Truck of

Page 34

Page 35

If you've noticed an error in this article please click here to report it so we can fix it.

the IRISH

North or South, Ireland's used truck dealers are faced with the same perennial problem as their British counterparts: finding good stock at the right price...

/f you like to gossip, you'll love Ireland. It's small enough for everybody to know (or think they know) your business, so there are always plenty of juicy stories in circulation. The trick is to separate fact from fiction and, considering the lack of official statistics on the Irish road transport industry that's not easy.

According to Tom Hendron, boss of Dublinbased ERF dealer Summerhill Commercials: "The new market for trucks above 17 tonnes will probably be between 1,500 and 1,600 this year but as to the total Irish truck pare, that's difficult. Above 17 tonnes it's probably around 17,000 vehicles, of which 12,000 were sold new in Ireland and 5,000 were brought in from the UK and re-registered. But there are a lot of very old trucks here!"

Judging how many hauliers there are south of the border is equally difficult. At the last count there were some 4,000 accounting for 65% of Irish freight movements. And catching up with them isn't easy. "You can't just go and see an Irish haulier; most of them are out working until nine or 10 at night," says Hendron. ERF currently has a 3% share of the 17-tonne-plus sector, and its growing at 1% per annum, says Hendron.

The Irish used market is smaller than in the rest of the UK but it's been growing; Summerhill expects to sell some 20 used trucks of all makes this year.

With very few "home-grown" good-quality, late-model ERFs around, Hendron regularly rings round British dealers for stock, but imports don't come cheap. "ERFs over there are selling at a higher price than they do over here," says Hendron. "I recently answered an ad for an E14.320 and when the man told me what he wanted I told him he was off his head, but that was what he could get." ERFs certainly seem to last in Eire. "A lot of big Irish operators like them," he says. "In 1992 Irish Rail bought 29 secondhand ERFs that came out of contracts with Esso and Texaco. They're still running today and not one of them came with less than 250,0001on on the clock."

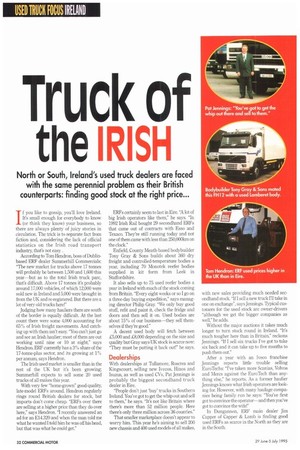

Enfield, County Meath-based bodybuilder Tony Gray & Sons builds about 360 dry freight and controlled-temperature bodies a year, including 70 Monotek reefer bodies supplied in kit form from Leek in Staffordshire.

It also sells up to 75 used reefer bodies a year in Ireland with much of the stock coming from Britain. "Every eight weeks or so I go on a three-day buying expedition," says managing director Philip Gray. "We only buy good stuff, refit and paint it, check the fridge and doors and then sell it on. Used bodies are about 15% of our business—they sell themselves if they're good."

A decent used body will fetch between £5,000 and £8,000 depending on the size and quality but Gray says UK stock is scarce now: "They must be putting it back out!" he says.

Dealerships

With dealerships at Tullamore, Roscrea and Kingscourt, selling new Ivecos, Hinos and Isuzus, as well as used CVs, Pat Jennings is probably the biggest secondhand truck dealer in Eire.

"People don't just 'buy' tucks in Southern Ireland. You've got to get the whip out and sell to them," he says. "It's not like Britain where there's more than 52 million people. Here there's only three million across 36 counties."

That smaller marketplace doesn't appear to worry him. This year he's aiming to sell 200 new chassis and 400 used models of all makes, with new sales providing much needed secondhand stock. "lf !sell a new truck I'll take in one on exchange", says Jennings. Typical customers for the used stock are owner-drivers "although we get the bigger companies as well," he adds.

Without the major auctions it takes much longer to turn stock round in Ireland. "It's much tougher here than in Britain," reckons Jennings. "If I sell six trucks I've got to take six back and it can take up to five months to push them out."

After a year with an Iveco franchise Jennings reports little trouble selling EuroTechs: "I've taken more Scanias, Volvos and Mercs against the EuroTech than anything else," he reports. As a former haulier Jennings knows what Irish operators are looking for. However, with many haulage companies being family run he says: ''You've first got to convince the operator—and then you've got to convince the wife!"

