ANOTHER R.T.C. MCI S CONTRACT RATES

Page 26

Page 27

Page 28

If you've noticed an error in this article please click here to report it so we can fix it.

Comment Upon the Schedule of Rates j Has Been Approved by the Regional Tra act Hire of Coaches and Buses Which irnmissioner for the North-eastern Region

THAT a Regional Transport Commissioner should take an interest in rates, sometimes to the extent of suggesting what they should be in connection with particular traffics, is regarded by most operators as reasonable. The fact that the R.T.C. may, in such cases, be slightly exceeding his legally authorized powers is accepted as being beside the point.

A particular example which comes to mind is the attitude of the R.T.C.s in the areas in which sugat beet is grown. They have asked for an agreement between the N.F.U. and hauliers on a schedule of rates, not so that they may take steps to enforce those rates but so that they may use the schedule as* a guide when making provision for haulage in cases where a shortage arises. Action such as that is not only acceptable but welcome by those in the sugar-beet industry. It is almost tantamount to stabilizing rates for the traffic and as the operators have been consulted in the first case they should have no criticisms to offer as to the charges thus fixed. .

It is different when the R.T.C. acts -arbitrarily, fixing rates himself according to what he deems to be fair costs and profits, making no attempt to consult operators, and adopting what are regarded as unfair means to compel operators to accept the rates so determined, • An instance of this is the attitude adopted by Sir Arnold Musto, Midland Regional Transport Commissioner, in connection with operators running coaches and buses on contract hire to mu,nition works and similar establishments. That matter was fully dealt with by me in February of last year when I pointed out that the rates which this R.T.C. deemed to be fair and reasonable were, in fact, barely sufficient to cover the running costs of the vehicles eoncerned.

R.T.C. Accepts Schedule Drawn Up by Regional Fares Committee Operators in Yorkshire, and in the North-eastern Region generally, must be glad that Major F. S. Eastwood takes a more reasonable line. He has recently had to solve the same problem as that which was presented to the R.T.C. in the Midlands. Instead of deciding upon the rates and attempting to enforce them by using the powers which he enjoys as controller of petrol supplies, Major Eastwood con. suited the Yorkshire Regional Fares Committee and asked. it to draw up a suitable schedule of rates for the contract hire of passenger vehicles. Having received that schedule he considered it carefully and accepted it. He followed up by circularizing local operators requesting that they should apply those rates to any regular contracts of the kind now prevalent, namely, for the -conveyance of workpeople to and from sites of Government buildings, aerodromes. and, so on. , • The rates submitted by the Regional Fares Committee and approved by the Commissioner are as follow: (1) As regards vehicles which remain on the site throughout the day, that is to say, vehicles which run out with their workpeople in the morning, Wait there, and bring them back at night, the rates are: 20-25-seaters: a minimum charge of £3 10s. per day. including 50 miles of running plus Is. per mile excess.

26-35-seaters: a minimum charge of £4 per day, including 40 miles of running with an excess of 4s. 3d. per mile.

Double-deckers: a minimum charge of £4 10s, per day, including 40 miles of runningb with Is. 6d. per mile exCess. (2) Vhicles which rettirnfor other work, that,is to say, for journeys of a kind in which the vehicle takes the workpeople in the morning and can return and be available to do other work in the day, going out in the evening to bring the workpeople back again:

20-25-seaters: a minimum charge of 21 10s. per day, including 20 miles of running with Is. 3d, per mile excess. 26-35-seaters: a minimum charge of £1 Hs, per cisy, including 20 miles of running with Is. 6d. per mile excess. Doutle-dgckers: a minimum charge of £2 55. per day, including 20 miles of running and 2s, per mile exc'ess.

Where the conditions are such that the vehicle must be garaged away from its home premises the operator is to be paid 2s. 6d, per day extra on that account.

It is of interest to examine these rates and to see how A24 they compare with what may be put forward as reasonable

minima, and in investigating the matter I propose, so far as they apply, to use the data given in " The Commercial Motor" Tables of Operating Costs.

