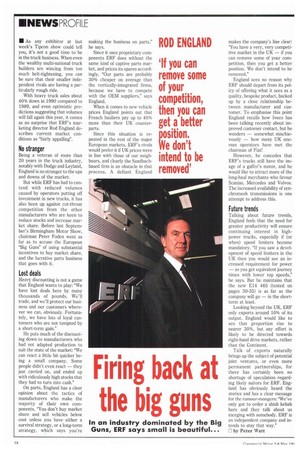

Firing back at the big guns

Page 20

If you've noticed an error in this article please click here to report it so we can fix it.

In an industry dominated by the Big Guns, ERF says small is beautiful...

• As any exhibitor at last week's Tipcon show could tell you, it's not a good time to be in the truck business. When even the wealthy multi-national truck builders are wincing from too much belt-tightening, you can be sure that their smaller independent rivals are having a particularly rough ride.

With heavy truck sales about 40% down in 1990 compared to 1989, and even optimistic predictions suggesting that volumes will fall again this year, it comes as no surprise that ERF's marketing director Rod England describes current market conditions as "fairly appalling".

No stranger

Being a veteran of more than 20 years in the truck industry, notably with Dodge and Leyland, England is no stranger to the ups and downs of the market.

But while ERF has had to contend with reduced volumes caused by operators putting off investment in new trucks, it has also been up against cut-throat competition from the other manufacturers who are keen to reduce stocks and increase market share. Before last September's Birmingham Motor Show, chairman Peter Foden went as far as to accuse the European "Big Guns" of using substantial incentives to buy market share, and the lucrative parts business that goes with it.

Lost deals Heavy discounting is not a game that England wants to play: "We have lost deals here by many thousands of pounds. We'll trade, and we'll protect our business and our customers wherever we can, obviously. Fortunately, we have lots of loyal customers who are not tempted by a short-term gain."

He puts much of the discounting down to manufacturers who had not adapted production to suit the state of the market: "We can react a little bit quicker being a small company. Some people didn't even react — they just carried on, and ended up with ridiculously high stocks that they had to turn into cash."

On parts, England has a clear opinion about the tactics of manufacturers who make the majority of their own components, "You don't buy market share and sell vehicles below cost unless you have either a survival strategy, or a long-term strategy, which says you're making the business on parts," he says.

Since it uses proprietary components ERF does without the same kind of captive parts market, and prices its spares accordingly. "Our parts are probably 30% cheaper on average than the vertically-integrated firms, because we have to compete with the OEM suppliers," says England.

When it comes to new vehicle prices England points out that French hauliers pay up to 40% more than their UK counterparts.

Since this situation is repeated in the rest of the major European markets, ERF's rivals would prefer it if UK prices were in line with those of our neighbours, and clearly the Sandbachbased firm is an obstacle in that process. A defiant England makes the company's line clear: "You have a very, very competitive market in the UK — if you can remove some of your competition, then you get a better position. We don't intend to be removed."

England sees no reason why ERF should depart from its policy of offering what it sees as a quality, bespoke product, backed up by a close relationship between manufacturer and customer. To emphasise this point England recalls how Iveco has been talking recently about improved customer contact, but he wonders — somewhat mischievously — how many UK oneman operators have met the chairman of Fiat!

However, he concedes that ERF's trucks still have the image of a gaffer's motor, and he would like to attract more of the long-haul merchants who favour Scanias, Mercedes and Volvos. The increased availability of synchromesh transmissions is one attempt to address this.

Future trends

Talking about future trends, England feels that the need for greater productivity will ensure continuing interest in highpower trucks, especially if (or when) speed limiters become mandatory. "If you saw a development of speed limiters in the UK then you would see an increased requirement for power — so you get equivalent journey times with lower top speeds," he says. But he maintains that the new E14 465 (tested on pages 30-35) is as far as the company will go — in the shortterm at least.

Looking beyond the UK, ERF only exports around 10% of its output. England would like to see that proportion rise to nearer 30%, but any effort is likely to be directed towards right-hand drive markets, rather than the Continent.

Talk of exports naturally brings up the subject of potential joint ventures, or even more permanent partnerships, for there has certainly been no shortage of speculation regarding likely suitors for ERF. England has obviously heard the stories and has a clear message for the rumour-mongers: "We've only got to order a shish kebab here and they talk about us merging with somebody. ERF is an independent company and intends to stay that way."

E by Peter Watt