-.a1M13ING CO:51$

Page 48

Page 51

Page 52

If you've noticed an error in this article please click here to report it so we can fix it.

0 PERATORS appear to have become cost-conscious to a degree hitherto unknown as a result of the increased cost of.fuel and the imposition of purchase tax on goods vehicles. The fact that they are inquiring into the effect these increases will have is a good thing, and"! have selected three particular inquiries for discussion in thit article.

The first relates to the cost of operation of representatives' cars used by a big operator. This company makes an allowance to its travellers for the mileage they run in their own. cars. About 18 months ago, the : concern asked me to draw up a schedule of costs for 10 h.p. and 12 h.p. cars so that they could arrive at appropriate allowances. A week or so ago I had a request from the same quarter to indicate the extent to which these figures were affected by the new tax, also by any increase in car operating costs arising during th3 intervening period.

'The Cost of a Car

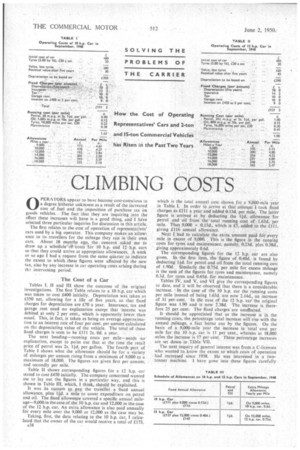

Tables I, II and III show the outcome of the original investigations. The first Table relates to a 10 h.p. car which was taken to cost £400 initially. Depreciation was taken as £350 net, allowing for a life of five years, so that fixed charges for depreciation are £70 a year. Insurance, tax and garage rent need no explanation except that -interest was debited at only 2 per cent., which is apparently lower than usual. This, in fact, is taken as being an average approximation to an interest rate of four per cent. per annum calculated on thz depreciating value of the vehicle. The total of these fixed charges is seen to be £111 2s. Od. a year.

The next heading-running costs per mile-needs no explanation, except to point out that at the time the retail price of petrol was 2s. lid. per gallon. The fourth part of Table I shows what the allowance should be for a variety of mileages per annum rising from a minimum of 9,000 to a maximum of 18,000. The figures are given first per annum, and secondly per mile.

Table 11 shows corresponding figures for a 12 h.p. car stated to cost £450 initially. The company concerned wanted me to lay out the figures in a particular way, and this is shown in Table III, which, I think, should be explained.

It was its custom to pay, the traveller a fixed annual allowance, plus lid, a" mita to cover expenditure on petrol and oil. The fixed allowance covered a specific annual mileage-9,000in the case of the 10 h.p. Car and 12,000 in the case of the 12 h.p. car. An extra allowance is also paid annually for every mile over the 9,000 or 12,000 as the case may be.

Taking, first, the data relating to the 10 h.p. car, I calculated that the owner of the car would receive a total of £173, A38

which is the total annual cost, shown for a 9,000-mile year in Table I. In order to arrive at that amount I took fixed charges as £111 a year and added 0.13d. per mile. The latter figure is arrived at by deducting the lid.. allowance for petrol and oil from the total running cost of 1.63d. per mile. Thus 9,000 a 0.13d., which is £5, added to the ill!, giving L116 annual allowance.

Next I had to calculate the extra amount paidfor every mile in excess of 9,000. _ This is the figure in the running costs for tyres and maintenance, namely, 0.23d. phis 0.38d., giving approximately 0.6d. .

The corresponding figures for the 12 h.p. car are also given. In the first item, the figure of .0.40d. is found by deducting ltd. for petrol and oil from the total running cost of 1.90d.Similarly the 0.75d, per mile for excess mileage is the stun Jaf the figures for tyres and maintenance, namely 0.3d. for tyres and 0.45d. for maintenance.

Tables IV, and V, and VI give the corresponding figures to date, and it will be observed that there is a considerable increase. In the case of the 10 h.p. car the running costs per mile instead of being 1.63d. are now 2.I4d., an increase of 31 per-cent. In the ease of the 12 h.p. car the original figure was 1.90 and is now 2.38d. The increase is therefore 25 per cent, The fixed charges are unaffected.

• It should be appreciated that as the increase is in the running costs, the percentage total increase will rise with the annual mileage, a fact borne out by the figures. On the basis of a 9 000-mile year the increase in "total cost per mile for the 10 h.p. car is 11 per cent., whereas at 18,000 miles the increase is 17 per cent. These percentage increases are set down inTable VII. "

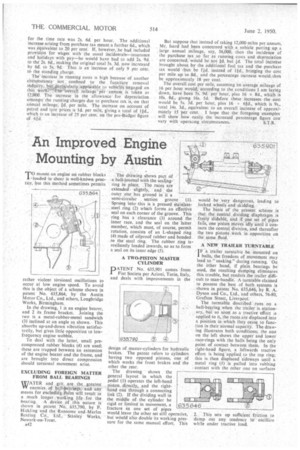

The next inquiry of general interest was from a C-licensee who wanted to, know the extent to which costs of operation had increased since 1938. He was interested in a twotonner machine, I have gone into these figures Carefully

cent. There is a vast difference between these figures and the generally agreed increase of 10 per cent. recommended by the Road Haulage Association, also by myself; in consequence, many operators are puzzled to know how this apparent discrepancy arose.

