JUST LIKE death and taxes, rivals bidding for work at ridiculously low rates has always been with us.

Page 20

Page 21

If you've noticed an error in this article please click here to report it so we can fix it.

And for nearly three-quarters (71%) of respondents to the second Trucking Britain Out Of Recession (TBOOR) survey, it is the main issue that is keeping them awake at night.

Of the respondents, 79% said they had lost business (both a little and a lot) to rivals' suicidal bids.

Hire-and-reward hauliers had it toughest, with 91% saying they had lost business. Logistics and contract distribution operators fared slightly better (74%), while the issue affected a lower 55% of own-account operators. Of the five largest industry sectors that road transport serves, agriculture attracted the most idiots — 92% of operators here suffered at the hands of others' suicidal bids. Construction, mired in its worst slump for decades, is the next worst at 89%. The issue seems to dissipate as fleet size increases: 83% of both small (one to 10 vehicles) and medium-size (11 to 50 vehicles) operators suffered, but 'just' 70% of larger operators (51 vehicles or more) were similarly affected.

Overall, the other main concerns are: customers collapsing, creating bad debts (65%); late payments from customers (57%): and the inability to obtain credit (24%).

The main concern to operators working in retail and wholesale distribution, and those who serve the manufacturing sector was clients collapsing (66% and 67% respectively). While operators in agriculture were significantly more worried about late payments than those operating in any other sector: 75% against the next worst — 59% in construction.

Emotional response

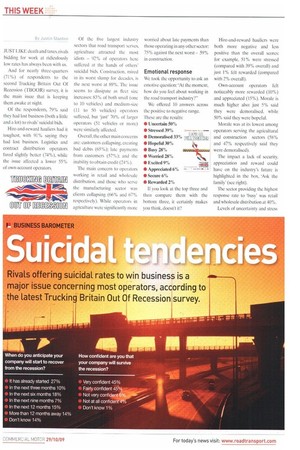

We took the opportunity to ask an emotive question: "At the moment, how do you feel about working in the road transport industry?"

We offered 10 answers across the positive to negative range. These are the results: • Uncertain 50% • Stressed 39% •■—■•• • Demoralised 33% Ti-Erraz&A-nilitl • Hopeful 30% • Busy 28% • Worried 280/ • Excited 9% • Appreciated 6% • Secure 6% • Rewarded 2% If you look at the top three and then compare them with the bottom three, it certainly makes you think, doesn't it? Hire-and-reward hauliers were both more negative and less positive than the overall scores: for example, 51% were stressed (compared with 39% overall) and just 1% felt rewarded (compared with 2% overall).

Own-account operators felt noticeably more rewarded (10%) and appreciated (15%). Morale is much higher also: just 5% said they were demoralised, while 50% said they were hopeful.

Morale was at its lowest among operators serving the agricultural and construction sectors (58% and 47% respectively said they were demoralised).

The impact a lack of security, appreciation and reward could have on the industry's future is highlighted in the box, 'Ask the family' (see right).

The sector providing the highest response rate to 'busy' was retail and wholesale distribution at 40%.

Levels of uncertainty and stress declined as fleet sizes grew For example: uncertainty fell from 55% of small operators to 42% of larger operators, while stress declined from 45% of smaller operators to 30% of larger operators.

Managing the downturn Of course, the transport industry hasn't just sat back and watched itself implode. Operators are doing everything they possibly can to control their cost bases and maximise profits.

Here are the top six measures operators are taking in order to manage their costs: • Measure and manage fuel consumption 67% • Measure and manage drivers' performance 58% • Review routing and scheduling 46% • Deflected 39% • Invest in more efficient equipment 33% • Train drivers to use less fuel 32% Logistics and contract distribution operators were more likely to measure and manage drivers' performance than hire-and-reward hauliers: 74% against 57%. The divergence was greater still (and more worrying) when comparing the numbers that trained drivers to use less fuel: 56% of logistics and contract distribution operators compared with just 22% of hireand-reward hauliers.

Confidence

Analysing responses by fleet size provided the expected result the larger the fleet, the more actions had been taken.

But it's not all bad news. Overall, confidence levels remained high. A total of 89% of respondents were confident their businesses would survive the recession; 26% said their businesses had already started to recover from the recession, while 50% expected to recover in the next 12 months.

• The next TBOOR survey will he available on 2 November. Take part by going to vvvv$i: roadtransport.corn/britain