In Dungannon, ERF main dealer Jim Capper of Capper & Lamb is finding good used ERFs as scarce in the North as they are in the South. "If the market continues the way it is we'll sell between 50 and 60 used, but we'd like to sell a lot more," he says.. "Secondhand supply is getting easier but we could do more if we could get the right spec—the mainland is snapping them all up! We could certainly sell more multi-wheelers if we could get them."

Fellow ERF dealer Redford Commercials is sited in the heart of Belfast docks. It couldn't have a better location—its neighbours include the major petroleum operators who are traditionally ERF buyers. And with the arrival of the EC range managing director David McClean reports: "We're now getting enquiries from people who previously wouldn't have asked us to the party" Redford has yet to enter the used market in a big way but "ifs not light years away", says director Billy Cameron. "We'll take trade-ins and look very hard at the market."

Until October last year R&K Trucks Centre at Carryduff was one of two Iveco Ford heavy truck dealers serving the Belfast area. Then it lost out to Dencourt and dealer principal Donal Rice had some hard thinking to do: "We decided we were going to be in business and

we talked to a number of manufacturers," he explains. MAN, it seems, wanted RK, based on its local reputation for handling heavies. "The only fly in the ointment is that they don't have a six-wheeler," says Rice. By way of compensation R&K is selling a tidy number of eight-leggers to local tippermen.

Independents

Rice admits that when it comes to used trucks "we haven't got that involved because we're close to three or four independents. But we'll certainly take vehicles in exchange. If it's good we'll retail it. If not well push it out to the trade. We're aiming to sell 15 to 20 a year," he says.

RK is already hoping to expand beyond its Carryduff site by opening a service point in Mallusk in mid-July. This site will eventually be used as the main outlet for its secondhand sales operation.

While others hunt for used stock Rod Hawkins, sales manager for Newtownabbeybased main Mercedes-Benz dealer Agnew Commercials, is content to wait until the right deal comes along. I'm quite happy to sell my used target in three months—right now I'm being kept busy selling new trucks across all the weight range."

, At the last count 60% of all secondhand trucks imported into Northern Ireland had the three-pointed star on the grille, says Hawkins, who has a no-nonsense approach to exchange deals: "If the truck's good we'll retail it; if not it'll go straight out to the trade."

North or South, Irish operators love to haggle. "It doesn't matter what they're buying, they'll want to bid on it," says Billy Dougan, sales manager for Gray & Adams (Ireland). "It's horsetrading but that's because a lot of operators are from a farming background."

G&Ns rigid business has been particularly busy, says Dougan while: "Nobody can build a meat-rail trailer to touch Gray & Adams— and a big percentage of what we sell ends up hauling beef." By contrast the used market is pretty quiet, not least because interest in 24pallet reefers is declining. But Dougan promises: "We intend to do more, because we know the true value of a trailer when it comes to refurbishing them_" That process includes stretching 24-pallet reefers to maximum 26pallet trailers.

For Larne-based Road Trucks the rumour mill was working overtime: the gossip was that the Scania main dealer was about to be bought out by Harold Montgomery's Ballyvesey Holdings. General manager Con Marks scotched it quickly: "Utter rubbish!"

Road Trucks is one of the most active used dealers in the Scania network: "We're a big provider of 14-litre tractors," says Marks. "We probably have the biggest stock of used 143s of any dealer. We work in co-operation with the Scania network and try to sell our used trucks to Northern Ireland people. Our typical used customer is an owner-driver or a guy with three to four trucks who'll use it as a stepping stone to a new vehicle.

"We'd hope to do around 100 used," he adds, "although that obviously depends on the new side." Marks finds that the high reputation and residuals of Scania in the used market means "you almost always have to retail it. Our used business shows a profit—we don't treat them as a necessary evil, we see it as a business opportunity" Finding used stock hasn't been easy for Ballyclare-based Volvo dealer Dennison Commercials. "We can't get enough!" says sales manager Tom Gourley who hopes to sell about 250 used trucks this year, retailing up to 80% although "Irish operators are tending to hold on to stock right now," says Gourley.

As the former general sales manager for a Scottish dealer, Gourley sees similarities in his new customers: "They're like the Scots— everybody wants something for nothing! When it comes to striking deals they're a bit more inclined to say 'let's get it done'. It just takes a wee bit longer."

3 by Brian Weatherley