nite and conquer

Page 32

Page 33

Page 34

Page 35

Page 36

Page 37

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

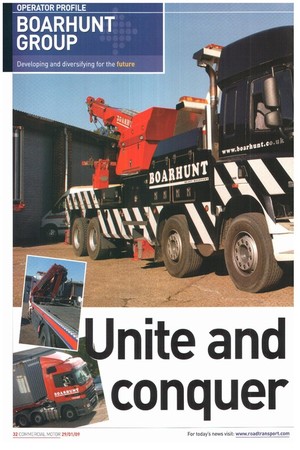

Boarhunt Group has built its portfolio on the back of hard graft and prudent planning, and it is confident it can buck the recessionary trend while continuing to diversify.

Managing change in any business is tough enough at the best of times, but it is especially so during times of recession. Convinced growth was the only viable option for Boarhunt Group, the recovery and haulage business, that chairman Robin Doney had painstakingly built up from scratch over 44 years, he went outside of the company to add directors to the family members already toiling away at this Hampshire-based enterprise. Container work joined the expanding low-loader portfolio, and Castle Recovery at Ferndown near Bournemouth was purchased to bolster the lightweight aspect of that sector.

-Due to my impending retirement.! held back the development of the company for three years, but you can't hold back too long, so I bought an MD in to make it grow. I didn't see standing still as an option,explains Doney.

However, earlier this year, he became concerned, believing "things were being pushed too quickly" and it was "time for consolidation".

To achieve maximum cost savings he went to the top of the managerial hierarchy and, he says, an amicable parting with the firm's then MD was agreed at the end of September.

Consolidation and cost-cutting

Now returned from his self-imposed semi-retirement, a fit and confident Doney belies his 65 years, and is once more holding the Boarhunt reins.

''It was better to be here than sit at home worrying," he reckons. Doney has no regrets about his outside appointments to the board, and one of them, haulage director David Pushman, is present when CM visits the company's Fareham HQ.

"These people freed my time to make more strategic decisions," says Doney. He concedes his former MD "had some good ideas," but in difficult times, it's clear he feels a transport man, rather than someone with an accountancy background, is best placed to advance the firm's interests.

"He tried to take us too far too quickly..." believes Doney. "He was driving us as three separate businesses. I've come back in to reintegrate them and take cost out."

The firm's founder is halting new vehicle purchases, maintaining a tight grip on costs and looking at new business areas and ways to add value. With a constant eye on the bottom line, Doney and Pushman are no doubt pleased they invested in IT systems and telematics to provide them with real-time monitoring information, and, consequently, very frequent and accurate cost reporting.

Doney is refeshingly frank about having built the business up the hard way. He has no formal academic qualifications, but a formidable work ethic, starting, part-time, aged 11, in forestry, then a mechanic's apprenticeship with Wadham Stringer. Pushman's background is equally eclectic truck driving on the Continent, various managerial roles and he's a trained upholsterer.

The current Boarhunt Group has its antecedents in local family entrepreneurship, but the Boarhunt garage business has outgrown the Hampshire village north of Fareham, between the Portsmouth and Southampton where it began.

This original garage business was bought by Doney with help from retirement money his father got on leaving the fire service.

Spotting an opportunity. Doney added recovery to its range of services with a Land Rover and towing dolly (the latter remains on the HQ office roof to this day). A David Pushman Another recovery vehicle was a D-series rigid with a self-loading crane and beaver tail. Aware this sat idle most the week, Doney decided to find the Ford some gainful employment and leapt at the chance to shift some plant. Similar jobs followed, so instead of doing it himself, Doney employed a driver, unknowingly laying the foundations of the current thriving lowloader business.

No distance too great Boarhunt now holds the national Manitou contract and also moves a large amount of cherrypickers. construction and agricultural equipment. Additionally, as an approved MOD contractor, it is also involved in shifting military machines. Where most own-account lowloaders stay relatively local to base, Boarhunt contract for longer distance moves, and are adept at sourcing return loads, many for export from the nearby docks. "We've grown with Manitou, but we've also made the decision not to rely on one large customer," reveals Pushman.

