The latest fads on track costs

Page 6

If you've noticed an error in this article please click here to report it so we can fix it.

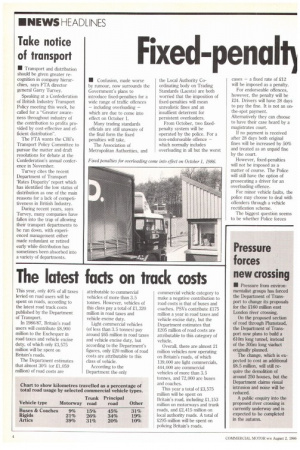

This year, only 40% of all taxes levied on road users will be spent on roads, according to the latest road track costs published by the Department of Transport.

In 1986/87, Britain's road users will contribute £8,900 million to the Exchequer in road taxes and vehicle excise duty, of which only £3,575 million will be spent on Britain's roads.

The Department estimates that almost 30% (or 21,059 million) of road costs are attributable to commercial vehicles of more than 3.5 tonnes. However, vehicles of this class pay a total of £1,320 million in road taxes and vehicle excise duty.

Light commercial vehicles (of less than 3.5 tonnes) pay around 265 million in road taxes and vehicle excise duty, but according to the Department's figures, only £20 million of road costs are attributable to this class of vehicle.

According to the Department the only commercial vehicle category to make a negative contribution to road costs is that of buses and coaches. PSVs contribute £175 million a year in road taxes and vehicle excise duty, but the Department estimates that £205 million of road costs are attributable to this category of vehicle.

Overall, there are almost 21 million vehicles now operating on Britain's roads, of which 139,000 are light commercials, 444,000 are commercial vehicles of more than 3.5 tonnes, and 72,000 are buses and coaches.

This year a total of 23,575 million will be spent on Britain's road, including £1,153 million on motorways and trunk roads, and £2,415 million on local authority roads. A total of £295 million will be spent on policing Britain's roads.