Check Your Earnings Against Your Costs

Page 60

Page 63

If you've noticed an error in this article please click here to report it so we can fix it.

Many Hauliers do Not Know Whether the Rates They Charge are Remunerative or Not. "The Commercial Motor" Costs Expert Shows how Expenses Should be Computed to give Bases for Profitable Charges Applicable to Varied Types of Work

MANY inquiries I receive from hauliers are descriptions of work .done and payment received,

, together with requests for me to say whether money is being made or lost. The astonishing thing to me is that so many of the inquirers have, apparently, proceeded for so long before taking the trouble to find out whether the work they are doing is profitable or not. Curiously, in all the inquiries of this kind that I have been receiving, the majority of correspondents seem to be on the right side. One of the difficulties in dealing with inquiries of this kind is that the information given in the preliminary letter is rarely sufficient to enable a complete answer to be given. Moreover, a request for supplementary data is often ignored. Sometimes, however, the inquirer is sufficiently apprehensive about his position to take the trouble to write a second letter. Here is an example of that kind.

In the original letter I was informed that the haulier was running a 5-ton lorry, purchased used for £750. It was running 300-400 miles per week, sometimes hired by time • and sometimes by mileage. The time rate was 9s. 6d. per. hr. and the mileage charge 2s. per mile. Fuel consumption was stated to be 9 m.p.g. and oil 1 quart a week at 3s. per quart. The tyres were stated to be 35 by 71, with a life of 20,000 miles per set.

On the face,of it, this seemed to provide the information

I wanted, so that I should have no difficulty in giving a satisfactory reply. I first of all set out a statement of his operating costs, supplementing the information given by references to "The Commercial Motor" Tables of Operating Costs.

Running Expenses

So far as petrol was concerned, if he were getting 9 m.p.g. ind was paying 3s. 5d. per gallon, his petrol would cost him 3.56d. per mile. For lubricants he was spending 3s. per week and if I take the average weekly mileage to be 360. then I get exactly .0.1d. for that item.

A set of 35 by 71 tyres will cost £190, and at 20,000 miles to the set that is 2.28d. per mile. (This is a figure which should make the hardest rate-cutter think-his tyres are costing him more than 2id. per mile.) For maintenance (e) I refer to the Tables and get the figure of 1.34d.

Nslw comes depreciation. We must not forget that this is a used vehicle. Taking the original price at £750 and deducting 11190 on account of the tyres, 1 get a residue of £560. It is not likely that the operator will get more than 1150 for this vehicle when he sells it, and I feel sure that 1 need to give it a life, I should Say perhaps the remainder of a life, of three years or 50,000 miles. I am going to split the depreciation, taking half of it as a running cost and half as a standing charge. For the running costs I divide 50,000 miles into £255 (half of £510), which gives me approximately 1.25d. The total of my running costs is thus 8.48d„ which I am going to call 81d. .

Total of Fixed Charges Now for the fixed costs. I take them out per week and for the tax assume 14s. The letter comes from a Grade I area and the driver's wage will therefore be £5 13s, (1 am assuming that the vehicle is loaded up to 6 tons most of its life, as is usual with a 5-tonner); I add 10s. to that to cover insurances and provision for holidays with pay. For garage rent I take 10s.; insurance £1 1s.; interest at 3 per cent. per annum on £750 works out at 9s. per week; maintenance (d), 10s,; depreciation (half), £1 13s.; and overheads at a minimum £2 per week. The total is £13 per week, and on the basis of a 44-hr. week that is nearly 6s. per hr.

My net figures for costs are therefore 6s. per hr. and 81d. per mile, and if I add 20 per cent. for profit I get the corresponding charges to be 7s. 3d. per hr. and 101d. per mile.

This correspondent was being paid 9s. 6d. per hr. on a time basis. Whether that will be profitable or not would depend upon the mileage he covered in the hour. A sum of 75. 3d. of the 9s. 6d. is for time without mileage, and there is 2s. 3d. left which is about enough for 2 miles of running in the hour.

Satisfactory Rates It can be stated, therefore, that in any particular job where the mileage does not exceed 21 in the hour, the 9s, 6d. will be satisfactory and will show a fair profit. If the mileage is over 21., then 9s. 6d. per hr will be insufficient.

So far as the mileage charge is concerned, it is possible to discover whether 2s. per hr. is profitable or not, only if we know the weekly mileage. In the letter, he stated he did 300400 miles per week. One way to check it would be to take those twolimiting figures and see how the rate runs out for each.

If he does 300 miles per week, then the running cost per week is £10 12s. 6d.: add the fixed expenses. £13. and I get 123 12s 6d. That is the total expenditure per week: divide that by 300 and I get I8.9d. per mile or Is. 7d.: add 20 per cent to that for profit, another 4d., and I get is. 1 Id On the basis, therefore, of only 300 miles per week, 2s. per mile is sufficient. It may be of interest to inquire into the appropriate figure for a 400-mile week. The running cost for 400 miles at 81d. per mile is £14 ls. 4d. Add the 113 for fixed expenses and we get £27 3s. 4d., which is equivalent to is. 4=Id. per mile, Add 3.1d. for 20-per-cent, profit, and it is seen that Is. 8d. per mile would be enough.