An increase in health and safety legislation and awareness — coupled with a desire to cut labour costs — has led to a greatly increased use of access plant in the building industry in recent years, and this has proved a welcome source of traffic growth over the past few years.

"Our business is based on high-quality service, and the fact there are few specialist hauliers and recovery operators who run a lowloader fleet," explains Pushman. "We do a lot of work for trade shows, and have special covered trailers for this." The construction industry may be on a downturn, but, reveals Pushman, agriculture is on a boom; his stepframe trailers also support Boarhunt's heavy recovery work.

Consequently, although the three distinct business areas at Boarhunt initially appear haphazard, they are, in fact, closely and deliberately interlinked. The move into container work was dictated partly by proximity to ports, partly to diversity and partly to provide a 'one-stop-shop' service to shippers. "We moved into container because we had 70% of our business in haulage with one customer," says Doney. As a result, Boarhunt is now moving into (Special Type General Order) STGO work at the behest of container customers such as NYK.

The majority of Boarhunt's tackle is from Andover Ti.ailers and boast a long ramped front deck and fully folding forward whole width rear-loading ramps to afford improved aerodynamics. Escort services are bought in from Hills of Botley, once a heavy haulier in its own right.

Haulage vehicles are usually purchased on R&M leases, but the 90-tonne srruo FH12.460 and Nooteboom trailer was a secondhand buy from Truswell.

Development strategy Recovery trucks and their associated towing equipment can cost £200,000 or more, but tend to do less miles, so it's more likely for them to be bought outright. Like many service manufacturer or dealer contracts, the make often reflects the work. About 90% of Boarhunt's vehicles are fitted with CANbus data downloads, use software to analyse data and monitor fuel use and driving style. On the container side, 10 trucks are used full time with 00CL. with another 22 working for shipping lines and freight forwarders. "We find our own work and tend not to sub-contract," reveals Pushman. NYK is another important big customer, initially for container movements, but lately using lowloaders to move break bulk on a project for Toyota as well as working alongside Pentalver, which handles dockside duties.

"It's part of our development strategy to get into these added-value-services for better margins," says Pushman, who believes 10 trucks on guaranteed (container) contracts reduces their exposure to economic downturn.

Boarhunt claims to be the largest rescue and recovery firm in the south of England, covering Hampshire, Wiltshire and Dorset. Their 70-vehicle strength includes Smart cars for roadside assistance in urban areas. The heavy recovery trucks have their own depot at Rownhams on the M27 and Boarhunt also undertakes EELV collect and disposal and vehicle storage. Doney, who sits on the RHA rescue and recovery committee, admits, "numbers are down" here. Hence the decision to widen its geographical base and buy Castle.

Vehicles are more reliable these days, and the insurance firms who run roadside recovery schemes in place of the old auto clubs drive harder bargains — a difficult situation when equipment costs so much, but volumes are falling.

Much to his dismay, Doney says he can't get other recovery operators to join him in an bid to raise rates, despite, as he notes, "everyone in this sector struggling".

So what of the future for this five-depot firm and its 200 staff? Boarhunt has customarily financed expansion from revenue, so although it needed bank assistance to buy Castle, its exposure to the banking crisis isn't huge. And, as Doney says, during the 1988 recession, the firm kept wreckers and lowloaders busy with repossessions of cars, trucks and plant. He and Pushman think growth will be found by offering complete transport packages to blue-chip customers such as NYK — a sound idea in our eyes • tors. More recently, ACEA (the European Automobile Manufacturers' Association) has added its own 'weight' to the longer, heavier vehicle (LHV) debate by declaring that "...the promotion of use of the modular concept throughout Europe would have an immediate positive effect on transport efficiency and the environment."