First, with regard to the 20-25-seaters. The fixed charges per week comprise: Road Fund tax. 148. 7d.; wages (for seven days), £6 10s.: garage rent, 12s.; insurance, £1; interest on first cost, 16s.; establishment charges and overheads, ZS, a total of £14 12s. 7d. To this amount. add, for the first class of employment, 20 per cent, for profit on the fixed charges. That is £2 18s. 6d, and the total is £17 us. Id. Dividing that by seven gives the minimum

revenue, on account of fixed charges only, per day; the amount is £2 10s. 2d.

The minimum charge allowed in the schedule covers 53 miles of running and the bare running cost per mile for a 20-seater is 61d.; 50 miles at 6id. is 21 7s, Id., to which must be added, again, the 20 per cent. for net profit (5s. 5d.), giving a total of 21 12s. 6d. Adding that to the £2 10s. 2d. per day on account of fixed charges gives us the total minimum revenue which the operator should obtain, namely; 24 2s. 8d. That is seen to be in excess of the agreed charge, which is only RS 10s. per day. On the other hand, the running cost is only 60. per mile and increasing that by 20 per cent, to gE.t at the rate for excess mileage gives 7.8d. (iay, 8d.), as against the excess of Is. per mile which the operator is to receive.

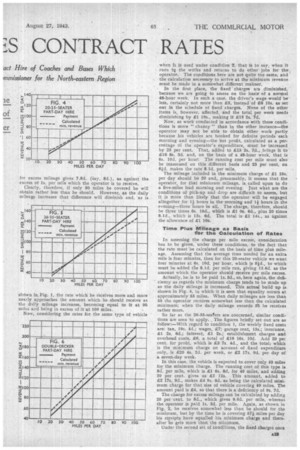

Clearly, therefore, if only 50 miles be covered he will obtain rather less than he should. However, as the daily mileage increases that difference will diminish and, as is

shOwn in Fig. 1, the rate which he receives more and more nearly approaches the amount which be should receive as the daily mileage increases, becoming equal to it at 90 miles and being in excess of it at 100 miles.

Now, considering the rates for the same type of vehicle when it is used under condition 2, that is to say, when it runs tQ the works and returns to do other jobs for the, operator. The conditions here are not quite the same, and the calculation necessary to arrive at the minimum revenue must be made in a somewhat different manner.

In the first place, the fixed charges are diminished, because we are going to assess on the basis of a normal 48-hour week. In such a case, the driver's wage would be less, certainly not more than 25, instead of 26 10s. as set out in the schedule of fixed charges. None of the other items is, however, affected, and the total per week needs diminishing by 21 10s., making it 2.13 2s. 7d.

Now, as work conducted in accordance with these conditions is more " chancy" than in the other instance-the operator may not be able to obtain other work partly because his vehicles are booked for definite periods each morning and evening-the net profit, calculated as a, percentage of the operator's expenditure, must be increased by 25 per cent. That, added to 213 2s. 7d., brings it to 2,16 Bs. 3d. and, on the basis of a 48-hour week, that Ls 6s. 10d. per hour; The running cost per mile must also be reassessed on this different basis and 25 per cent, on

60. makes the rate 8.1d, per mile. •

The mileage included in the minimum charge of 21 10a. per day should be 20 and, presumably, it means that the operator, for that minimum mileage, is called upon to do a five-miles lead morning and evening. Just what are the conditions of pick-up and drop are difficult to assess, but it is more than likely that the operator will be engaged altogether for l hours in the morning and 11 hours in the evening-three hours in all. The charge, therefore, should be three times 6s. 10d., which is 21 Os. 6d., plus 20 times 8.1d., which is 13s. 6d. The total is £1 14s., as against the allowance of £1 10s.