Clearly, therefore, this operator is winning on all those jobs for which he charges on a mileage basis, but may. be losing on the jobs which are charged on a time basis, according to whether the mileage per hour is more or less than n. Having got so far. I became curious to know what the final result would be, and to get that information I had to find. out what sort of week's work he was doing with the vehicle, I wrote. to him, giving the findings as above and asked what was a typical week's work and pay.

Weekly Routine

He described his working week. It started on the Monday morning with' a load of bricks delivered 30 miles away. For some reason, the job took 9 his. and was charged on a mileage basis, 60 miles at 2s. per mile, £6. On the Tuesday morning, the first job was the delivery of a load of lime to be dumped in a farmer's field 10 miles away. That took 4 hrs. end was charged on a time basis; 4 hrs. at 9s. 6d. £1 18s. In the afternoon be picked Up a load of coal at ;he pits and delivered it to a factory 15 miles away. That was bharged on a mileage basis and brought in £3. •

. On Wednesday, 4 iuss. in the morning were occupied in delivering a load of corn over.a 10-mile lead. It was charged on an hourly basis and brought in £1 18s. In the .afternoon of the same day a load of tiles was taken 20 miles away and charged at 2s. per mile, bringing in £4.

Thursday morning was similar to Wednesday. He took a load of corn to the same place nnd earned :El 18s. In the afternoon, he took a full load of brickbats to a farm where they were being used for remaking a road, and as the distance was 20 miles he charged on amileage basis and earned £4.

Friday brought as its first job a load of potatoes • to be taken over a 20-mile lead and was charged at 2s. per mite. bringing in £4 for the 40-mile run. In the afternoon, he took another load of lime to a different spot, 121 miles lead, taking 5 -hrs-. over the job, and charging for time so that the revenue was £2 7s. 6d.

On the Saturday morning he picked up another load of lime over a short lead of 71 miles; this job took 3 hrs. and brought in £1 8s. -6d.

He added: "You will note that, there is 4 hrs, overtime to be debited and that the mileage run was 310; the revenue was £30 10s. I should be glad if you would apply your l7s. 3d. per hr. and 101d. per mile to that week's work to see how I should, have come pet ageording to your method of charging."

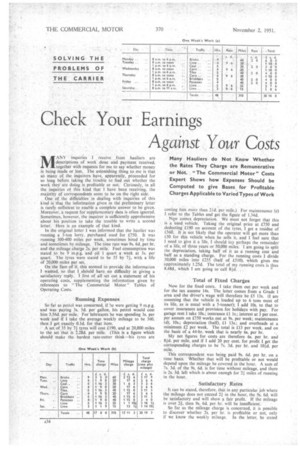

For the sake of clarity I hate set out on one of the two accompanying schedules the details of this week's work, the hours, the mileages and the charges. I have headed that schedule. "One Week's Work (al." In the second schedule., described as "(b)," I give the figures according to my time-and-mileage method of assessing the rates. It will be noted that the result differs so little from the original that there seems no point in recommending the operator to change his method of charging.

It is advisable, however, fur me to point out that his method of charging is profitable only if the work done he usually the same or similar to that described in these two schedules. It is profitable because there is a sufficient proportion of work at 2s. per mile, which I have shown to be a good rate, to offset the meagre-returns which come on those jobs which are done at a rate of gs. 6d., which is not a good rate.

in order to emphasize this. I have -in the third schedule under the heading of "(c)" shown how the revenue would differ if, on the one hand, all the jobs were charged at the time rate, and on the other if all the jobs were charged at a mileage rate.

On the time rate the revenue is only 122 16s., but if all .jobs be on the mileage rate the revenue is £31. The mileage method is, of course, profitable, being more so than that shown by either Of the two methods exemplified in the first and second schedules. The revenue of £22 16s. would not cover the costs, as can easily be shown:

The cost, es was demonstrated earlier in the article, is at the rate of 6s. per hr. plus 81d. per mile, and this week's work has *involved 48 hrs. and 310 miles. Now 48 hrs. at 6s. per hr. is £14 8s., and 310 miles at 8id. is £10 19s. 7d. The net cost, therefore, is £25 7s, 7d., which is more than the revenue accruing if the work Were all done on ea hourly rate.

Actually, this operator in earning £30 10s. per week. according to his own schedule of work done and rates paid, has earned a profit Of £5 2s. gd. in the week. If he had charged according to my methods, that is to say at the rate of 7s, 3d. per hr..plus 101d. per Mile, the profii would be £5 11s. 6d. Either of those two amounts can reasonably be regarded as satisfactory.

False Assumption

Two minor points may be. raised by way of concluding this article. The first I bring forwara to show how easily the operator might come to the conclusion that he is making much more profit than is actually the case. The disbursements during that week will comprise the following items: wages, £5 13s., insurance stamp, 4s. 2d. He may have paid his garage rent, 10s., also some expenditure under the heading of establishment costs, we will say £1. He spends 14 12s. oa petrol, 3s. on oil, and may have to spend, say, 10s. on some minor maintenance operation. The total is £12 2s. 2d, and if he substracts that from his revenue of £30 10s., he has apparently made a profit of 117 17s. 10(1. in that week.

If he be under that impression, then the best thing that can happen to him would be that in the next week he has to buy a new tyre cover, which will cost £28. If I add £28 to 112 12s. 2d., which I have shown to be his normal weekly disbursement, then, lais, total for that particular. week would be I:40 I2s.'2d., and his kiss £10 2s, 2d. S.T.R.