Pitfalls in Allocating Overheads

Page 58

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

Difficulties of Spreading Establishment Costs Over Individual Vehicles in a General Haulage Business Undertaking Widely Varied Kinds of Work

F, 4STABLISHMENT costs are usually, spread over the number of vehicles in a fleet quite simply so that each

terry bears an amount proportional to its carrying capacity. Assume a fleet of 10 vehicles comprising four 6-tonners, two 8-tonners, two 15-tonners and two 30-cwt. vehicles and a total of establishment costs of £2,000 a year, or £40 per week. Total carrying capacity of the fleet is 73 tons, and to allocate the weekly £40 for establishment costs we proceed as follows.

Forty pounds divided by 73 is, roughly, us. This is the amount of establishment cost per ton of payload throughout the fleet, so that each 6-tonner must be debited with six times

1 Is., £3 6s. a week. Similarly, the 8-tanners will carry 14 8s., the 15-tonners 18 5s., and the 30-cwt. vehicles 16s. 6d.

This method is satisfactory only if all the vehicles be engaged on the same kind of work. There is otherwise the risk that some vehicles may be overcharged and others let off with too small an allocation. The case would be extreme if some vehicles were engaged on sand and ballast haulage and others on parcels collection and delivery. Establishment costs in connection with sand and ballast haulage are low, whilst those for smalls traffic are high. Overheads for ordinary long-distance haulage come between the two extremes, being nearer the upper limit, whilst those for local mediumand short-distance work come between longdistance and sand and ballast haulage.

Important Effect on Rates

However, few hauliers to-day are concerned with long-distance transport and fewer still with smalls. The difference between the expense of running a sand and ballast haulage business and one concerned with local haulage is certainly great enough to necessitate differentiation in the allocation of overheads among the vehicles in a fleet engaged in mixed business. Establishment costs have an important bearing on rates. Accepting that sand and ballast vehicles incur lower overheads than general-haulage lorries, the reader may appreciate the difficulty.

If establishment costs be equally applied to all the vehicles in a mixed business, the sand and ballast rates will be too high and general-haulage charges insufficient. Business may be lost because sand and ballast rates are too high, whilst the revenue which may be gained through increased work on the general-haulage side, by virtue of low charges, will not be enough to offset losses in the other department.

The problem is how to relieve the sand and ballast vehicles of their excess overhead debit and burden the others so that they take their proper share. To solve it requires study of two separate businesses, one concerned with the haulage of sand and ballast, and the other with local general haulage. Having discovered the amount of overheads for each B24 company, it would be reasonable to infer that in a mixed business the amounts of establishment costs to be carried by its two departments would be in the same ratio as the overheads of the separate businesses.

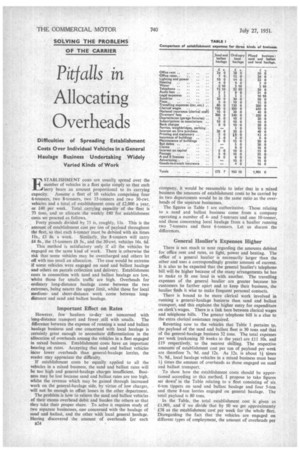

The figures in Table I are authoritative. Those relating to a sand and ballast business come from a company operating a number or 4and 5-tonners and one 10-tonner, and those concerning local haulage from a haulier running two 7-tonners and three 6-tonners. Let us discuss the differences.

General Haulier's Expenses Higher There is not much to note regarding the amounts debited for office rent and rates, or light, power and heating. The office of a general haulier is necessarily larger than the oiher and uses a correspondingly greater amount of current. It is also to be expected that the general haulier's telephone bill will be higher because of the many airangements he has to make to fit one load in with another. The travelling expenses of the general haulier are greater because his customers lie farther apart and to keep their business, the haulier finds it wise to make frequent personal contacts.

There is bound to be more clerical work involved in running a general-haulage business than sand and ballast transport, and this explains the higher entry for expenditure on clerk's wages. There is a link here between clerical wages and telephone bills. The greater telephone bill is a clue to the extra clerical assistance required.

Reverting now to the vehicles that Table 1 pertains to, the payload of the sand and ballast fleet is 30 tons and that of the general-haulage business 32 tons. The total expenses per week (reckoning 50 weeks to the year) are f I I 10s. and £19 respectively, to the nearest shilling. The respective amounts of establishment cost per ton of payload per week are therefore 7s. 9d. and 12s. As 12s. is about l times 7s. 9d., local haulage vehicles in a mixed business must bear times the amount of overheads as those engaged on sand and ballast transport.

To show how the establishment costs should be apportioned according to th;s method, I propose to take figures set down in the Table relating to a fleet consisting of six 6-ton tippers on sand and ballast haulage and four 5-ton and three 8-ton lorries engaged on general haulage. The total payload is 80 tons.

