DOUBLE ACT

Page 49

Page 48

If you've noticed an error in this article please click here to report it so we can fix it.

At last a buyer may have emerged for BR's Freightliner service as Russell Davies and P&O consider making a joint bid for the container operation.

Russell Davies and P&O Distribution's revelation that they are interested in bidding for the Freightliner container train service from Railfreight Distribution (RfD) might prove to be the making of a business which seems to have collided with an inordinate number of buffers in its quarter century on the rails (CM 23-29 September).

Freightliner was conceived in the sixties as part of the Wilson government's plan for an integrated transport system.

It was part of NFC when NFC was a nationalised corporation but by the seventies Freightliner had been shunted into British Rail. It enjoyed a surprising degree of autonomy as a rail operator which was also a haulier, running feeder trucks into its railheads and having to co-operate with, and speak the language of, a private sector haulier while also running scheduled longhaul freight trains to move its containers.

That split personality may explain why it never quite realised its ideal of combining commercial and environmental goals to take significant volumes of truck traffic off the motorways. It probably also has a lot to do with geography. Freight experts argue that rail only comes into its own as a viable freight mover at around the distances where Britain begins to run out of rail tracks.

But Freightliner has carved out a market niche hauling deep-sea containers from coastal ports to the major industrial centres—runs like Southampton to Glasgow or Felixstowe to Manchester—and it is a service which the shipping lines appreciate.

On the other hand, it is losing money. RID doesn't spell out how much, but in the year to April the company as a whole lost £90.1m on a turnover of £172.3m, even allowing for profits made by its contract services and European operations. Freightliner's turnover is about £70m.

Restructured

The whole of RID is being restructured for sale, with Freightliner in some form being sold off as a separate entity. Russell Davies and P&O's interest stems from the DOT's request for "expressions of interest" from potential buyers. Rail Minister Roger Freeman told the Conservative conference in Blackpool that "several interesting propositions" have come forward but no one knows enough about what they would be buying, or when they might get the chance of buying it, for any formal bids to be made.

RID doesn't anticipate a sale before "well into next year at the earliest". By that time it will have to agree with the DOT exactly which terminals, trains, routes and other fixtures and fittings are bundled together in a Freightliner package. If they liked the package Russell Davies and P&.0 would be showing their faith in a service they both support and benefit from.

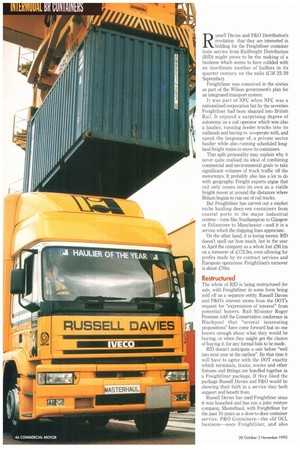

Russell Davies has used Freightliner since it was launched and has run a joint venture company, Masterhaul, with Freightliner for the past 10 years as a door-to-door container service. P&O Containers—the old OCL business—uses Freightliner, and also operates intermodal services in Germany and other European markets. Together the two would-be bidders account for more than half of Freightliner's turnover.

Russell Davies group chief executive Ron Davies says: "The Freightliner network plays a vital role in achieving effective container utilisation, cost effectively for deep-sea shipping lines." The two companies will want to ensure that Freightliner is saved from the clutches of a port owner which might only keep the bits that favour its own interest. This bid would retain the nationwide coverage, but bring a vigorous, entrepreneurial private sector approach to its management in the hope that it could become profitable.

They would run Freightliner at arm's length. It would be owned 50-50 by the two companies and would sell its services to them and to other customers just as it does today. But they are keen to involve other companies in the venture, probably as providers of door-todoor services in areas where they do not already have depots.

That, and the use of subcontractors for some of the haulage work, could benefit other hauliers in areas the company would serve.

They know that they need to maintain customers' perception of the benefits which Freightliner already offers. For deep-sea shipping companies the benefit in question is relatively cheap haulage. Because of the need to run nightly liner trains, regardless of whether or not they are full, and the ability to haul far more containers in one move than can be achieved by road, Freightliner is especially attractive for returning empty containers to the docks.

Competitive

One need look no further than the competitive rates available to hauliers shifting containers to and from docks to see how much pressure the shippers are under when selling their services across the world. Even marginal differences mean a lot and this is an area in which rail stands to gain.

But as British — Rail never tires of saying, it doesn't generate the returns it needs to invest in this or many other parts of its scattered network. Some observers say its management effort is not up to the standard of the most go-getting road operator. Regardless of whether those are real or perceived failings, and the would-be bidders certainly aren't expressing an opinion, Russell Davies and MO promise to do better.

Resources

Masterhaul has already given Freightliner a consignment tracking system it might not otherwise have been able to afford; it certainly brought it in a lot sooner than its own resources would have allowed. A Russell Davies spokesman indicates that we could expect more of the same if the new company takes over: "We believe we can make it work. We've got the people with experience of the business and of private enterprise over 20 years. We've worked very closely with the customers over the years" But there are still plenty of red lights and sidings ahead before this proposal even turns into a formal bid. RfT) will need to open its books a lot wider than it has so far to reveal just how viable each part of the network could be. Questions to be answered include the cost of leasing track from Railtrack; which terminals are classed as belonging to Freightliner; and the terms on which they would be sold.

Only then will we learn whether this initial expression of interest will turn into anything more positive. If it doesn't other potential buyers are going to have to do business with Russell Davies and MO. Either way, they are crucial to its long-term success.

11 by Alan Millar