column 6 contains, or course, the sum total of Columns 2, 3, 4 and 5. It does indicate, within a reasonable degree of accuracy, the total cost of the transport department.

The remaining columns are self-explanatory. Columns 11, 12, 14, 15 were inserted by request. I do not consider that the information they embody is of any use. whatever. All that is needed is shown in Columns 16 and 17.

If Column 6 tends to show an increase, without apparent cause, then an investigation of the "Individual Vehicle Records" should disclose the reason and point the way to economies. If, without such an• increase in the total cost of the department, the item in Column 17 is entered in red ink (showing a loss), instead of black which betokens a profit, then one of two things is wrong. Either there is too much empty, running or the rate credited for traffic is tob low.

When an Adjustment of the Rates is Called For The former is something which can best be investigated „ from the " Individual Vehicle Records." The defect may, at the time and in the circumstances, be unavoidable. If that state of inevitability seems likely to be permanent, then some adjustment of the rates is necessary if the department is to show a profit.

Having obtained the approval of the transport manager I bethought me of the chief accountant, a real " died-in-thewool " expert in costs. He had declared time and time • again that it was folly to institute a complicated system of costing for transport and that he could within five minutes produce figures for that cost.

He grinned sardonically when I presented my scheme.

" And this," he said, "is what you. call simple." He then proceeded to pull it to pieces, item by item, directing his criticisms in the main towards demonstrating that, in reality, the scheme was frightfully, complicated and would involved considerable work in his department if the results were to be even approximately near to the truth. Ultimately, however,, he admitted that his' criticisms were purely academic, and that, so far as he was concerned, the scheme would have his blessing.

In general, therefore, there is no point In repeating the conversation. Two matters of practical. Interest did, however, emerge, and are worthy of record:

First, as to the item " Interest " in the "Individual . ALse Vehicle Records." He agreed that interest must be charged as an operating cost and that the figure of 4 per cent. was correct.

He pointed out emphatically, however, that it should be assessed on the current capital value of the vehicles so that, whilst one of them might have been bought 2+ years ago for £500, the interest chargeable would be £20; that same vehicle was probably worth £1,000 and the debit against operating costs for interest should, therefore, be £40 per annum.

The overheads chargeable against the service shop • (under " Maintenance ") should, strictly speaking, vary, as to the unit amount, from week to week, being high when the department is slack, and vice versa. In order to be able to answer them, it would be necessary, he said, to take the job cards of the men for each month and take out agure showing the time actually worked as compared with the total time, using the proportion as a measure for the assessment of the overheads.

For example, assume that the basic overhead charge is £125 per week, for a normal total of 1,000 man-hours. That is 2s. 6d. per hour. If, however, the time actually shown on the job cards—and that is the litrie charged out for maintenance work—is only 750 hours, then the overhead charge becomes 8s. 4d, per hour. In this, also, I was able to persuade him that it would be sufficiently accurate, for the end in view, to take an average figure, which might he 35. per hour, and apply that continuously until conditions changed.

I have instanced these two points fmm the many which arose during the discussion, because they relate to subjects which are continuously controversial. The principle of including interest as an item of operating cost has often been challenged. I am glad to have this emphatic and unsolicited support of an expert for my view that it should be so treated.

With regard to overheads, this is the point -particularly germane to haulage costs! If a haulier's overheads relatirg to a particular vehicle be £260 per annum, the charge per working week is not £5 (£260 divided by 52), but es Is. 4d. (£260 divided by 48), because a vehicle normally

works only 48 weeks per annum. S.T.R.