TDG boosts its corporate identity

Page 54

Page 55

Page 56

If you've noticed an error in this article please click here to report it so we can fix it.

The Transport Development Group is something of an 'eminence grise` in the transport business. The 130 subsidiary companies in the group enjoy a good deal of independence and few people are aware of the TDG involvement. David Wilcox gives you a guided tour

THREE WEEKS AGO we reported that the Transport Development Group had bought a controlling share of an American company with haulage interests.

It was not a startling piece of news, partly because the TDG is not a headline-grabbing company and partly because it has been buying companies in Britain and abroad for the past 60 years. The TDG has chosen to keep a low profile and let the companies it has bought retain their own identities.

For this reason, few people are aware of the true extent of the voup and its presence in the road transport industry. At the time of the latest USA acquisition TDG chairman and chief executive Sir James Duncan and company secretary Ray Garwood spoke to CM and gave a clearer insight into this widespread and diverse group.

Sir James Duncan is probably better known than his multi-million pound turnover group and is an influential and respected figure in the industry. He is a past president of the Chartered Institute of Transport and in October will became president of the Institute of Road Transport Engineers.

In the current TDG annual report Sir James comments that

1983 has been a year of change for the TDG. During the year it sold its last barge on the Thames. The group had started as a barge/lighterage business on the Thames in 1922 and the first chairman swiftly established a pattern of acquisition and related diversification by buying wharfage and haulage businesses to complement the river traffic. And he also decided to keep the various businesses separate.

Barges continued to predominate until the late Fifties when the group started to buy an increasing number of haulage businesses. These had just been denationalised and were looking for capital for expansion. The TDG stepped in, but it was no asset-stripping tactic — the corn panies were bought on the grounds that they were sound, viable businesses and could justify the injection of capital.

After a very rapid period of growth of acquisition in the late Fifties and Sixties TDG has continued to add companies and foster their growth. Today it has 130 subsidiaries, 4,500 vehicles and 11,700 employees.

In comparison, the National Freight Consortium has around 50 subsidiary companies, 12,000 vehicles and 23,000 employees.

In 1983 the TDG had a turnover of almost £368m and pre-tax profits of E21m. About 40 per cent of the turnover comes from the group's activities overseas.

Among the 130 TDG subsidiaries are some surprising names that few would connect with the group. Sir James Duncan conceded that many of the companies' customers do not even know with whom they are dealing ultimately.

In Britain the group's activities can be split into four sections. First, there is road haulage which accounts for just over half of the UK turnover, but sadly contributes a lower proportion of the operating profit.

The TOG has a fairly good spread of companies across the haulage industry. At the heaviest end there are companies such as Econofreight in the North-East and Beck & Pollitzer and Dallas (Kingston) in the South-East.

Then there is a plethora of companies in general haulage. J. Spurling in East London, Runcorn Transport Services, Charles Alexander of Aberdeen, Western Transport in Avonmouth and Flowers Transport in York are just a selection.

Looking at some of the more specialised companies there is a proliferation in the tanker world cuch as Cleveland Tankers, Reliance Tankers of Altrincham, W. and J. Riding of Preston and Buckley Tankers of Warrington.

Having seen the trend in the USA towards next-day delivery of freight without parcels-style size restrictions, Sir James Duncan felt that this was a business that could be explored in this country. It was this belief that lead the group last October to back the fledgling express freight carrier Independent Express by taking a 50 per cent share for £500,000.

The group already owns the Sheffield-based parcels carrier Tuffnells, but Sir James said that there is a "gulf of difference" between traditional carriers like Tuffnells and the new breed of express freight carriers which offer next-day delivery without restriction.

Many TDG subsidiaries are in distribution and warehousing, so their revenue is partly under the haulage heading and partly under the storage classification which is the group's second largest activity. Examples are Harris Warehousing and Distribution in the North-West, Storage and Haulage in the Midlands, C. Albany in Hertfordshire, and Gilyott and Scott in Hull. In total TDG has 1.1m cu m of cold storage and 0.8m sqm of warehousing. Although storage is smaller than haulage in turnover terms it has been contributing very much more operating profit since 1981. In view of this superior margin, is the TDG increasing its storage business and gradually coming out of the less-rewarding haulage sector? Sir James: "Yes, storage is making a good return on investment. And we are not wedded to road haulage anymore than we were to tugs and barges. But these things are cyclical to a certain extent and I can see a long-term future for road haulage."

A third and smaller area of business is plant hire and industrial installation work; Cox Plant Hire is the major contributor here.

Finally, the group has a number of reinforcement and exhibition companies. Reinforcement refers to the manufacture of Square Grip reinforcing steel for construction , while the exhibition business came as part of the package when Beck and Pollitzer was bought.