The argument is simple enough.The more you can put on one truck, the lower the emissions per tonne carried. And the more you can put on one truck, the fewer you'll also need overall.

While in the UK, the Department for Transport still recoils at the thought of LHVs on our roads, in Sweden they're looking to put on even more weight thanks to the 'One More Pile' super logger experiment that's just begun in Northern Sweden (see box, overleaf).

Billed as a "project for climate-efficient timber transportation", the scheme centres around a special 30m-long FH16.660 roadtrain, which has been ,Oven a special exemption from the Swedish Road Administration to travel the 170km-long stretch between overkalix and Norrbotten in Northern Sweden with a 60-tonne payload as opposed to the current 40 tonnes. The One More Pile' name simply refers to the fact that the outfit carries an extra stack of timber.

What's the difference?

Under normal conditions, a Swedish logging outfit typically consists of a load-carrying 6x4 (or 6x2) rigid. pulling a two-axle converter dolly onto which is hitched a two-axle semi-trailer.This 'standard' combination measures 24m and grosses out at 60 tonnes, with its 40-tonne payload. However, on the 'super logger', the converter dolly is first coupled to a short, three-axle '13-Double' style trailer, which is then connected to a three-axle semi-trailer via a fifth wheel mounted over the intermediate trailer's bogie (below). It's on this intermediate trailer that the extra pile of timber is loaded.The upshot being that the twin-trailer, super-logger roadtrain, with a gross weight of 90 tonnes and an overall length of some 30m, is capable of hauling 60 tonnes of timber.

Though the super logger is six metres longer and almost 30 tonnes heavier, by virtue of the fact that it has 11, rather than seven axles, its loading per axle is actually lower than a regular logger — 8.18 vs 8.57 tonnes — and thus road wear is reduced. And because it's based on the same modular design as other Scandinavian ILHVs, it's possible to use it with existing equipment with a few minor adjustments. That extra 20 tonnes on the back certainly makes the Fi super logger more productive... hut where does the green benefit come in? Volvo Truck's environmental affairs director Lars Martensson insists: "Longer vehicle combinations benefit both the environment and our customers. The solution we are now testing considerably reduces climate impact and fuel consumption, without in any way compromising on safety."

According to Skogforsk, Sweden's Forestry Research Institute and initiator of the One More Pile' project, by using the super logger, the amount of diesel consumed per m3 of timber (excluding bark) carried is estimated at 1.8 litres compared with 2.2 litres for a 60-tonner. It also says that CO, emissions per ni"' of timber carried would drop from 5.5kg on the seven axle 60-tonner to 4.5kg on the super logger. Put simply, the ultimate aim of the project is to prove that two super loggers can do the same work as three regular vehicles while delivering a green payback.

Testing times "Previous results indicate that fuel consumption and CO, emissions are cut by about 20% per tonne-km," confirms Volvo. "The project will last for three years and will validate test results in practical everyday operations."

Hans Borjesson, Nordic region manager, is adamant: "By testing this system in practical everyday operations, we gain valuable experience for our ongoing work on the development of climate-efficient and safe transport solutions that are also profitable for our customers. This is different parts of the countrv, and a study will be made of the impact of the haulage rigs on the environment, road safety, road wear, etc. The hypothesis is that an increase in payload would reduce CO, emissions and fuel consumption by some 20-25%, together with a reduction in haulage costs.

It also seems likely that the wear and tear on the roads would be reduced, thanks to lower axle weights and new haulage rigs that will distribute their payloads more efficiently." Naturally that hypothesis will be proved or disproved out on the road.

And while, admittedly, roads in Northern Sweden are a world away from the Ml, given the growing pressure on all EU Countries to tackle climate change — and the potential green benefits of LHVs — it's hard to see why UK transport ministers are still so reluctant to risk even modest trials of shorter and lighter LHVs (if that isn't a contradiction in terms) on British roads.

After all, what's the worst that could happen? •