A Sure Guide to

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

EASY COSTING

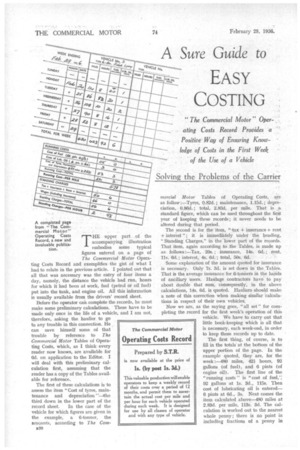

THE upper part of the accompanying illustration embodies some typical figures entered on a page of The Commercial Motor Operating Costs Record and exemplifies the gist of what I had to relate in the previous article. I pointed out that all that was necessary was the entry of four items a day, namely, the distance the vehicle had run, hours for which it had been at work, fuel (petrol or oil fuel) put into the tank, and engine oil. All this information is usually available from the drivers' record sheet.

tion.

Before the operator can complete the records, he must make some preliminary calculations. These have to be made only once in the life of a vehicle, and I am not, therefore, asking the haulier to go to any trouble in this connection. He can save himself some of that trouble by reference to The Commercial Motor Tables of Operating Costs, which, as I think every reader now knows, are available for 6d on application to the Editor. I will deal with this preliminary calculation first, assuming that the reader has a copy of the Tables available for reference.

The first of these calculations is to assess the item "Cost of tyres, maintenance and depreciation' third down in the lower part of the record sheet. In the case of the vehicle for which figures are given in the example, a 6-tanner, the amounts, according to The CornB30

11.7 ercial Motor Tables of Operating Costs, are as follow :—Tyres, 0.82d. ; maintenance, 1.15d.; depreciation, 0.86d. ; total, 2.834. per mile. That is _a standard figure, which can be used throughout the firgt year of keeping these records ; it never needs to be altered during that period.

The second is for the item, tax + insurance + rent + interest " ; it is immediately under the heading, "Standing Charges," in the loWer part of the records. That item, again according to the Tables, is made up as follows ;—Tax, 20s.; insurance, 14s. ad. ;. rent, 11s. ad.; interest, 4s. 6d.; total, 50s. 6d.

Some explanation of the amount quoted for insurance is necessary. Only 7s. 3d. is set down in the Tables. That is the average insurance for 6-tanners in the hands of ancillary users: Haulage contractors have to pay about double that sum, consequently, in the above calculations, 14s. ad. is quoted. Hauliers should make a note of this correction when making similar "calculations in respect of their own vehicles.

Now we are, as the saying goes, "all set" for completing the record for the first week's operation of this vehicle. We have to carry out that little book-keeping which is all that is necessary, each week-end, in order to keep these records up to date.

The first thing, of course, is to fill in the totals at the bottom of the upper portion of the page. In the example quoted, they are, for the week ;-480 miles. 42.!.r hours, 92 gallons (of fuel), and 6 pints (of engine oil). The first line of the "running costs" is "cost of 92 gallons at 1s. 3d., 115s. Then cost of lubricating oil is entered6 pints at ad., 3s. Next comes the

item calculated above 80 miles at 2.834. per mile, 113s. 3d. The calculation is worked out to the nearest whole penny; there is no point in including fractions of a penny in

these totals. Adding the foregoing three amounts gives us the total running cost for 480 miles, namely, 231s. 3d.

If that figure be reduced to pence and divided by 480, the number of miles run during the week, the result is 5.78d„ the running cost per mile of that particular vehicle for the week under consideration.

Next come the standing charges, and these, once the second of the above calculations has been made, are only two in number. Enter the calculated amount first, 50s. 6d. Then set down actual wages paid, including cost of insurance -stamps. and a proper proportion of the insurance, premium under• the Workmen's Corn, pensation Act, commonly called employers' liability. Add the two items of standing charges together and the total, in the above case, of 116s. 6d., is reached. Divide that amount by tiè number of hours worked-42f in the case which I am quot ing and the result, 2s. 90., is the i.otal standing charges per hour for that vehicle during that week.

Now I am going to assume either that the reader has not his copy of The Commercial Motor Tables of Operating Costs and wants to commence pending receipt of it, or that he prefers to use his own figures and, if he has not yet actual costs available, to estimate the amounts on a sound basis. The method is quite simple.

For the item "tyres," he should take the cost of a set of tyres and divide it by the number of miles which be expects to obtain froth" that 'set. For exampte, if he paid .60 and expects 20,000 miles, he should pro60 x 240 ceed as follows : 0.72d. Or suppose that 20,000 he has paid 00 and expects 30,000 miles, the calcule80 x 240 thin is = 0.04d. Again, assuming that he has 30,000 paid 00, but expects only 24,000 miles, a similar calculation will give him a figure of 0.80d. per mile.

For maintenance, the operator will have to accept my figures and I suggest that he takes something between id. per mile for a 3G-cwt. vehicle, up to lid, per mile for a 7-8-tanner, or lid. •per mile for a maximum-load six-wheeler. He can take an amount between those figures for a vehicle between those sizes. If the vehicle's work be rough, if it involves a considerable amount of traffic work, or if the roads be bad, with many hills and dales, he should add a small fraction of a penny to the ordinary average assumption, as above.

If the vehicle be a van, the maintenance cost will be a little higher. On the other hand, if the work does not keep the driver fully occupied on the road during the week, and if he can do the washing, polishing, greasing and routine maintenance, the figure for this item can be a little less than that suggested.

Finally; for depreciation, calculate in the same, way

as in the dase of tyres. Take the first cost of the vehicle, deduct the price of a set of tyres and divide the amount resulting from that division by the number

of miles which thefl vehicle is expected to run. Take about 100,000 miles for a low-priced vehicle and approximately double that figure for a machine of conaparatively high price.

Suppose, in the case of this 6-tonner, that the Original

cost was .000 and that the cost of a set of tyres is 480.

The net amount on which depreciation must be calculated is £720. If it be taken that the vehicle will last for 200,000 miles, the depreciation figure is calculated 720 X 240

as follows: = 0.86d.

The three items thus calculated can be added together in just the same way as I added those taken from The Commercial Motor Tables of Operating Costs.' For the other calculated item, "tax + insurance + rent + interest," the operator must use his own figures.

It is most important that it be appreciated that this method of arriving at costs ensures at once, in the first week of a vehicle's operation, that the haulier knows what his real costs are and is making provision for every eventuality which may reasonably be expected, for efficient maintenance, to meet the demands of the official inspectors, for depreciation; that is to say, setting aside a 'sum each week for a new vehicle, for the payment of his fax and insurance premium when they become due, and for replacement of tyres. S.T.R.