Rates for Tippers on

Page 43

Page 44

If you've noticed an error in this article please click here to report it so we can fix it.

MUNICIPAL HIRE

Fixing Fair Charges for the Hire of Tipping Lorries by the Day and by the Week, Taking into Account the High Operating Costs of This Class of Vehicle

IN the previous article in the issue dated March 21, some figures were given as a basis for the calculation of hire charges for lorries working for municipalities and public authorities. I had in mind charges based on an hourly rate either for weekly or daily hire. A start was made with a full schedule of costs of operation for lorries thus employed, ranging from vehicles of 2-ton capacity to those carrying 5 tons.

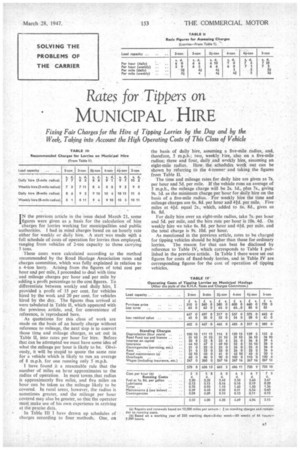

These costs were calculated according to the method recommended by the Road Haulage Association rates and charges committee, which was fully explained in relation to a 4-ton lorry. Arising from the figures of total cost per hour and per mile, I proceeded to deal with time and mileage charges per hour and per mile by adding a profit percentage to the cost figures. To differentiate between weekly and daily hire, I provided a profit of 15 per cent, for vehicles hired by the week and 20 per cent, for vehicles hired by the day. The figures thus arrived at were tabulated in Table II, which appeared with the previous article, and, for convenience of reference, is reproduced here.

As quotations for this class of work are made on the basis of an hourly charge without reference to mileage, the next step is to convert those time and mileage charges, as set out in Table II, into rates per hour for hire. Before that can be attempted we must have some idea of what the mileage per hour is likely to be. Obviously, it will be stupid to quote the same rate for a vehicle which is likely to run an average of 8 m.p.h. for one running only 5 m.p.h.

I have found it a reasonable rule that the number of miles an hour approximates to the radius of operation In most towns.that radius is approximately five miles, and five miles an hour can be taken as the mileage likely to he covered. In rural areas. however, the radius is sometimes greater, and the mileage per hour covered may also be greater, so that the operator muSt make use of his own experience in arriving at the precise data.

In Table Ill I have drawn up schedules of charges according to four methods. One, on

the basis of daily hire, assuming a five-Mile, radius; and, therefore, 5 .m.p.h.; two, weekly bire, also on a five-mile radius; three and four, daily and weekly hire, assuming an eight-mile radius. How the schedtiles work out can be shown by referring to the 4-tonner and taking the figures from Table IL The time and mileage rates.for daily hire are given as 7s. per hour and 5d. per mile. If the vehicle runs an average of 5 m.p.h., the mileage charge will be 2s. Id., plus 7s., giving 9s. Id. as the minimum charge per hour for daily hire on the basis of a five-mile radius. For weekly hire the time and mileage charges are 6s, 8d. per hour and 44d. per mile. Five miles at 4N. equal 2s., which, added to 6s. 8d., gives us 8s. 8d.

For daily hire over an eight-mile radius, take 7s. per hour and 5d. per mile, and the hire rate per hour is 10s. 4d. On weekly hire we take bs. 8d. per hour and 4f-d. per mile, and the total charge is 9s. 10d. per hour.

As mentioned in the previous article, rates to be charged for tipping vehicles should be higher than those for ordinary lorries. The reason for that can best be disclosed by reference to Table IV, which corresponds to Table I published in the previous article. In Table I there were set out figures for costs of fixed-body lorries, and in Table IV are corresponding figures for the cost of operation of tipping vehicles.

The figures in the two tables should be compared, but the following reference to the cost of operating the 4-ton tipper will give the required information, as I propose to deal with it, item by item, by way of comparison:—

First, a tipping vehicle is usually more expensive than a plain lorry of the same capacil. Sometimes, when a tipper is being compared with a long-wheelbase vehicle, however, the difference is not so great. Nevertheless, I am taking a figure of £600 as being the price of a 4-ton tipper, compared with £560 for an ordinary lorry of the same capacity.

