it pays to understand

Page 92

If you've noticed an error in this article please click here to report it so we can fix it.

yourtax by R. H. Grimsley BCom, FIAC

12. What is an in building?

THE director or manager with responsibility for a fleet of vehicles plus perhaps the entire running of the business could be influenced in his choice of buildings by knowing whether and to what extent they will qualify for capital allowances. Assuming that his company is one which would be eligible to take the allowances at all, as described in last week's instalment, his problem is to sort out the rules governing the allowances. The obvious time for doing this is before placing contracts rather than afterwards when it is too late to modify his plans.

It must be understood that it is the buildings themselves and not the land on which they stand which take the allowances. There is no tax relief on land but as it rarely goes down in value this is of little consequence.

However, it does mean that where an existing building is being purchased at a single price inclusive of the land that price must be carefully divided between the land and the building. The director has an obvious preference for placing as much as possible of the total price under the heading of building, but the Revenue may ask for supporting facts from the builder or architect.

Rough condition If a piece of land is bought vacant with a view to putting up a building, but in a rough condition, the costs of levelling, tunnelling and generally preparing the land, including bringing in main services, will all qualify for allowances, the calculation being left separate from the building proper. However, if the land already holds a derelict building needing to be demolished, the cost of demolition does not take tax relief, though the previous owner could have claimed relief through his industrial building allowances if he had carried out the demolition himself. Moral: try to buy the land without the encumbrance of old buildings.

The building will include the cost of boundary walls, roadways and surfacing the parking area for the commercial vehicles. It will also include the cost of electrical wiring and central heating which forms an integral part of the structure, but special electrical installations and the machinery for operating central heating will qualify for plant and machinery allowances.

The building must be used for active work of carrying on the business. For a road haulier, this means the storage of his vehicles, including trailers and containers, and the maintenance department. If the maintenance division also repairs vehicles for the general public or for other companies, it could miss the allowances as it might be classed as a service garage.

Moderate offices An office is not an industrial building and takes no allowances. However, if the office is just a minor part of a larger industrial structure, its cost accounting for not more than 10 per cent of the whole cost, then the entire building will qualify for the allowances. If the office is more than 10 per cent, its cost is deducted from the total and only the remainder takes allowances. Moral: keep the office within the same structure as the main building rather than independent and keep its scale moderate so as to come within this 10 per cent limit.

An architect's fees are treated as part of the cost of the building, so there is no incentive to attempt the expensive economy of dispensing with an architect's services. The solicitor's fees are not eligible for allowances even though they are an unavoidable part of the cost.

Allowances apply to extension to existing buildings just the same as the completely new structures. Often alterations to build

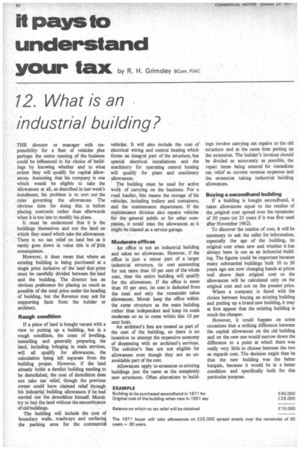

EXAMPLE

Building to be purchased secondhand in 1971 for Original cost of the building when new in 1951 say Balance on which no tax relief will be obtained

ings involve carrying out repairs to the old structure and at the same time putting up the extension. The builder's invoices should be divided as accurately as possible, the repair items being entered for immediate tax relief as current revenue expenses and the extension taking industrial building allowances.

Buying a secondhand building

If a building is bought secondhand, it takes allowances equal to the residue of the ,priginal cost spread over the remainder of 50 years (or 25 years if it was first used after November 1962).

To discover the residue of cost, it will be necessary to ask the seller for information, especially the age of the building, its original cost when new and whether it has always been in use as an industrial building. The figures could be important because many substantial buildings built 10 to 30 years ago are now changing hands at prices well above their original cost so the allowances will be calculated only on the original cost and not on the present price.

Where a company is faced with the choice between buying an existing building and putting up a brand new building, it may at first appear that the existing building is much the cheaper.

However, it could happen on some occasions that a striking difference between the capital allowances on the old building and on the new one would narrow down the difference to a point at which there was really very little to choose between the two as regards cost. The decision might then be that the new building was the better bargain, because it would be in a better condition and specifically built for this particular purpose.

£40,000 £25,000 £15,000