GOING PLACES

Page 37

Page 38

If you've noticed an error in this article please click here to report it so we can fix it.

Earlier this year one of the biggest surveys into contract distribution ever undertaken in this country was made by Corporate Development Consultants. Here, CDC director John Lawrence presents some of the major findings.

• Contract distribution has changed completely from being a part of the ill-defined world of haulage into an activity that is now of board-level concern in large companies. Getting the right goods to the right place at the right time is a key element of effective marketing in today's competitive environment.

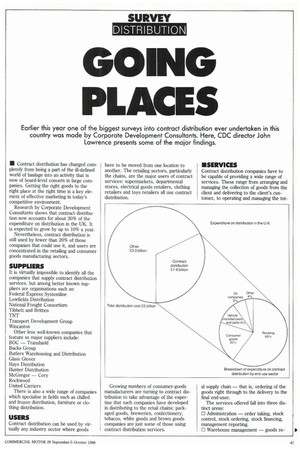

Research by Corporate Development Consultants shows that contract distribution now accounts for about 30% of the expenditure on distribution in the UK. It is expected to grow by up to 10% a year.

Nevertheless, contract distribution is still used by fewer than 20% of those companies that could use it, and users are concentrated in the retailing and consumer goods manufacturing sectors.

SUPPLIERS

It is virtually impossible to identify all the companies that supply contract distribution services, but among better known sup pliers are organisations such as: Federal Express Systemline Lowftelds Distribution National Freight Consortium Tibbett and Britten TNT Transport Development Group Wincanton Other less well-known companies that feature as major suppliers include: BOC Transhield Bucks Group Butlers Warehousing and Distribution Glass Glover Hays Distribution Hunter Distribution McGregor — Cory Rockwood United Carriers There is also a wide range of companies which specialise in fields such as chilled and frozen distribution, furniture or clo thing distribution.

USERS Contract distribution can be used by virtually any industry sector where goods have to be moved from one location to another. The retailing sectors, particularly the chains, are the major users of contract services: supermarkets, departmental stores, electrical goods retailers, clothing retailers and toys retailers all use contract distribution.

Growing numbers of consumer-goods manufacturers are turning to contract distribution to take advantage of the expertise that such companies have developed in distributing to the retail chains; packaged goods, breweries, confectionery, tobacco, white goods and brown goods companies are just some of those using contract distribution services.

• SERVICES

Contract distribution companies have to be capable of providing a wide range of services. These range from arranging and managing the collection of goods from the client and delivering to the client's customer, to operating and managing the tot al supply chain — that is, ordering of the goods right through to the delivery to the final end-user.

The services offered fall into three distinct areas: Administration — order taking, stock control, stock ordering, stock financing, management reporting.

0 Warehouse management — goods re ceipt, breaking bulk, order picking, chilled, frozen and ambient temperature storage.

Transport management — vehicle fleet, drivers, vehicle maintenance, delivery scheduling, route planning.

Distribution companies need to be able to provide and use sophisticated computer systems for on-line communication with the client and to control the whole distribution operation.

FLEET PROFILES

Vehicle fleet profiles vary just as much in contract distribution as they do in ownaccount distribution.

There is no such thing as an average contract distribution fleet; the profile varies not just between industry sectors but also within each sector. So much depends upon the client's distribution requirements: one of the secrets of success in contract distribution is knowing how to optimise the fleet mix.

The current trend is to use larger, rather than smaller, vehicles, so 12m (40ft) trailers are more common than 9m (30ft) trailers; 16 and 17-tonne rigids are more popular than 3.5-7.5-tormers. The exception to this trend is in tractive units, where 32.5-tonners are more frequently encountered than 38-tonne units.

Recently there has been an increasing use of drawbar trailers, while curtainsiders are superseding box trailers, but flats remain predominant in some sectors.

As mentioned earlier, fleet profiles vary widely from a straightforward mix of vehicles, such as 50 x 38-tonne tractors or 100 x 12m box trailers, to a relatively complex fleet consisting of say, 3 x 38tonne tractors, 4 x 12m curtainside trailers, 12 x 16-tonne flats, 1 x 12m flat trailer, and 1 x 3.5 tonne-curtainsider.

