1 N IT FOR THE

Page 48

Page 49

Page 50

Page 51

If you've noticed an error in this article please click here to report it so we can fix it.

LONG HAUL

CFI is one of America's most respected transport companies — but how

is it coping with the stagnant US economy? Tom Cunningham reports.

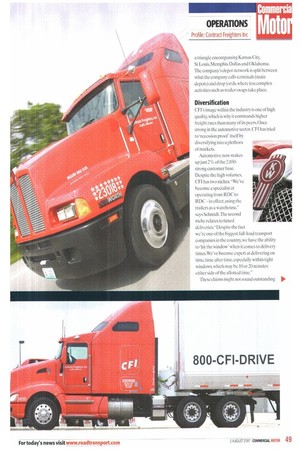

From his first-floor office on Joplin 's East 32nd Street, ever-resourceful chief executive Herb Schmidt delivers an upbeat report on life as head of a US transport company. Schmidt presides over Missouribased Con tract Freighters Inc (CFI), a fullload transport company that operates a fleet of 2,400 tractors and 7250 trailers.

"We currently operate Kenworth/Wabash as our tractor/trailer, with a standard front end 'CFI spec' of Cat or Cummins at 435-450hp, 13-speed Eaton/Fuller, driven through an Eaton 325 double-drive back end. Sat on top is a standard 72-inch sleeper cab," says Schmidt. The company still runs 100 trucks with auto gearboxes. although operator and driver preference is turning the clock back to manual.

Schmidt undoubtedly controls one of the industry's innovators.The firm was one of the first to adopt 53ft dry freight trailers, when everyone else seemed to be sticking with 48ft. Our hour-long interview (held before he headed off for his daily workout) was a fascinating insight into the trials and tribulations of US transport.

One of the many interesting facts about CFI is its command on profitability, or more precisely its ability to charge what are considered to be above-average freight rates. "We don't operate trucks for the sake of it, and we don't deploy new technologies for the sake of it either.says Schmidt. "We realise the current climate is toughbut as far as this sector's concerned, it's all about reciprocity. The US economy may be dipping, but the rate of decline is slowing to a manageable rate."

Schmidt took over as chief executive from the well respected Glen Brown, widely acknowledged within the company as the man who moulded CFI into one of the country's most successful operators. One of CFI's strong points is its key people, most of whom have a great deal of industry experience. Another strong point is its location; CFI's HO sits on the edge of the historic Route 66, roughly inside a triangle encompassing Kansas City, St Louis,Memphis, Dallas and Oklahoma. The company's depot network is split between what the company calls terminals (main depots) and drop yards, where less complex activities such as trailer swaps take place.

Diversification CFI's image within the industry is one of high quality, which is why it commands higher freight rates than many of its peers. Once strong in the automotive sector. CFI has tried to 'recession proof itself by diversifying into a plethora of markets.

Automotive now makes up just 2% of the 2,850strong customer base. Despite the high volumes. CFI has two niches, "We've become a specialist at operating from RDC to RDC — in effect, using the trailers as a warehouse," says Schmidt.The second niche relates to timed deliveries. "Despite the fact we're one of the biggest full-load transport companies in the country, we have the ability to 'hit the window' when it comes to delivery times.Vv'e've become expert at delivering on time, time after time, especially within tight windows, which may he 10 or 20 minutes either side of the allotted time."

These claims might not sound outstanding to British companies delivering daily to supermarket RDCs, but the average length of haul for CFI is far greater than anything experienced in the UK. For example, it hauls for the retail giant Wal-Mart and its wholesale sister company Sam's Club, where it undertakes vendor to RDC and RDC to store deliveries. Schmidt says:"'The average haul length for Wal-Mart is 725 miles,

Speeding ahead

The average length-of-haul figure for the whole company is 950 miles.The rate at which CFI's trucks cover the ground has undoubtedly been helped by former President Bill Clinton. who raised the national speed limit for everyone to 70mph."A team (typically a husband and wife) would cover 950 miles in 26 hours, whereas a solo driver would do it in roughly 33 hours," says Schmidt. Looking at the situation cynically, he wonders whether the speed increase was, in effect, a back-door taxation ploy.

Weight distribution is an easily workable 16% on the front tractor unit axle.42°/0 on the rear and 42% on the trailer. But weights across the US are now set atjust 80.000lbs (36 tonnes), which yields a payload of roughly 20 tonnes.

Some of the other figures are more impressive: average miles per truck per month for 2006 were 10,781.The company's balance sheet for the same year reveals a gross income of $416.9m, and Schmidt says that in its 56year history the company has never posted a quarterly loss.Another interesting fact is that roughly 40% of the firm's traffic goes south to Mexico. "But US trucks don't cross the border,so we've got a trailer-swap system with Mexican transport companies." The company's annual fuel bill is enormous and as a gallon of gasoline or diesel tips the $3 mark, operators are casting a more critical eye on operating costs,especi ally at the pumps. The majority of new tractor units are now far more aerodynamic, and the introduction of items such as stand-alone air conditioning and heating units has cut down on less attractive practices such as parked idling.

One surprising area of cost saving has been tyres. When CFI switched its drive-axle tyres from twins to the wide base Michelin X One (see panel), it wiped a staggering $4.25m off the annual fuel bill, "It equates to 4.4%, or $1,850 per truck per year," Schmidt enthuses. The picture is the same when it comes to overall tyre wear. When matched against dual rubber, a tractor unit fitted with X Ones has an average of 263,000 miles—the equivalent of an extended tyre life of 17,000 miles.

Continental catch-up

But although companies such as CH have made mammoth leaps in terms of tractor unit tyres, they lag behind their European cousins when it comes to trailer rubber. Almost all North American trailers operate with twins, although CFI is in the process of changing its fleet to the US equivalent of wide singles.

Driver shortages have been muchpublicised in the US. but Schmidt thinks the picture at CFI is less dramatic. "You might take the opinion that some carriers have created a driver shortage by simply adding trucks to the market," he comments dryly. "When we do expand it will he as a result of demand." He also discounts warehousing as a possible expansion path."1 wouldn't like to see CFI grow into another DHL, or at least as long as there's a demand for our kind of service.

"The future for us looks like following the same trends. using a conservative, methodical approach." is