Overseas. TDG is represented in Europe, North America and Australia. The European in terests are mainly Dutch, French and Belgian haulage companies which have shown a rather better profit margin on turnover than their UK counterparts.

In North America the dominant company is the West Coast carrier Willig Freight Lines the largest of all the 130 TDG subsidiaries. Lastly, the group has a 70 per cent stake in eight Australian haulage and cold storage companies.

Is the TOG planning to buy any more companies in the near future? Answered Sir James: "I'm not ruling out the possibility. Our rate of acquisition in the UK hasn't been as fast recently because the circumstances have not been right. We are intent on buying the right sort of company."

When assessing a potential purchase the TDG looks at three major factors in a company; its management, its profit record and its assets. Some of the companies in the group are in competition with each other. "We don't mind sensible competition providing that both companies are making a reasonable return on capital. But we do not want rate-cutting between them," explained Sir James.

Subsidiaries really do have a great deal of autonomy. The top level of management at the group headquarters in London is slim — there are just 35 staff there. Said company secretary Ray Garwood: "For our managers in the various companies it is like running their own businesses with someone else's money. But they have a regular day of reckoning."

The local managers have responsibility for pricing, wage negotiations and all other decisions that affect day-to-day operations. But they have to have head office approval for capital expenditure. They can choose what type of vehicles to operate because there is no central purchasing policy. "They have a lot of freedom, but that also means a lot of responsibility. If they specify their own vehicles there is no room for them complaining to us if they are not right," said Ray Garwood.

Head office is constantly comparing performances of the subsidiaries, but does not reveal the results to the companies. Nor is there any structured or formal system for exchanging ideas or moving personnel between companies. Group conferences were tried many years ago but the idea has been dropped.

There are just a few central services that subsidiaries are free to use if they wish. These include insurance, legal advice and surveyors.

This firm belief in such a high level of devolution rests on the principle that if you can keep things separate you can identify what your assets are earning. "It's also a very flexible structure. Our people are not swamped in a jumbo organisation. We feel it is best for customers, best for our staff and best for the shareholders. We're all in this together," said Mr Garwood.

The ability to identify assets' earning potential is not all sweetness and light. Emphasised Sir James: "There is a cold wind blowing. If a subsidiary fails to make a good return it will be sold. In this country recently that has meant killing it rather then selling it. We are not afraid to do it; look at our record with barges."

There are some subtle changes occuring within the TDG. In the past year some of the subsidiaries have merged and this seems to be settinrg a pattern for the future. Last September Inter City Transport and Trading of Cumbernauld merged with Glasgow Hiring Company. Other names like Smiths of Eccles and Paterson Transport also disappeared as they too merged with other subsidiaries. Westinghouse Cool Storage merged with Harris Warehousing during the year.

"The trend is towards slightly larger units," admitted Ray Garwood. "Our customers are doing it and we have to reflect their

needs."

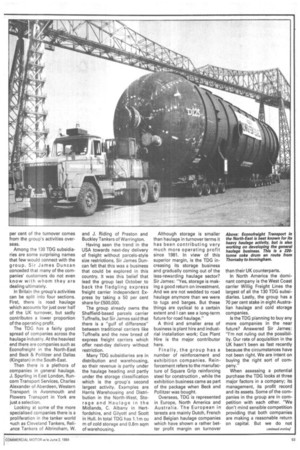

Consideration of the customers is also bringing about the second change in the group. The TDG name has always been kept well in the background, but is now beginning to emerge from the shadows. A new TDG logo has been introduced and any week now the group will publish a brochure that introduces the TDG to customers.

"It's not that we are cutting the ground from beneath our subsidiaries' feet. But in some circumstances we now need to show a larger identity to gain creditability for national contracts and the largest customers," Mr Garwood explained.

He hastened to add that this new TDG presence is not to be forced on the subsidiaries: "They won't even have to use the logo on their notepaper if they don't want to. It will be there for those who feel they want it."

This new higher-profile will also help in the City according to Ray Garwood. "We need strong links with the City to raise capital. The brochure will help explain who we are." Sir James Duncan agreed: "When we say TDG to some people, they ask TDG who?"

Financial results for the group in 1983 show pre-tax profits to be just 5.7 per cent of turnover. That was up on 1982 (5.3 per cent) but nowhere near good enough for Sir James. "We must be looking for margins of at least 10 per cent. In other words we have got to at least double the profits to justify the capital."

And how is 1984 shaping up, now that we are almost halfway through it? "It's steady," commented Sir James, "But we've a long, long way to go. And that goes for the whole industry."