ighting the industry's wrongs

Page 12

Page 13

If you've noticed an error in this article please click here to report it so we can fix it.

If you were put in charge of the Treasury and the DfT, what changes to the industry would you make? Trucking Britain Out Of Recession reveals all.

IF YOU HAD absolute power for a day, what would you do? End all wars? End famine and poverty? Cease publication of The Daily Mail? Take all those pointless talent shows off TV? Or would you concentrate on the issues that bedevil the transport industry?

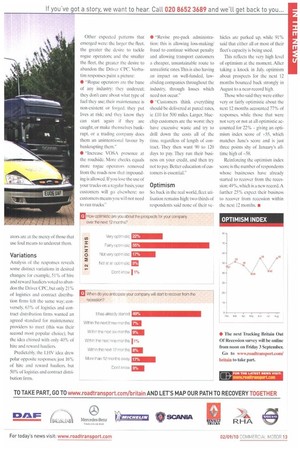

August's Trucking Britain Out Of Recession survey tackled the latter issue. We asked respondents: which of the following changes would you make to the industry if you had the power? We offered a dozen ideas, and respondents could pick up to six of those. The results may surprise you: • Impose harsher penalties on rogue operators: 79% • Abandon the fuel duty escalator: 61% • Educate customers as to why they should pay more for transport: 56% • Revise pre-pack administration rules to ensure no more legal phoenixes: 48% • Agree a standard of service for all maintenance providers to meet: 46% • Abandon Driver CPC: 39% • Abandon the introduction of Euro-6 engine emissions legislation:38% • Allow some form of longer and/ or heavier vehicles on UK roads: 28% • Introduce a road-user charge: 25% • Impose greater restrictions on entry to the industry: 24% • Make Driver CPC more robust and more flexible: 22% • Put more VOSA officers at the roadside: 21% So abandoning fuel duty wasn't the most popular! As evidenced by the launch of the Road Haulage Association's 'Rounding Up The Cowboys' initiative (CM 22 July), it is the enemy within — rogue operators — that matters most and needs addressing urgently That revision of the pre-pack administration rules comes in fourth, with 48% of the votes, reinforces the impression that professional oper ators are at the mercy of those that use foul means to undercut them.

Variations Analysis of the responses reveals some distinct variations in desired changes: for example, 51% of hire and reward hauliers voted to abandon the Driver CPC, but only 21% of logistics and contract distribution firms felt the same way; conversely, 63% of logistics and contract distribution firms wanted an agreed standard for maintenance providers to meet (this was their second most popular choice), but the idea chimed with only 40% of hire and reward hauliers..

Predictably, the LHV idea drew polar opposite responses: just 16% of hire and reward hauliers. but 50% of lo4stics and contract distribution firms. Other expected patterns that emerged were: the larger the fleet, the greater the desire to tackle rogue operators; and the smaller the fleet, the greater the desire to abandon the Driver CPC. Verbatim responses paint a picture: • "Rogue operators are the bane of any industry; they undercut; they don't care about what type of fuel they use; their maintenance is non-existent or forged: they put lives at risk; and they know they can start again if they are caught, or make themselves bankrupt, or a trading company does them an unintentional favour by bankrupting them."

• "Increase VOSA presence at the roadside. More checks equals more rogue operators removed from the roads now that impounding is allowed. If you lose the use of your trucks on a regular basis, your customers will go elsewhere; no customers means you will not need to run trucks." • "Revise pre-pack administration: this is allowing loss-making/ fraud to continue without penalty and allowing transport customers a cheaper, unsustainable route to unrealistic rates, This is also having an impact on well-funded, lawabiding companies throughout the industry through losses which need not occur."

• "Customers think everything should be delivered at parcel rates, ie £10 for 500 miles. Larger, bluechip customers are the worst: they have excessive waste and try to drill down the costs all of the time, regardless of length of contract. They then want 90 to 120 days to pay. They run their business on your credit, and then try not to pay. Better education of customers is essential."

Optimism

So. back in the real world, fleet utilisation remains high: two-thirds of respondents said none of their ye hides are parked up, while 91% said that either all or most of their fleet's capacity is being used.

This reflects the very high level of optimism at the moment. After taking a knock in July. optimism about prospects for the next 12 months bounced back strongly in August to a near-record high.

Those who said they were either very or fairly optimistic about the next 12 months accounted 77% of responses, while those that were not very or not at all optimistic accounted for 22% — giving an optimism index score of +55, which matches June's score and is just three points shy of January's alltime high of +58.

Reinforcing the optimism index score is the number of respondents whose businesses have already started to recover from the recession:49%, which is a new record. A further 25% expect their business to recover from recession within the next 12 months. •