In the Table, the total establishment cost is given as £1,901, and if we divide that by 50 we get approximately £38 as the establishment cost per week for the whole fleet. Disregarding the fact that the vehicles are engaged on different types of employment, the amount of overheads per ton of payload is 9s. 6d. We have to re-allocate that sum so that the overhead cost per ton of payload for the sand and ballast vehicles is two-thirds that debited against the general-haulage lorries. The way to do this is to calculate the figure for total payload imagining that all vehicles are engaged on sand and ballast. To do this, we must multiply the payload tonnage of the general-haulage vehicles by 1. There are 36 payload tons of sand and ballast and 44 of general haulage. For the purposes of this calculation we increase that 44 tons to 66. This means that 44 payload tons on general haulage are equal to 66 on sand and ballast. The total payload tonnage, assuming it to be all of sand and ballast, is 102. Dividing the total of £38 per week by 102 I get approximately 7s. 6d. per payload ton. This is the amount to be debited against the sand and ballast vehicles, but 1 times this, 1 Is. 3d., must be set against the general-haulage lorries.

Applying these figures to the vehicles of the fleet, we have for establishment costs of the sand and ballast 6-tonners £2 5s. a week. Each of the four 5-tonners must stand a charge of £2 16s. 3d„ and the three 8-tonners £4 10s. To add these amounts, we get six vehicles at £2 5s., which is £13 10s., four vehicles at £2 16s. 3d., £11 5s., and three vehicles at £4 10s., £13 10s. The total is £38 5s. a week, which is as near accurate as it could be.

Arbitrary, But Practical

It could be argued that this proportional distribution of overheads between the two departments is purely arbitrary. I would answer that I have never yet come across a scheme for the allocation of these costs which was not, nor one which was more practical than this. I would not, however. suggest that this method is inviolable. It might well pay an operator to juggle with the figures to meet the exigencies of the market for his two principal classes of traffic. If competition in sand and ballast haulage be keen, he may decide to lighten the load of overhead costs on those vehicles at the expense of those in general transport.

Let us assume he reduces the overhead cost per payload ton to 5s. per week. In that case, the total of £38 per week will have to be divided up again. Only £9 of it-that due to the 36 tons of payload on sand and ballast work-will go to those vehicles, leaving £29 to be allocated among the 44 tons of the general-haulage vehicles. The allocation per ton on these lorries will thus be increased to 13s. 2d. The full schedule of overhead charges will then be: for the 6-tonners (sand and ballast), £1 10s.; 5-tonners (general haulage), £3 6s. and the 8-tonners (general haulage), £5 5s.

On the other hand, if competition in the sand and ballast department be not so keen, he could raise the overheads on these vehicles to, say, 10s. per ton or £3 per vehicle. That would allow him to lower the overheads on the generalhaulage vehicles to £2 5s. for the 5-tonners and £3 12s. for the 8-tonners.

The course of action to be followed by the operator must be determined by conditions, but I want to make it quite clear that if the fleet be engaged on a variety of work, it is not correct to allocate overheads in the manner described at the beginning of this article-dividing the total of establishment costs by the total payload tonnage and allocating cost to each vehicle irrespective of its type of employment.

Before leaving the subject of establishment costs, I should like to discuss a matter raised by a correspondent. Suppose that one vehicle in a fleet of 10 is out of commission. Is it correct to load the rest of the fleet with total overheads until such time as that vehicle is back in service? The answer depends on circumstances. If the vehicle be out of commission because of an accident, there will presumably be a claim against a third party or the insurance company. As I have described in a recent article, a claim will probably include a portion of establishment costs which will have to be found although the vehicle is unemployed. That obviously indicates that there should be no interference with the allocation of overheads.

Spreading Overheads

Alternatively, the vehicle may be off the road for an overhaul, in which case it will be taking its turn with the others, each vehicle being brought in for maintenance in a...regular order. If that be so, total overheads should not be spread over the 10 vehicles but over the nine which are on remunerative employment.

One suggestion about the allotment of overheads is that it should be done on the basis of wages, thus conforming with common practice in other industries. This is impracticable. Take the sand and ballast vehicles as an example. The overheads have been shown to be 7s. 9d. per ton of payload per week. For a 5-tonner that is £1 18s. 9d., and for a 10-tanner £3 17s. 6d. The wage for the driver of a 5-tonner is £5 13s. a week, and if I apply the principle just described and accept LI 18s. 9d. as a fair amount to be charged for overheads, that is 34.3 per cent, of the wage. On the other hand, the standard wage for a driver of a 10-tanner is £5 17s, per week and of that, £3 17s. 6d. is

nearly 70 per cent. .

To take it another way, assume that it is decided to charge overheads at 100 per cent, of labour costs. In the case of the 5-tonner, the debit will be £5 13s. per week, too high by normal standards and certainly expensive for sand and ballast, whilst for the 10-tonner the amount would be only £5 17s., which is hardly enough to cover the overheads of ordinary haulage.

Regard for Earning Capacity

A more sensible way is to take vehicle-operating costs as a basis, for in that way some appreciation is being had of the earning capacity, which might reasonably be expected to serve as a measure of the overheads to be charged. On that basis, the operating cost for a 5-tanner running 50C miles a week would be about £25. If the establishment cost be taken as 20 per cent, of the operating cost, £5, this sum. although high, could be applied in the cases of a good many operators.

Taking the opposite extreme, a 15-tonner running 600 miles per week, the operating cost will be about £50 per week and establishment charges, again at 20 per cent., £10 per week. There is something to be said for that method of assessing establishment costs, but whether it is worth while to modify what has for so long been a practice is a moot point. I would suggest that things be left as they are.