Time Plus Mileage as Basis for the Calculation of Rates In assessing the charge per mile excess, consideration has to be given, under these conditions, to the fact that the rate must be calculated on the basis of time plui mile age. Assuming that the average time needed for an extra mile is four minutes, then for this 20-seater vehicle we want four minutes at 6s. 10d, per hour, which is 54d., to which

must be added tfie 8.1d. per mile run, giving I3.6d. as the amount which the operator should receive per mile excess. Actually, he is to be paid Is. 3d., so, here again, the deficiency as regards the minimum charge tends to be made up as the daily mileage is increased. This actual build up is shown in Fig. 4, in which it is seen that equality occurs at approximately 55 miles. When daily mileages are less than

55 the operator receives somewhat less than the calculated minimum; when the daily mileage exceeds 5'5 he receives rather more.

So far as the 26-35-seaters are concerned, similar conditions are seen to apply.. The figures briefly set out are as

follow:-With regard to condition 1, the weekly fixed costs are: tax, 19s. 4d.; wages, 27; garage rent, 13s.; insurance, £1 2s. Bd.; interest, El 2s.; establishment charges and overhead costs, 26, a total of 216 16s. 10d. Add 20 per cent, for profit, which is 23 7s. 4d., and the total; which is the minimum charge on account of fixed expenditure only, is 220 4s. 2d, per week, or 22 17s. 9d. per day of a seven-day week.

In this case, the vehicle is expected to cover only 40 miles for the minimum Charge. The running cost of this type is 8d. per mile, which is El 6s. 8d. for 40 miles, and adding 20 per cent, gives us 21 12s. This amount, added to 22 17s. 9d., makes 24 9s. 9d. as being the calculated minimum charge for that size of vehicle covering 40 miles. The amount paid is 24, so that there Ls a deficiency of 9s, 7d.

The charge for excess mileage can be calculated by adding 20 per .cent. to 8d., which gives 9.6d. per mile, whereas the operator is paid Is. 3d. per mile. Again, as shown in Fig. 2, he receives somewhat less than he should for the minimum, but by the time he is covering 57i miles per day his receipts have equalled his minimum charge and thereafter he gets more than the minimum.

Under the second set of Conditions, the fixed charges once

again are 21 10s. per week less and, proceeding to make the calculation in the same way as above, the time and mileage figures of 8s. per-hour and 10d. per mile are seen to be applicable. Three hours at 8s. is El 4s. and 20 miles at 10d. is 16s. 8d., so that the total minimum charge per day is £2 Os. ad., whereas the operator receives only £1 15s.

For the assessment of the excess charge per mile, there are four minutes-at 8s. per hour which is 60., to be added to 10d., giving Is. 40. per mile, as against tIzte standard of1s.• 6d. Here again, then, as shown in Fig. 5, the operatur receives less than he should until he has covered 35 miles

• in the day• and thereafter he gets a little more than the absolute calculated minimum.

The rates for double-deckers are not quite so favourable to the operator. Here I assess the fixed charges as follow:Taxation, £1 14s. 8d.; wages, £7 10s.; garage rent, 13s.; • insurance, £1 10s.; interest, £2 4s.; establishment costs £8, a total of £21 us. ad. Add 20 per cent, and we get £25 18s. for seven days, which is £3 14s. per,day. The net running cost Of a double-decker carrying 48-56 passengers is is. id. per mile. For 40 miles at that rate the total is £2 3s. 4d., 20 per cent, of which is 8s. 8d., so that, the charge should be £2 12s. making, with the £3 14s. for fixed charges, 26 43s. per day, instead of dnly £4 105. In this case the excess mileage is Is: 6d. and the operator's charge should be Is, 3.6d. There is, therefore, 'a gradual closing up of the two lines representing the charges, as shown in Fig. 3, but what is regarded as the, minimum charge is, right throughout, in excess of the actual rates.

Similarly, with regard to double-deckers engaged under the second series of conditions, that is to say on part-day hire. The minimum charge should, according to these calculations, be £2 18s. 2d., as .against the actual amount of ;£2 5s. The excess charge should be 2s. Old. per mile, whereas the operator receives only 2s. The difference and the way in which the minimum charge appears throaghoot to exceed the amount which the operator actually receives are indicated in Fig. 6. S.T.R.