Proceeding as before, I first deduct, as shown in the table, the cost of a set of tyres, £63, leaving £537. From that sum I take the residual value, which is the amount the operator

may reasonably expect to obtain for the vehicle when he disposes of it, and I assume that to be approximately 10 per cent. of the net value, £54, leaving £483. for calculating depreciation.

In dealing with a tipper I assume a life of four years instead of five, because tipping vehicles are, as a general rule, used more roughly than lorries. That gives me for depreciation £120 15s a year instead of IP As for the = fixed-body lorry.

The tax, of course, is the same, assuming that the unladen weight still comes within the 2-1-ton limit, but the interest on first cost increases from £22 8s. to £24.

An Increase of 5d. an Hour

The insurance premium is taken to be the same, also the allowance for contingencies, to which reference was made in the previous article. The garage rent stays unaffected, but maintenance is more costly in respect of a tipping vehicle than it is with a plain lorry. Instead of the £35 for fixed maintenance, £42 10s. is debited in the case of the tipper. Overheads and wages are deemed to be the same, and the result is that the total of fixed charges for a tipping vehicle is £686 us., as compared with £646 2s. for an ordinary lorry. That means that the hourly cost, based on 50 weeks of 44 hours, or 2,200 hours per annum, is 6s, 3d. for a 4-ton tipper, as compared with 5s. 10d, for a fixed-body lorry.

Turning now to the running costs, expenditure on petrol is greater, because, in most cases, a tipping lorry uses fuel to operate the tipping gear, and that greatly increases the consumption. In this case I have taken 8 m.p.g. for the tipping lorry, as against 9 m.p.g. for the ordinary lorry. The cost of oil increases in proportion. Tyres are certainly likely to be more expensive in the case of a tipper, chiefly becausethe work on which tippers are employed often involves going over rough surfaces, so that I have taken 1.4d. per mile instead of 1.26d. per mile.

I have already referred to maintenance, and the increase in the running cost section of maintenance charges corresponds to the increase in the fixed maintenance charge. The figure is 0.51d., as against 0.42d. The amount allowed for contingencies, which is, to a certain extent, a maintenance charge, is also increased, as shown, and the overall result is that for the running cost of the tipper we have 4.69d., as against 4.14d. for the ordinary lorry.

Corresponding figures for other sizes of vehicle are given in Table IV.

The next step is to transform. these figures for cost per hour and mile into the time and mileage figures per hour and per mile, and this is done by adding a percentage for net profit. As pointed out previously, this percentage differs according to the method of hire. I suggest a minimum of 15 per cent, for weekly hire, because that indicates more regular employment, and 20 per cent. for daily.hire, as that verges on the casual.

Charges for Time and Mileage Dealing in that way with the figures for the 4-tonner, we get 7s. 6d. per hour for daily hire by adding 20 per cent. to 6s. 3d. For weekly hire, adding 15 per cent, to 6s. 34., the sum is 7s. 2d. per hour. These are the hourly charges, and to them, of course, must be added provision for mileage.

The corresponding mileage charges are:—For daily hire, • 20 per cent. on 4.69d. (51,d.), and for weekly hire, 15 per cent. on 4.69d. (51d.). These figures, and corresponding information as regards the other sizes of vehicle, are set out in • Table V.

It now remains to conclude the calculations by transcribing these figures for time and mileage into hourly rates of hire. As pointed out at the beginning of this article, it is necessary, in order to do this, to take into consideration the probable number of miles which wilt be covered per hour during the service. This, as I have already stated, can be taken to be approximately equal to the radius of action, and in Table VI I have set out appropriate figures, first assuming that the radius is five miles and then assuming that it is eight miles. The operator can apply similar methods if he wishes to calculate rates for other radii of action.

The method has already been described, and I need not go into it in great detail. I propose to take as an example daily hire over a five-mile radius. We have, for that purpose, to take the figure of 7s. 6d. per hour and Rd. per mile from Table V. Five times Sid. equals 2s. 311-d.—say, 2s. 4d. —so that the rate should be 9s. 10d. Rates can be calculated similarly with other sets of conditions and with other types of vehicle. S.T.R.