The explanation is simple and arises from the peculiar yet perfectly proper method of costing recommended bylt.hc N.A.F.W.R. tO its members. Furniture removers have la asiii their costsn the basis of cost of vehicle to which is added cost of labour. The labour: involved may differ from one job to the next. Sometimes only driver-and mate accompany the lorry, sometimes there may be three or four mates, and from this has grown the custom of assessing the cost of operation of the vehicle without the driver. The figures given by Mr. Isard differ from those normally presented, therefore, in that there is no

provision for the driver's wages. .

Let us see what effect the addition of • the driver's wages has on the figure. Mr. Isard stated that the present figure

and they are set out in Table VIII. Those for 1938 are taken from "The Commercial Motor" Tables of Operating Costs for that year. Those for1950 are in accordance with the latest information Ilhave. It is., of interest, to note that the percentage increase in totalcost is 68, the actual difference being £7 3s. 5d. per week, nearly £400 per annum. Percentage increases in individual items which are outstanding are, wages 95 per cent., interest on capital outlay 115 per cent., and fuel costs 111 per cent.

Following this up myself, I thought it might be of interest to go to the other extreme in load capacity and check the figures for a maximum load eight-wheeler which I have described in Table IX as a I5-ton lorry. The percentage increase is nothing like so great, 47 as against 68, nor is the percentage increase in individual items so great as in the ease of the two-tormer. The actual increase per week in total operating costs for 800 miles per week is, however, £15 10s., more than £750 per annum.

One factor, however, Is not evident in Tables VIII and IX, namely that the data in 1938 related to a 48-hour week, whereas to-day's figures relate to a 44-hour week, and naturally that makes a difference to the real percentage increase. So far as the two-tonner is concerned, the wages item in 1938 was is. 30. per hour. It is now 2s. 60., so that the increase is practically 100 per cent. The standing charges in 1938 were Is. 100. per hour as against 3s. 4d. per hour to-day, so that the annual percentage increase assessed on an hourly basis is 76 per cent., and not

61 per cent. as shown in Table VIII. Comparative 0 Similarly, as regards the total cost per lour, in 1938 it was 4s. 44d. and is now 8s. Old., an increase of 84 per cent., instead of 68 per cent, as shown. in Table VIII.

Corresponding figures for the 15ionner are wages Is. 60. in 1938, 2s. 91d. to-day, an increase of 82 'per cent.' Standing charges 3s. 60., as against 5s. 71d., an increase of 60 per cent. Total increase is also 60 per cent, or 21s. 110. instead of 13s. 8d. per hour.

I have had one or two inquiries about figures published in "The Commercial Motor" ot May 12 in a report on the Jubilee Conference of the National Association of Furniture Warehousemen and Removers. Figures were given for the increase in cost of operating a furniture van before the Budget and after. According to the cost expert of the Association, Mr. W. Isard, the standing charges had increased by 20 per cent and the running costs 28 per

Licences .. ..

Wages .

Rent and rates ..

Insurance ..

Interest ..

Totals ..

Fuel .. ..

Lubricants ..

Tyres .. ..

Maintenance ..

Depreciation ..

Totals .. ..

Running costs per 400 miles ..

Total cost per 400-mile week

for the time rate was 2s. 6d. per hour. The additional increase arisingfrom purchase tax meant a further 6d., which was equivalent to 20 per cent. If, however, he had included ProvislOn for wages with the usual incidentals—insurance and holidays with pay—he would have had to add 2s. 9d. to the.2s. 64., making the original total 5s. 3d. now increased by 6d. to 55. 9d. That is an increase of only 9 per cent. tri the standing charge.

The increase in running costs is high because of another circumstantenot confined to the furniture removal industry : 'bet itliartieularly applicable to vehicles engaged on that -WOrlei7.71-he-''Irover'all mileage per -annum is taken as 12,000. The increase, in the allowance' for• depreciation a'rtiongst the running charges due to purchase tax is, on that annual mileage, id. per mile. The increase on account of petrol and tyre prices is Id. per mile, giving a total of lid, which is' anincrease of 25 per cent. on 'the pre-Widget figure of 6d. But suppose that instead of taking 12,000 miles per annum, Mr. hard had been concerned with a vehicle putting up. a large annual mileage, say, 36,000, then the incidence of the purchase tax so far as running costs and depreciation are concerned, would be not id. but id. The total increase brought about by the additional fuel tax and the purchase tax would thus be lid. instead of lid., bringing the cot per mile up to 8d., and the percentage increase would then be approximately I8-per cent.

The overall cost per mile, assuming an average mileage of 16 per hour would; according to the conditions I am laying down, have been 5s. 9d. per hour, plus 16 x 8d., which is 10s. 8d., giving 16s. 5d. Before these increases the cost would be 5s. 3d. per hour, plus 16 x 64(1., which is 9s., total 14s. 3d., equivalent to an overall increase of approximately 15 per cent. I hope that the foregoing examples will show how easily the increased percentage figure can' vary with operating circumstances, S.T.R.