STATE OF THE ART

Page 32

Page 33

If you've noticed an error in this article please click here to report it so we can fix it.

With higher excise duty and interest rates, and the Single European Market to contend with, Commercial Motor asked a cross-section of heavy haulage operators how they saw the state of their industry.

• Britain's heavy haulage industry has experienced a rough couple of years, with massive increases in Vehicle Excise Duty for special trucks, persuading several operators to withdraw from the market.

Hauliers like 1'am:thy's Heavy Haulage and Thomas Mader and Sons have disappeared from the scene, yet those businesses remaining seem very confident about future trends. Commercial Motor spoke to 50 of the UK's top heavy hauliers to get their views on the state of the UK heavy haulage industry.

Half those questioned described preseni business as "booming" or "buoyant". One Bristol operator told us that business can be unpredictable at present, but is generally good. "We can go for two weeks," he said, "without even turning a wheel and then be rushed off our feet."

HIGH INTEREST

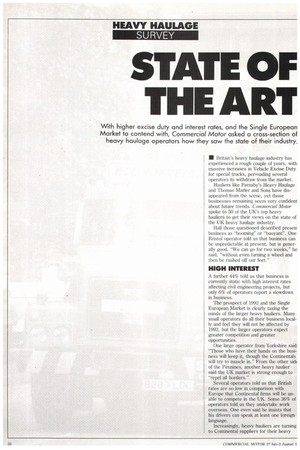

A further 44% told us that business is currently static with high interest rates affecting civil engineering projects, but only 6% of operators report a slowdown in business.

The prospect of 1992 and the Single European Market is clearly taxing the minds of the larger heavy hauliers. Many small operators do all their business locally and feel they will not be affected by 1992, but the larger operators expect greater competition and greater opportunities.

One large operator from Yorkshire said: "Those who have their hands on the business will keep it, though the Continentals will try to muscle in." From the other sidt of the Pennines, another heavy haulier said the UK market is strong enough to "repel all borders."

Several operators told us that British rates are so low in comparison with Europe that Continental firms will be unable to compete in the UK. Some 36% of operators told us they undertake work overseas. One even said he insists that his drivers can speak at least one foreign language.

Increasingly, heavy hauliers are turning to Continental suppliers for their heavy haulage equipment. Some 58% told us they are more likely to buy overseas-built equipment now than five years ago, and many more told us they have always been prepared to purchase overseas equipment.

FOREIGN MARKETS

Most told us that there is more choice in foreign markets and that standards are higher with a greater attention to detail. One Shropshire operator said: "UK manufacturers have stopped making specialised vehicles.

There is really only one that can be considered, namely King." Another operator said: "There is now a need for more versatile trailers, with better steering: the Europeans seem to know more."

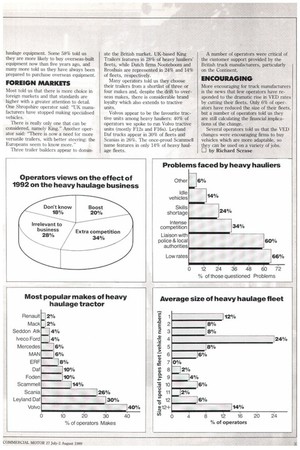

Three trailer builders appear to domin

ate the British market. UK-based King Trailers features in 28% of heavy hauliers' fleets, while Dutch firms Nooteboom and Broshuis are represented in 24% and 14% of fleets, respectively.

Many operators told us they choose their trailers from a shortlist of three or four makes and, despite the drift to overseas makes, there is considerable brand loyalty which also extends to tractive units.

Volvos appear to be the favourite tractive units among heavy hauliers: 40% of operators we spoke to run Volvo tractive units (mostly F12s and F16s). Leyland Daf trucks appear in 30% of fleets and Scanias in 26%. The once-proud Scanunell name features in only 14% of heavy haulage fleets. A number of operators were critical of the customer support provided by the British truck manufacturers, particularly on the Continent.

ENCOURAGING

More encouraging for truck manufacturers is the news that few operators have responded to the dramatic rise in VED rates by cutting their fleets. Only 6% of operators have reduced the size of their fleets, but a number of operators told us they are still calculating the financial implications of the change.

Several operators told us that the VED changes were encouraging firms to buy vehicles which are more adaptable, so they can be used on a variety of jobs.

by Richard Scrase