A Plea for Reduced Taxation

Page 49

If you've noticed an error in this article please click here to report it so we can fix it.

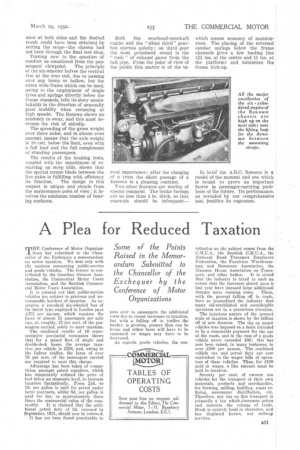

Some of the Points Raised in the Memorandum Submitted to the Chancellor of the Exchequer by the Conference of Motor Organizations

THE Conference of Motor Organizations has submitted to the Chancellor of the Exchequer a memorandum Oa motor taxation. We deal only with the sections concerning public-service and goods -vehicles. The former is contributed by the Omnibus Owners Association, the Commercial Motor Users Association, and the Scottish Commercial Motor Users Association.

It is pointed out that public-service vehicles are subject to grievous and unreasonable burdens of taxation. As examples, a standard six-wheeled bus of the latest type employed in London pays £373 per annum, which requires the fares of almost 21 passengers per mile run, or, roughly, 15 per cent. of the passengers carried, solely to meet taxation.

The combined results of 16 representative provincial companies shows that for a mixed fleet of single and double-deck buses, the average taxation per vehicle is £256, and, owing to the lighter traffics, the fares of over 18 per cent. of the passengers carried are required to meet this charge.

Advantage has been taken of competition amongst petrol suppliers, which has temporarily minced the price of fuel below an economic level, to increase taxation fantastically. . From 2,0. to 3d. per gallon is paid for petrol under large contracts, whilst 8d. per gallon is paid for tax, or approximately three times the commercial value of the com modity. It is claimed that the additional petrol duty of 2d. imposed in September, 1931, should now be removed. It has not been fount' practicable to

pass over to passengers the additional costs due to recent increases in taxation, but with a falling off in traffics the burden is growing greater than can be borne and either fares will have to be increased or wages may have to be decreased.

As regards goods vehicles, the con tribution on the subject comes from the C,M.U.A., the Scottish C.M.U.A., the National Road Transport Employers Federation, the Furniture Warehousemen and Removers Association, the Mansion House Association on Trans port, and other bodies. It is stated that the industry is taxed to such an extent that the increases placed upon it last year have imposed large additional charges upon running costs. These, with the general falling off in trade, have so jeopardized the industry that many old-established and considerable operators are in a precarious situation.

The injurious nature of the present scale of taxation is shown by the falling off of new licences. The tax on motor vehicles was imposed on a basis intended to be a reasonable payment for the use of the roads, and in the case of a goods vehicle never exceeded £66; this has now been raised, in many instances, to over £300 per annum. The combined vehicle tax and petrol duty are now equivalent to the wages bills of operators of these vehicles. Thus, for 1100 paid in wages, a like amount must be paid in taxation.

Seventy per . cent, of owners use vehicles for the transport of their .4-rwn materials, products and merchandise, for brewing, milling, building, sugar refining, newspaper distribution, etc. Therefore, any tax on this transport is primarily a tax which increases prices and restricts the volume of trade. Much is entirely local in character, and has displaced horses, not railway

services. .