Contract distribution fleet profiles, however, would appear to be more simplified than those in the own-accont sector, where the following fleet mix might well be encountered: 20 x 32.5-tonne tractors, 10 x 38-tonne tractors, 25 x 12m box trailers, 5 x 12m curtainside trailers, 5 x 10m box trailers, 35 x 16-tonne box vans, 3 x 7.5-tonne box vans and 30 x 3.5-tonne box vans.

NUMBERS

It is rare for a client to use just one contract distribution company for its requirements; generally they will use five or more contractors. Retailers use the least, with two contractors on average.

When using more than one contractor, the usual reason is that the distribution is organised on some sort of geographic basis and a separate contractor is specified for each region.

It is also rare for contract distribution to be split between trunking and regional distribution; where trunking is involved, all the contractors are expected to provide this service.

PURCHASING

It is the exception rather than the rule for a contract distributor to be involved in the purchasing of stock on behalf of a client, although this does occur in a small number of cases. Normally the client retains the responsibility for stock ordering, with the distributor responsible for the receipt of the stock once it has been ordered and for keeping the client informed of stock levels.

Certainly to compete for the major contracts of today, contract distributors need to have considerable financial muscle; this is especially true where a green-field-site operation is started.

In the future information technology is likely to feature even more strongly than it does at present. On-line computer networks, improved communications with drivers and Electronic Point of Sale (EPOS) driven systems will become an increasing part of the contract distribution service profile.

ADVANTAGES

Users of contract-distribution specialists retain them for a number of reasons, but three stand out as being the primary advantages of using a third-party contractor. The most important of these is that it provides a cost-effective solution to their distribution problems in terms of capital outlay, administrative costs and staff.

Other advantages of contract distribution are that it is seen as being more flexible than own-account, and transfers the responsibility for operating the system from the client to the distributor.

There is also a downside to using contract distribution. Many users feel that they have less control over their distribution system because it is handled by a third party. With modern computer systems, the question arises as to the extent to which this loss of control is real, or simply a perception because the operation is not physically based at the client's site.

In some cases, where the distributor orders the stock himself, he also takes title to the goods but this does involve a number of legal consequences for the contract distributors.

EXPENDITURE

Contract distribution is no small market; among the 35 industry sectors included in the research programme, contract distribution accounted for about 30% of a total distribution expenditure estimated to be in excess of £5 billion. About 65% of the money spent on contact distribution is spent by the retailing sector.

The number of users of contract distribution can be expected to double in the next few years. If this trend continues, it is not unrealistic to predict a situation in which contract distribution expenditure will double in the next 10 years.

Growth will not be restricted to specific sectors: currently a general trend across all sectors can be expected, primarily among those companies that do not currently use contract distribution.

Other opportunities could occur as users of own-account distribution strive to improve the efficiency of their distribution systems. When improvements in their systems are being contemplated, such as lead time reductions, reduced stock levels, and improved computerisation, opportunities will occur for contract distribution companies.

FUTURE

Continued growth can be expected, but to take advantage of the opportunities that will become available, contract distributors will need to maintain and improve the standards of service offered.

The full implementation of EPOS will revolutionise the way distribution systems are operated, while 1992, with its harmonisation of cross-border trade, must bring opportunities for British distribution expertise to be exported to the Continent. Closer to home, Direct Product Profitability (DPP) accounting is starting to be used where distribution costs are calculated in terms of product profitability, and not necessarily as costs in themselves.

The total-cost approach to distribution wil become more prevalent so that "lowest costs" will not necessarily be the decision criterion. Increased expenditure on distribution may well lead to increased savings in other areas of a business.

Finally, home deliveries are becoming part of the retail scene again and will almost certainly increase — particularly as home shopping becomes more developed. Contract distributors face a time of change with many opportunities to develop as an increasing and vital part of an expanding UK economy. D by John Lawrence