Chris's 12-month business plan

Page 49

Page 50

If you've noticed an error in this article please click here to report it so we can fix it.

by Johnny Johnson

THE ACCOUNTANT chosen by Chris to look after the financial side of his proposed business, being a keen type and newly qualified, has been only too eager to advise him on the advantages of designing a business plan for the next 12 months.

He has devised an operating budget from which Chris will be able to monitor the progress of events. Fuel and oil has been calculated each quarter based on 220 gallons a week for a vehicle averaging 2,000 miles. At 65p a gallon this works out at £1,859 a quarter and a round figure of £1,900 has been included in the budget for each quarter to cater for lubricating oil and unforeseen fuel gallonage.

The tyres on the vehicle Chris has reserved for himself by putting down an initial deposit are fairly new and he does not expect to have to replace any of these till the final quarter of the financial year. During that quarter, he will reserve £1,000 for the renewal of tyres.

For preventive maintenance, he has been told by the contracting garage that each preventive maintenance check will cost about £20. At threeweekly intervals, this will average four times a quarter so that £80 has been allocated in each period.

Though Chris is taking something of a chance on repair costs not being incurred in the first six months of operation, he realises the importance of allocating funds for this purpose and has in cluded £500 in the third quarter to cover this eventuality.

His own wages have been allocated each quarter on the basis of £60 a week and the hire-purchase and bank loan repayments must be met regularly and can be easily calculated.

In insuring the vehicle and arranging goods-in-transit insurance, he has been able, by shopping around the insurance companies with the help of an insurance broker, to negotiate a regular monthly payment for this item. By doing this he has eased his cash-flow position so that he does not have to find £675 in a lump sum before his customer begins to pay him for his services. This aspect has other implications as will be seen when Chris examines his cash flow budget more closely, next week.

Similarly, he has been able to include the road tax in the asking price of the vehicle and paying for this, for the first year at any rate, will not arise till the final month of the budget. At £377 for a 6k-ton vehicle this is perhaps just as well at the initial stages of setting up in business.

Quarterly budget

The budgeted mileage has been included because Chris will have to keep an eye on the quarterly mileage to ensure that it does not deviate to any great extent from that on which he has based his charges. If it does, then he must quickly recalculate his costs and adjust the rate which is based on those costs.

Finally, the expected revenue which he should have received at the end of each quarter is shown based on the standing cost of £104 per week and the running cost of 20p a mile previously worked out.

With the help of his accountant, Chris has planned a cashflow budget on a monthly basis so that he can see quickly that the money will be available to meet immediate financial commitments and where it is to come from. He has kept this quite simple and included those commitments which he knows he will have to meet. He has not catered for such things as income tax as this will not have to be paid until the end of the year. He will then, of course, have to make provision for tax and National Insurance.

Though only the first three months of Chris's cash-flow budget is published here, he has the details for the whole of his first year's operation. Those involving other, later, months will show how he has allocated expenditure on tyres and vehicle repairs.

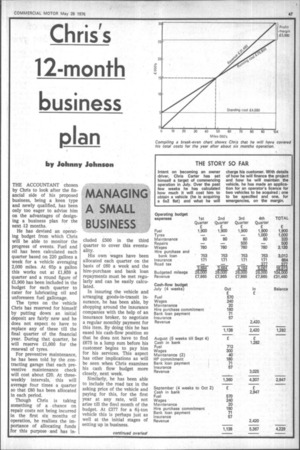

To complete the picture, Chris's accountant has worked out a chart which shows when the business has reached such a stage that it is bound to break even whatever happens subsequently. This means that, though Chris cannot afford to be complacent once that stage is reached, at about 4,750 miles of operation earning a revenue in the region of £14,500 there will be enough in the kitty to cover the costs of operation for the rest of the year. It can be seen from the chart that the profit from the business really begins, from this point, increasing as the mileage is run.

Next week we will examine more closely the implication of Chris's cash flow budget and the importance of credit control.